Shares of Micron (NYSE: MU) have soared around 7% after the tech giant reported results for its third quarter of fiscal 2020, which ended May 28, 2020.

The company said it recorded revenue of $5.44 billion. This is much higher than $4.80 billion for the last quarter and $4.79 billion a year ago. Analysts expected slightly higher revenue of $5.46 billion.

“Micron’s exceptional execution in the fiscal third quarter drove strong sequential revenue and EPS growth, despite challenges in the macro environment,” said Micron Technology President and CEO Sanjay Mehrotra.

“Our portfolio momentum positions us exceedingly well to leverage the long-term growth across our end markets.”

Micron expects adjusted fiscal fourth-quarter earnings of $0.95 per share to $1.15 per share. Last year, the tech giant reported earnings of $0.56 per share.

“As we look ahead at the second half, of course, you know, given the total COVID environment and uncertainties around COVID around the globe, we basically have limited visibility,” said Sanjay Mehrotra, Micron’s chief executive.

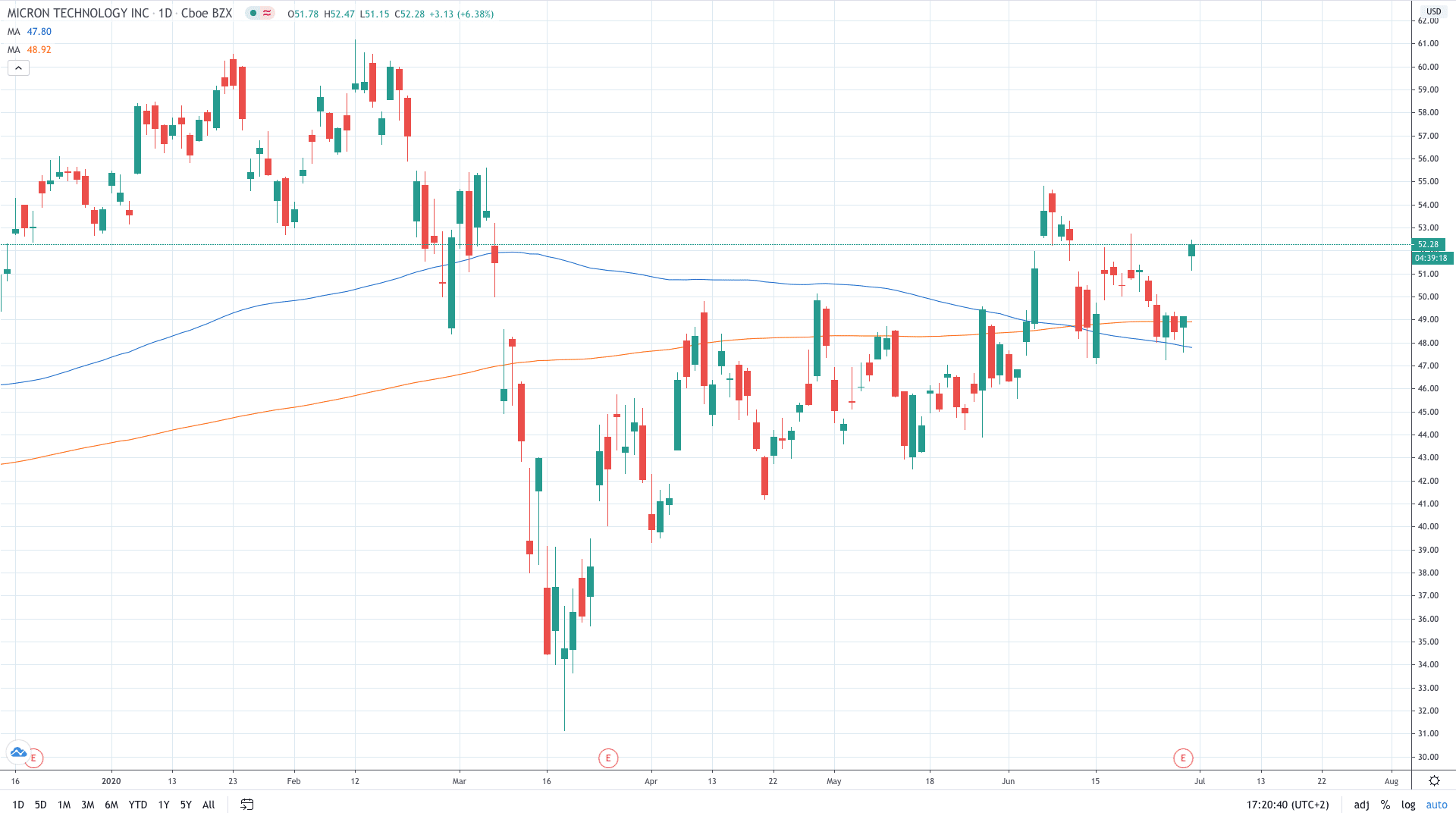

Despite the fact that Micron already informed investors about strong performance in the third quarter, shares still surged over 6% today. Micron share price now trades comfortably above the $50 mark, eyeing June highs near the $55 handle.