Shares of National Grid (LON: NG.) jumped 2% in early London trading after Barclays issued a “buy” rating on the NG. stock. Their analyst Dominic Nash has advised investors to buy shares of National Grid and target GBX 1040, a level that represents a 9.5% premium on yesterday's closing price.

Yesterday, the energy network giant said that the COVID-19 outbreak could eventually cost the company £1 billion due to a plunge in demand for energy and unpaid bills. As a result, National Grid expects a £400 million drop in its profits in the current financial year.

“The group hasn’t been immune to the effects of the pandemic and since the outbreak has seen increased demand from the residential sector more than offset by plunging demand from the industrial sector,” said Heal Miah, an investment research analyst at The Share Centre.

The energy firm reported a pre-tax profit of £1.75 billion for the last financial year, which is 5% lower compared to the year before.

“The company announced they expect a £400mln hit to 2021 profits from the crisis. Most of this relates to its North American business where they expect increased late payments and bad debts, additional direct costs and the deferral of rate increases,” added Miah.

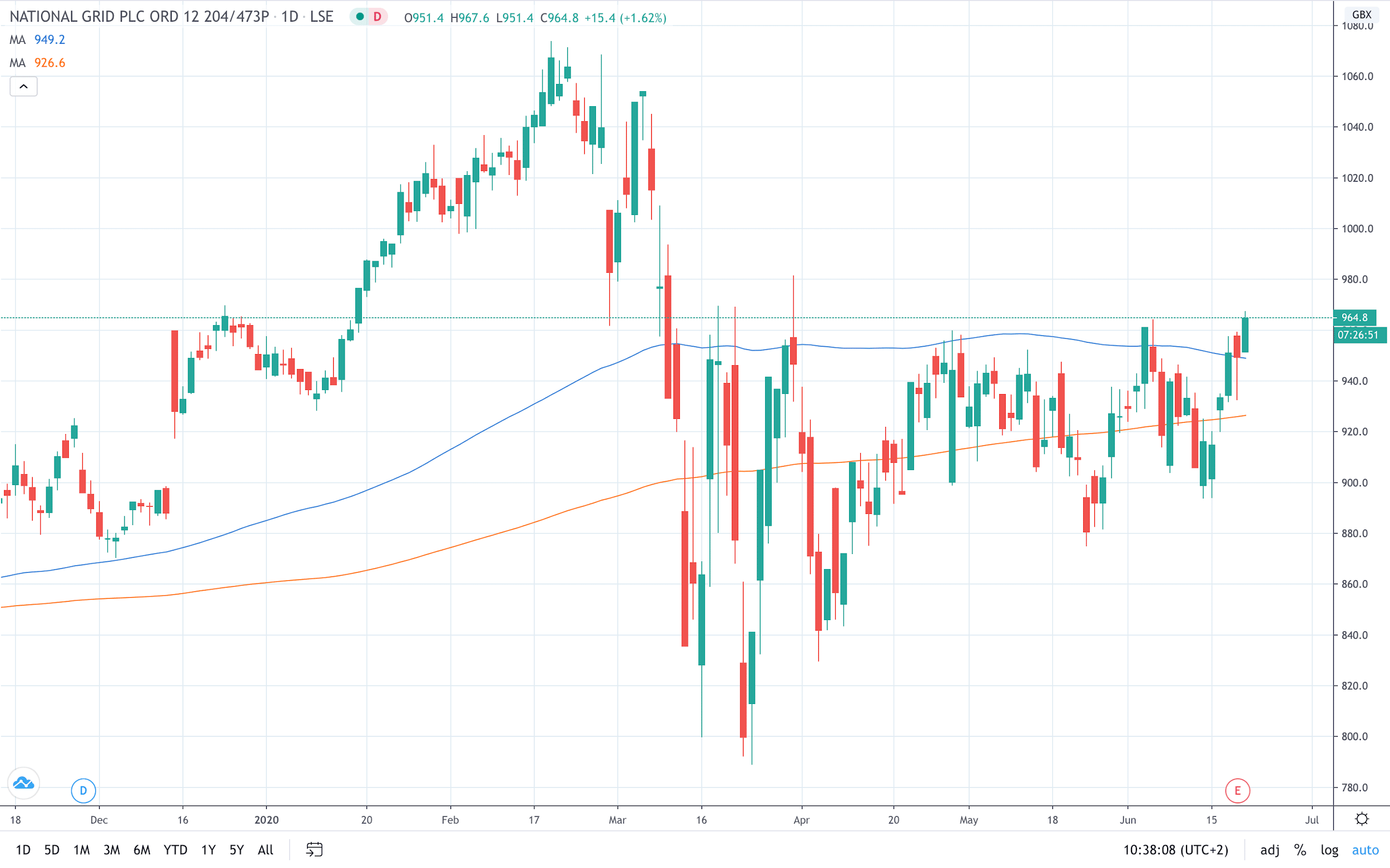

Today’s high of GBX 967 represents the highest level recorded since March as the stock price recovers from the COVID-19 market selloff.