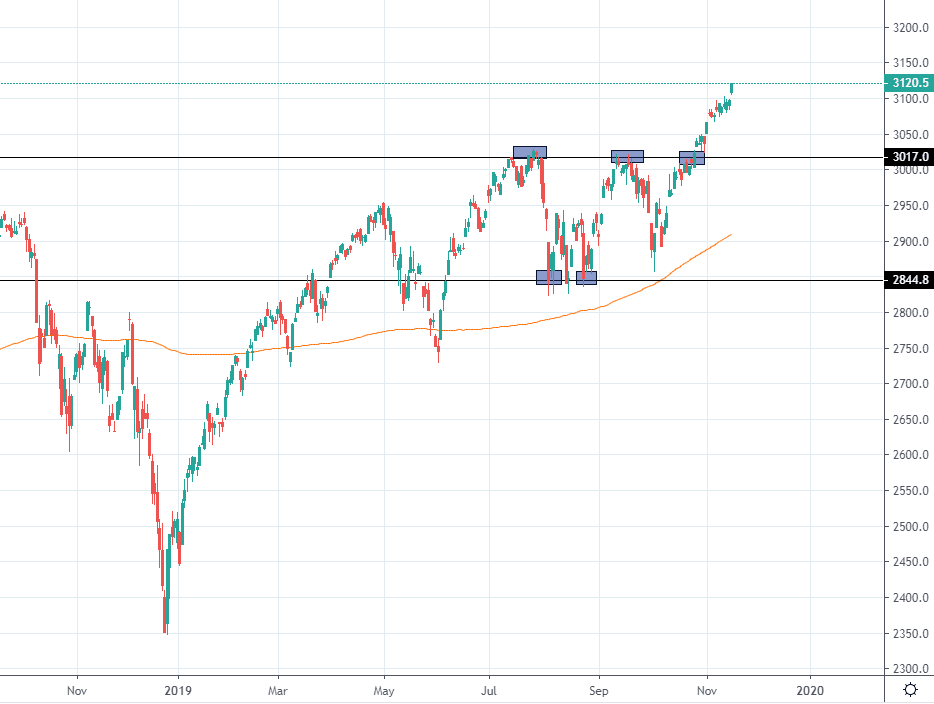

US equity markets have continued the squeeze higher. In early November I wrote about the possible risk of a break out higher in equity markets. US indices had until early November moved inside a big consolidation, but the set up was more and more tilting over to a break out. On November 4th I wrote the below:

What is interesting to see is the break out higher here occurring with so much bearishness still in the air. Trump, China, Brexit etc are all risks that have faded over past weeks, but so many investors still expect this market to turn sharply lower. Many of the smartest guys out there like Dalio and Tudor Jones have been outlining their bearish arguments. Yes, they are all valid arguments, but price action is telling us different, at least for the shorter term.

Break outs out of consolidations can create powerful moves, resulting in big squeezy moves. This is what is taking place in the SPX right now.

The break out proved to be powerful and has taken many by surprise. The vacuum above the resistance level has managed fuelling the rally. Most have been caught by surprise due to the simple fact, fundamental have been so bearish, but markets do not care about the fundamentals in the short term. It is all about what story is “running” the markets currently. The economy has not changed since early November, but many of the stories back then have ebbed out in terms of focus.

Hegde fund managers are once again beaten by a simple buy and hold SPX long strategy. This along other factors has produced a lot of frustration among money managers. Just as we mentioned above, many of the top hedge fund managers globally have remained stuck in the recession camp, confusing the recession with an “imminent” bearish SPX price action.

The first, often easy part of the range break out has already played out, but the question remains how do you play it from here?

Price action has been strong, but volumes have been relatively weak. This has added to the squeeze, price moving higher without big volumes.

Below is the updated chart of SPX. A “simple break out price target area” would indicate SPX reaching 3150/3160 in this move, but given the fact we are approaching low liquidity and strong seasonality, I would not be surprised if a looming Santa rally exaggerates the squeeze in SPX, leaving many money managers extremely frustrated. The last part of the year is historically the most bullish season for equites.

The problem buying here (if you are not long already) is that you would feel like a real sucker should you go long here for the first time and see the market reverse. I believe this is a strong part of the current psychology. People wait for the entry level but markets are not coming off. Finally, you go long, see the price move higher and realize what an idiot you have been not buying. This is currently taking place on a larger scale, thus reinforcing the squeeze move higher.

For me, adding to longs is not a problem if you have enjoyed the break out move I mentioned, but it needs all to be monitored extremely disciplined as we do not want to give back much p/l should markets go against our view. We are high up, but that does not mean we can’t go higher.

Getting long here for the first time looks a bit “problematic”, but if you apply a tight stop loss, why not.

Longer term, the SPX should not trade away from the 200-day average. There is no rule of how much an index can move above/below the longer-term moving average, but moving “away” in an extreme way would cause problems.

First supports are just below the 3100 area and then the big break out level around the big 3000 level. Resistance is hard to “chart” here as we are in uncharted territory, but 3150/3160 is my first price target.

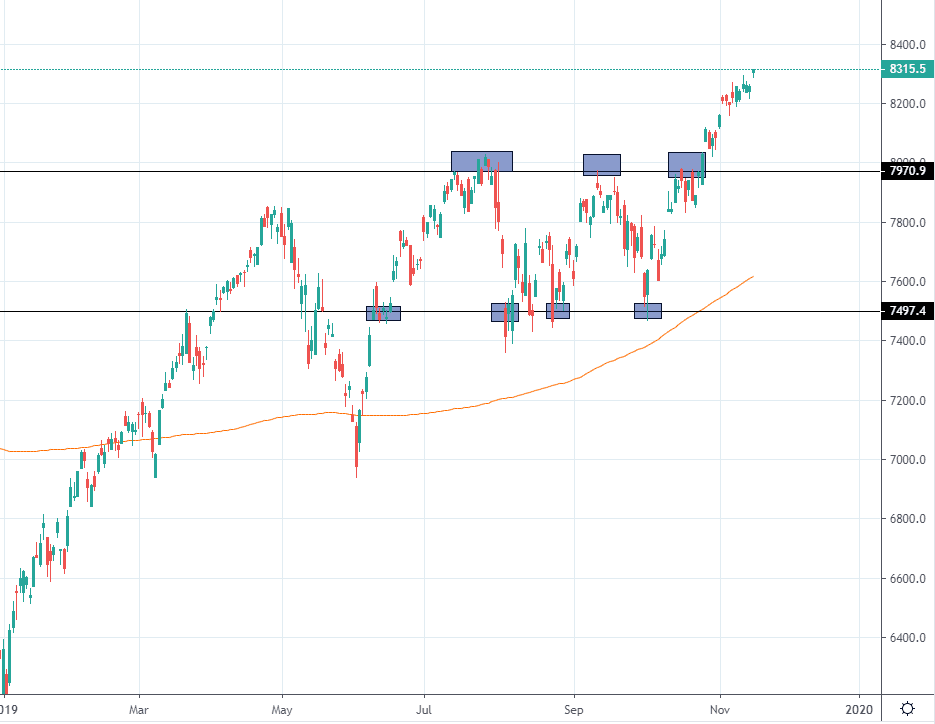

NASDAQ paints a similar picture to the SPX, but the move in NASDAQ has been even more brutal to the upside. The NDX has moved sharply higher after taking out the big 8000 resistance level. The “simple” consolidation break out price target would see the NDX at 8500, which is possible, but I doubt it will continue in this fashion.

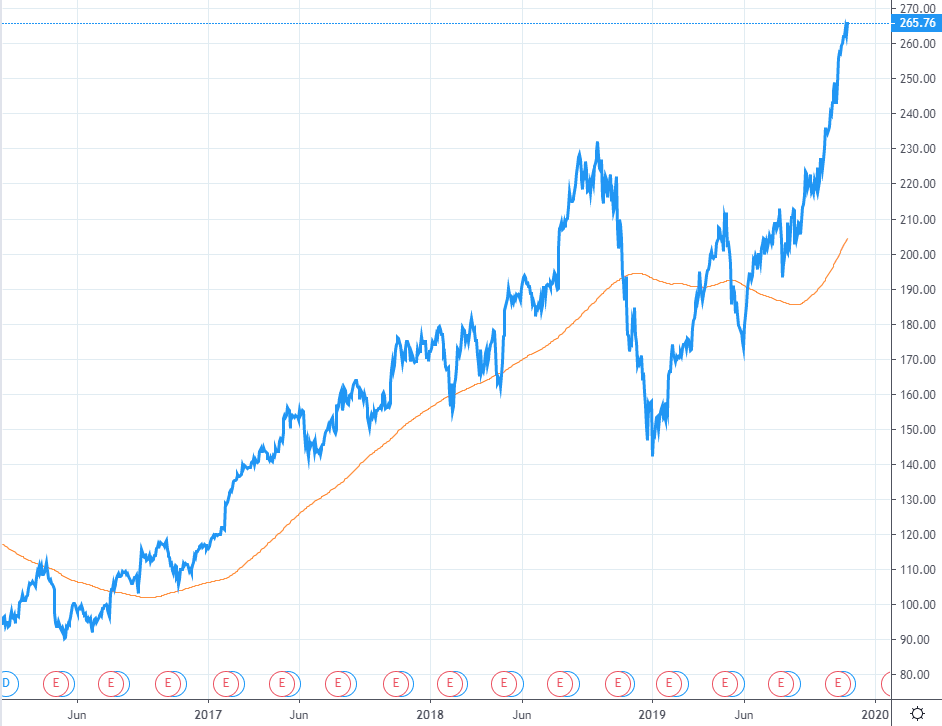

We have seen some of the biggest components of NASDAQ surge extremely over past weeks. The Apple chart is fascinating. The stock was at 170 this summer and is now at 265. Revaluation or the crowd caught totally wrong on discounting the wearables bull and the iPhone cycle bear along with the China/US story fading has managed pushing huge companies like Apple much higher.

To sum it up, the break out I have been mentioning over past weeks has been a great play. Momentum is still strong, but we are approaching some first price target levels. I do not mind pushing the momentum further, especially if you have played the move higher already. Strong p/l over past weeks will give you the right power to play this market going forward. Maybe you will feel scared trading longs here, but if you let the objective risk management methodology take care of the risk, you can focus on your trading and not trade with a constant fear we must pullback, which seems to be the big story out there.