Key points:

- SOS Ltd stock appears to be up 4,400%

- That's purely a nominal price change though, the real price is down 12%

- It's a reverse stock split of course

SOS Ltd (NYSE: SOS) stock is down 95% on the year just gone and yet has risen 4,600% overnight. It would be nice to think that this is some startling turnaround in the business but no, it's simply one of those reverse stock splits – consolidations to Brits. In fact, the nominal price change upwards disguises a real price fall in this case. The reason for the fall over the year is almost certainly the move into crypto and blockchain – those were fashionable things to do and now aren't.

As to what SOS does it works in the People's Republic of China. It's part of the back office suite underpinning certain insurance and medical insurance systems, providing marketing data and tech and so on in those industries. That could be a good business, might not be, that's a function of how good the management are at running it. But there has also been an expansion into the crypto world. SOS stock jumped when this was announced. That's something that definitely was fashionable and now isn't so much. Partly just because crypto isn't as exciting as it once was and also because the CCP – the ruling power in China – has set itself against crypto. So that business is rather falling away.

The problem this produces for SOS is that it makes the stock price decline. Well, that sometimes happens. But the NYSE, as with NASDAQ, has minimum pricing rules. Fall below $1 for long enough and it's possible to lose the quote. Off to the OTC boards for you, with their lower liquidity, smaller ability to raise capital and thus lower valuations.

Also Read: An Nio Stock Forecast

The answer is to try to get the SOS stock price back up above that $1 level that it fell below – an stayed below – back 6 months around the turn of the year. One way to do this is to report excellent business but that hasn't happened. The other is simply to change the number of shares. This is known as a reverse stock split, or consolidation to Brits. Here, with SOS stock, what is actually traded is the American Depositary Receipt. These used to represent 10 pieces of the underlying stock. As a result of the consolidation they now are 500 pieces of the underlying.

This should lead to a 5,000% change in the listed price. It hasn't – therefore the 4,400% SOS stock price rise (at pixel time) is actually a fall in real value. The 4,400% nominal price rise is about a 12% real price fall.

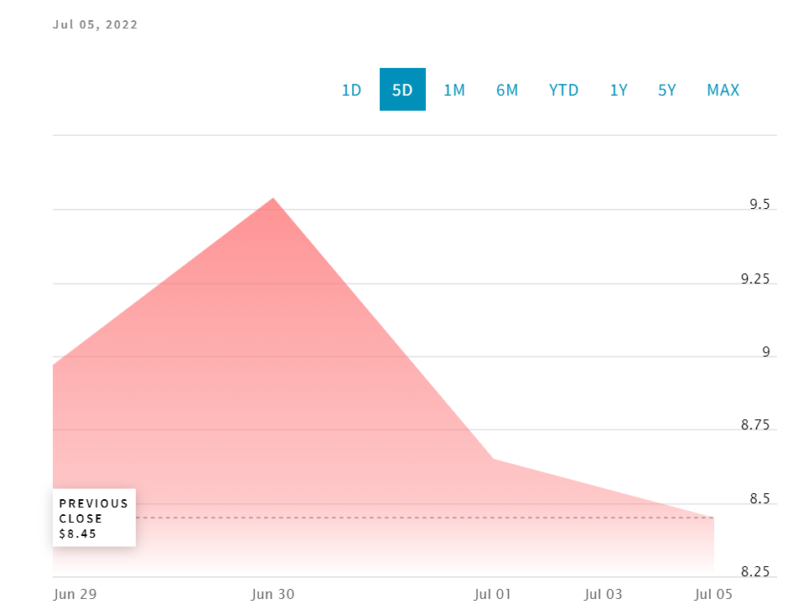

Different tickers and markets catch up with these changes at different speeds. Most tickers of losers and gainers are showing the 4,000% and change. As we can see from the NASDAQ chart above, that has already recalculated to the new base. All historical SOS stock price measurements are now, on that exchange, presented post consolidation value. This can make it difficult to compare historic prices and trends immediately after such a stock split – whether forward or reverse in fact.