- The US Fed kept its benchmark Fed Funds interest rate target range at 1.5%-1.75%.

- The ‘no-change’ decision announced on Wednesday was widely expected and could mark 2020 as a period of stable US economic growth.

- Jerome Powell, US Fed chair, has declared an intention to limit Fed intervention, to let the economy navigate its own course – with the Fed waiting on the sidelines.

- This hands-off style is in central banking terms a significant achievement.

Like a proud parent watching its child take its first steps, the Fed sat on its hands on Wednesday as the US economy demonstrated that it can indeed walk unaided. The notes from the last Federal Open Market Committee (FOMC) meeting of 2019 record the economy posting historically low unemployment and moderate GDP growth. Despite the distractions of a US-China trade war, tensions in the Gulf, and the impeachment of the president, the jobs and growth numbers suggest that the US may be robust enough to carry on into 2020 without any hand-holding from Jerome Powell.

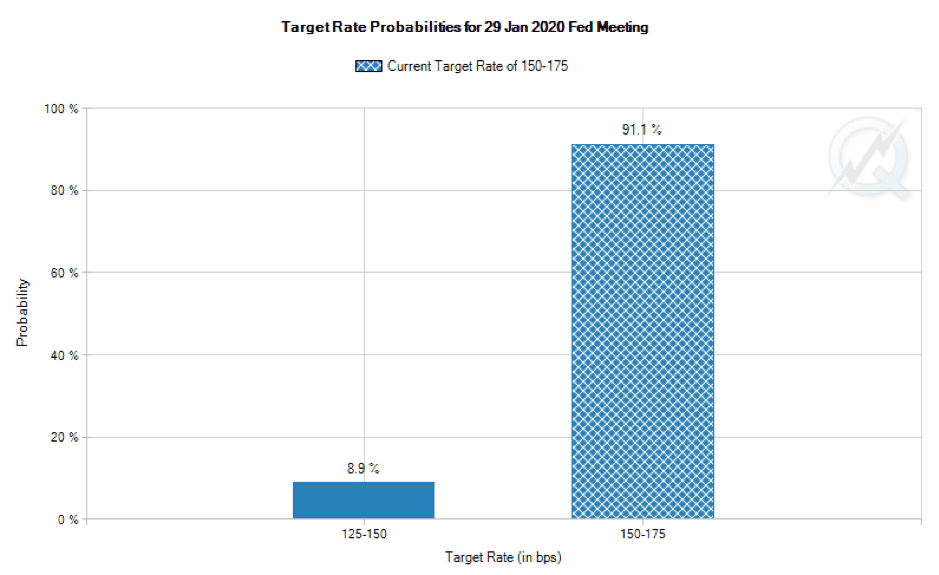

The rate announcement was widely expected. In the run-up to Wednesday, the CME FedWatch tool calculated with over a 99% degree of confidence that rates would remain as they are. It’s early days, but the early positioning points towards a 91.1% chance of the Fed leaving rates unchanged at the next meeting on 29th January next year.

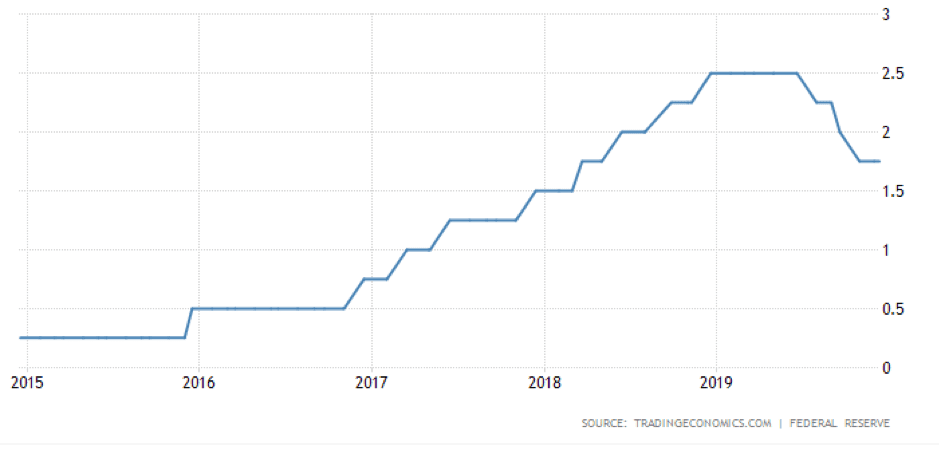

The Fed started 2019 implementing a tighter monetary policy and turned 180 degrees mid-year. Three quick rate cuts later and a surprising degree of stability appears to be in place.

US interest rates – Five years

With the market considering the rate announcement a ‘gimme’, the main focus of the analysis was on Powell’s commentary and Q&A session. His comments were something of a contradiction but were generally welcomed by the markets. Powell expressed an intention for the Fed to stand on the sidelines – but to then intervene when necessary. Ward McCarthy, chief financial economist at Jefferies, was speaking with CNBC when he said:

“They [The Fed] want to be viewed as being in neutral. And in fact, he made it clear he thinks they’re probably not really in neutral. They’re still accomodative … The take away from that is the probability they’re going to make any changes in policy for at least six months is very low, and it would take something quite significant for that to happen.”

Source: CNBC

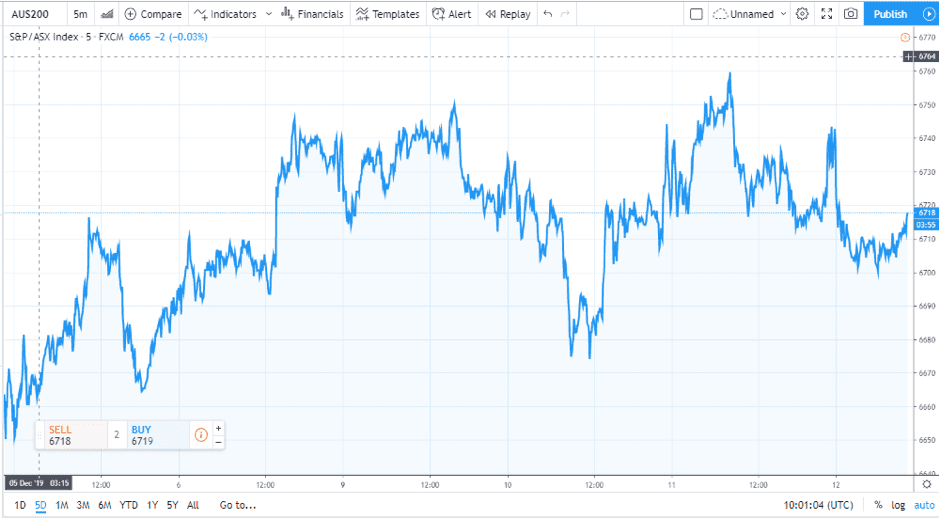

Markets took Powell’s comments as neutral with a dovish bias. The CME FedWatch metric shows that any outlier event is thought to be towards lower rather than higher rates. The Dow ended the day with a gain of 29 points, at 27,911. Asian shares had more time to consider the Fed’s statement and rallied with more force, up almost 1%. As European markets opened on Thursday, the MSCI’s broadest index of world shares, the MIWD0000PUS index, was just 0.1% off its January 2018 all-time high. The ASX 200 index showed continuing price consolidation rather than any kind of breakout, the five-day chart suggesting that the commodities-heavy indices still have one eye on the geopolitical risks to the economy.

ASX 200 (FXCM:AUS200) – Five-day price chart

Michael McCarthy, chief market strategist at CMC Markets in Sydney, said:

“The Fed’s accommodative stance does support equities, but the chance of a disruptive election outcome in Britain is very real.”

Source: CNBC

Code red

The calendar for the next few days has a sequence of geopolitical issues written in bold red ink. McCarthy’s reference to the UK election highlights that a hung parliament still has a puncher’s chance of winning the day. If the bullish sentiment is to remain, then sometime before 15th December, the US and China need to get their story straight about how and why a new range of tariffs won’t come into effect on $160bn of Chinese goods.

These hurdles come halfway through December, a time when the markets are typically beginning to wind down. Jordan Rochester, forex currency strategist at Nomura, will be monitoring the UK election on Thursday/Friday and expects to put in a work shift of more than 24 hours. He said:

“By 6am (on Friday) it will be a normal day although I will hope to leave early in the afternoon. But if there is another hung parliament, I suspect I may have a conference call in the afternoon with North American clients.”

Source: BBC

Rochester predicts that he’ll be watching and reacting to election results as they come through. This challenges the perception that traders staying up all night in the run-in to year-end are letting off steam, celebrating a promotion, or thinking of how to spend their bonus.

If it’s busy now, then there appears little reason to think that 2020 will be any different. As with most of 2019, the markets are braced for ‘one thing after another.’ The US presidential election stands out as an issue that will become increasingly important next year. Then there is the reminder that even if December’s tariffs are somehow averted, there is a lot of work to do to bring the US-China trade dispute to an end.

The positive reaction of the markets on Thursday denotes that Powell may have got things about right. One conclusion being drawn from his guidance is that the Fed, despite being more hands-off, still appears willing to intervene if there is a ‘significant’ shock to the financial system or the US economy.

Mañana

Thursday saw the Fed able to momentarily bask in the glory of a relatively benign economic climate. The ‘debate’ between the White House and the Fed may be due to quieten down as the economy shows signs of entering a period of moderate and stable growth. Powell can point to his record of responding to fundamental data and Donald Trump will be able to refer to historically low unemployment as the US presidential race comes into view.

For one moment, Powell and the Fed were able to put off addressing any problems until “tomorrow.” The unfortunate thing for Powell is that “tomorrow” was meant quite literally. The first exit polls on the UK election will be released 10pm UK time on Thursday evening.