- Oversupply and waning demand are dragging on the tech sector.

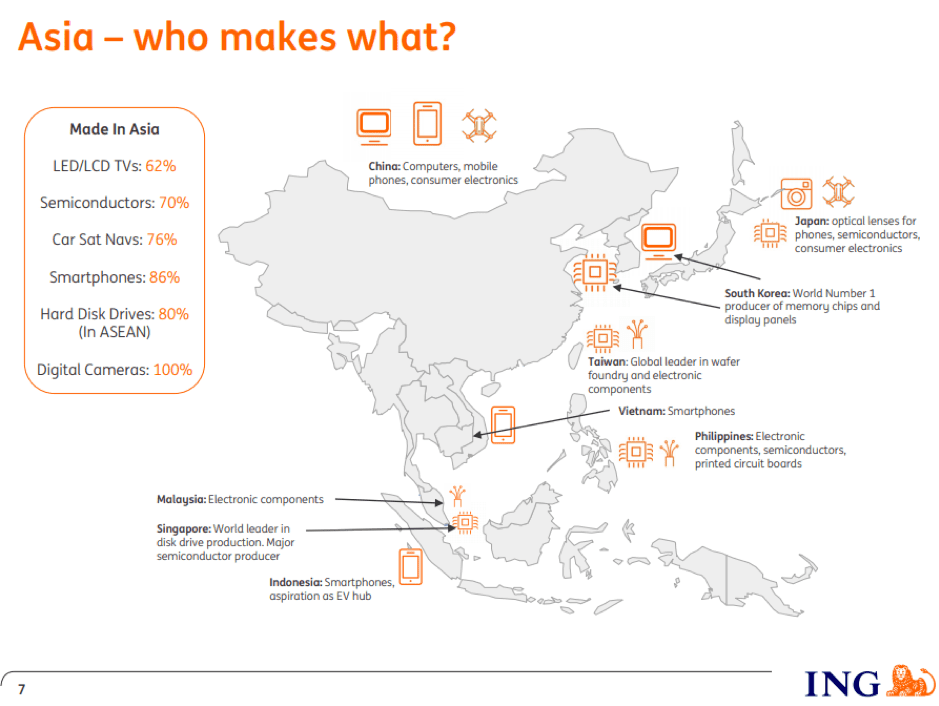

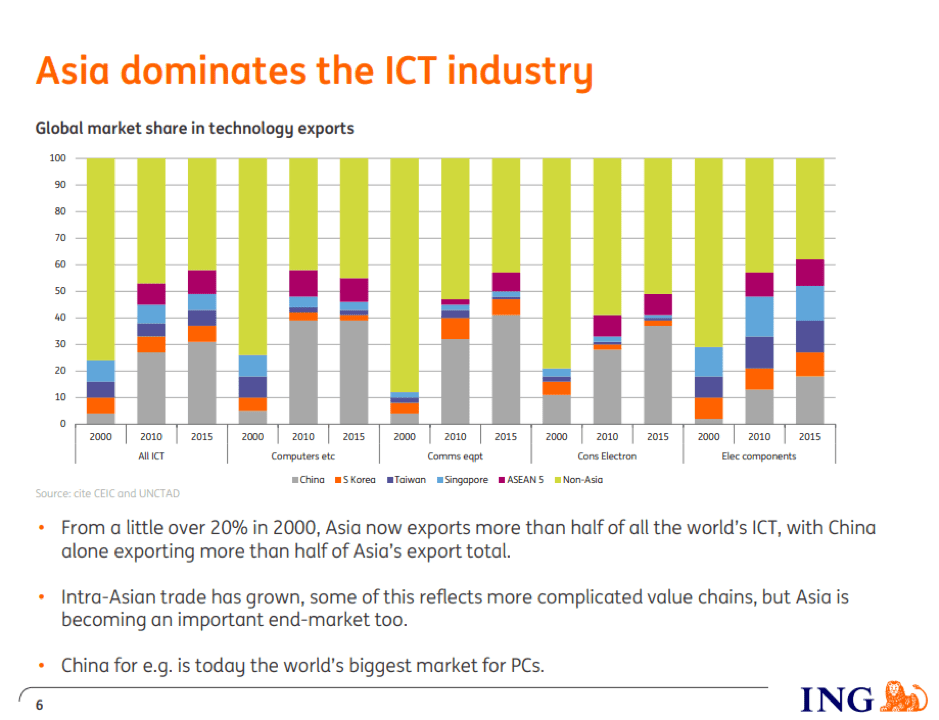

- Asia is the world’s largest producer of ICT but is also increasingly becoming a key consumer of the products, so is heavily exposed to the sluggishness.

- Cloud services are one source of good news and highlight the potential for growth and profits for those firms that can get their product, timing and pricing right.

Two reports released on Friday shed light on the different fortunes of tech firms. Analysts at ING Think have broken out what they refer to as “Asia and the global tech slump.” The report by Rob Carnell, head of research, APAC, takes the ING study down to a granular level, including non-Chinese Asian tech. This helps the analysis filter out and study the drag on growth formed by the tech slump rather than the US-China trade war or the US-China tech war. The study acts as a reminder that tech sales thrive on product advancement and probes the issues associated with trading through periods of time when major new products just aren’t being released.

The news from Google Cloud is much more inspiring for its shareholders, with Thursday seeing the firm report that it is seeing “enormous growth around the world.” These were the words used by Google Cloud’s CEO Thomas Kurian when speaking with CNBC. Kurian’s comments are those of a man with a new tech product that everybody realises they now need.

Global tech slump

Looking through the gloomier areas of the tech sector, Carnell has shared his own interpretation of the tech slump. His report notes:

“Global tech slump

- Capacity overbuild 2017/18 hits demand slump 2018/19.

- Poor product design/launch.

- Poor incremental performance to cost increase.

- Consumers hold fire pre-5G.

- Excess supply + demand slump leads to big drop in prices of products and components.”

Source: ING

The slump that Carnell identifies is inherent in the tech sector. It is related to, but distinct from, the US-China trade war – a general decline in sales due to costs and uncertainty surrounding global trade. It’s also related to, but distinct from, the tech war, which is best exemplified by the Huawei-US-5G dispute, where US suspicion of Huawei has been converted to the Chinese firm being blocked in various ways. His geographical focus is Asian tech because that region now produces and exports over half of the world’s ICT.

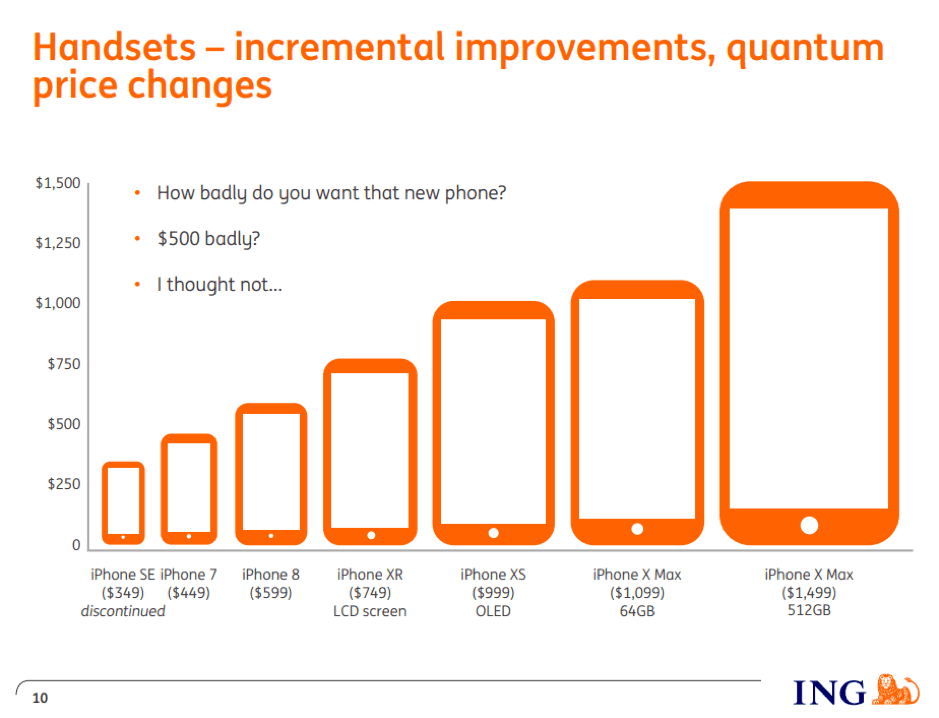

The problem is partly cyclical, with current oversupply a major issue because demand for electronics has slumped. The reasons for the falling demand are poor products and pricing points. In short, producers are making more devices that, at least in the eyes of the consumer, appear to be based on existing technology instead of offering anything new.

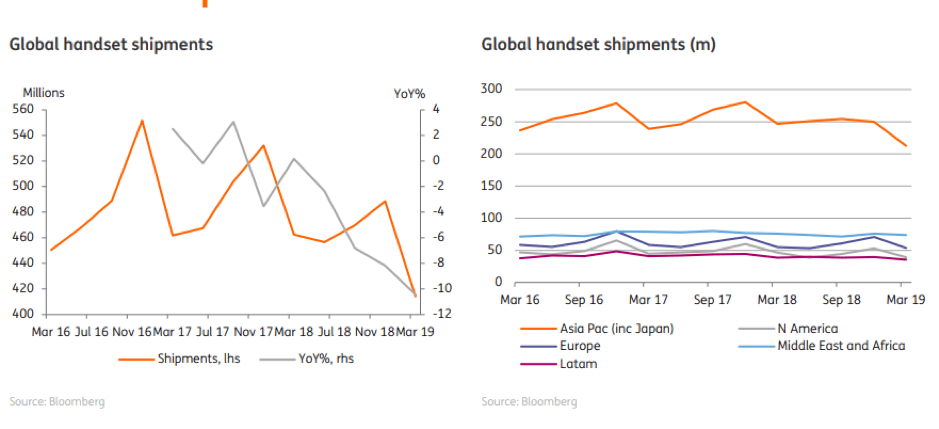

Apple iPhone handsets are a good example of the problem. The firm has grown to be one of the largest companies in the world, largely off the back of producing the handsets that consumers crave and leveraging off that relationship to cross-sell a range of other services. Industry analysts Gartner (Source: Fierce Electronics) estimates that handset sales fell 13.5% in the second quarter, and during its latest trading statement, reports that Apple itself disclosed that iPhones are no longer its biggest revenue driver. Samsung’s lower-than-expected sales of its Galaxy S9 point to the problem being industry-wide as consumers, particularly in the US, hold onto handsets longer and keep an eye on the next big shift to 5G networks.

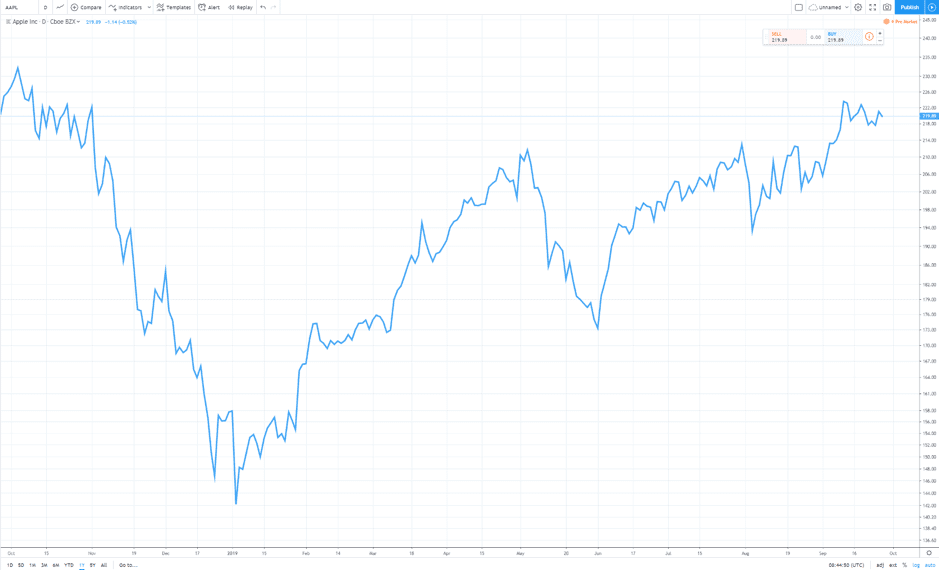

Apple (Ticker AAPL) Share price – One year

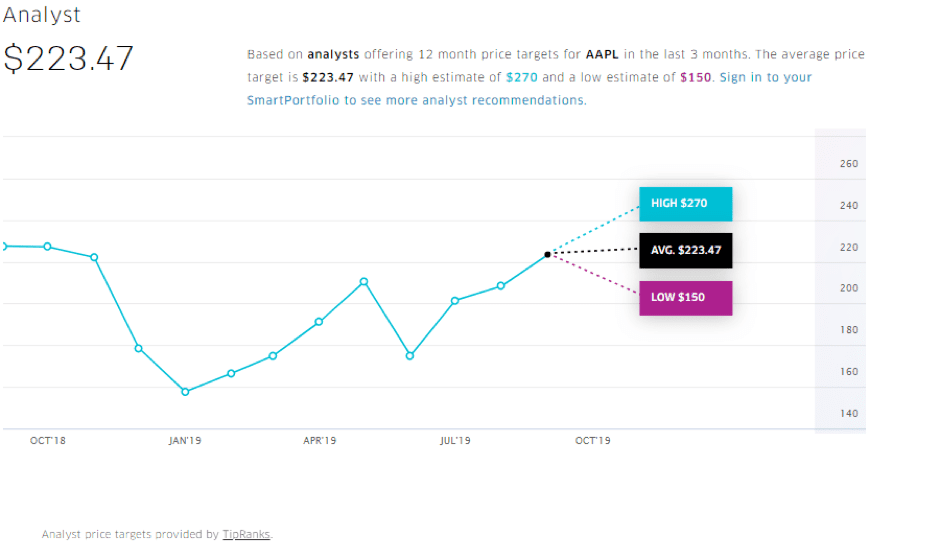

Analysts’ price targets for the AAPL share price range from $150 to $270, but the average is $223.47, which is less than $4 above its current trading price of $219. Sideways trading is not necessarily going to catch the eye of investors, who might feel that they’ve missed the trading opportunity when they note that the share price in May 2016 was $90.

Pricing points are also an issue. The latest iPhone 11 has a retail price around the US$1,000 mark but comes with relatively marginal technological upgrades. In an effort to drum up business, In the spring of 2020, Apple is launching a smaller, ‘cheaper’ handset based on the iPhone 8 but with some add-ons from the iPhone 11. The model will come with a more cost-effective LCD screen and be targeted at emerging markets, which the firm recognises as being more price-sensitive.

Good news from the cloud

During an interview with CNBC on Thursday, Google Cloud’s CEO had a more positive tech story to share. Kurian said:

“We’ve hugely expanded all of the elements of our customer-facing front. Sales, technical people, customer service, even our business practice and legal team … We’re seeing the results of that.”

Source: CNBC

The firm is seeing “enormous growth around the world”. Its product is making inroads to Hong Kong, Taiwan and mainland China. Kurian explained:

“We continue to monitor the demand for our technology from Chinese customers.”

Asked how he sees competition from those local players such as Tencent and Alibaba, Kurian replied that“we worry about everybody.”

Source: CNBC

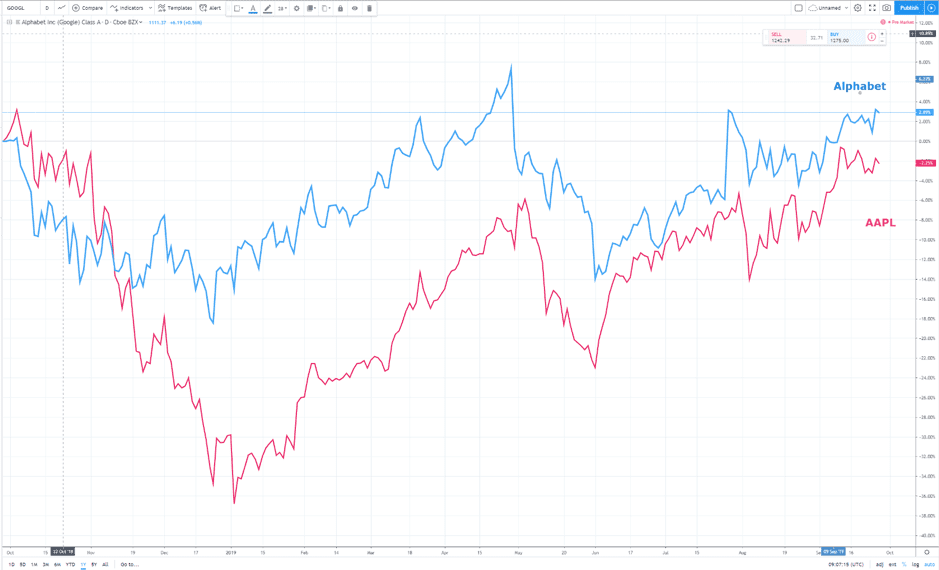

Cloud services are only a part of the parent company’s business, but over the last 12 months, the Alphabet share price has outperformed the AAPL share price by about five percentage points.

Apple Inc. vs Alphabet Inc. – Share price comparison – 12 months

5G – the bend at the end?

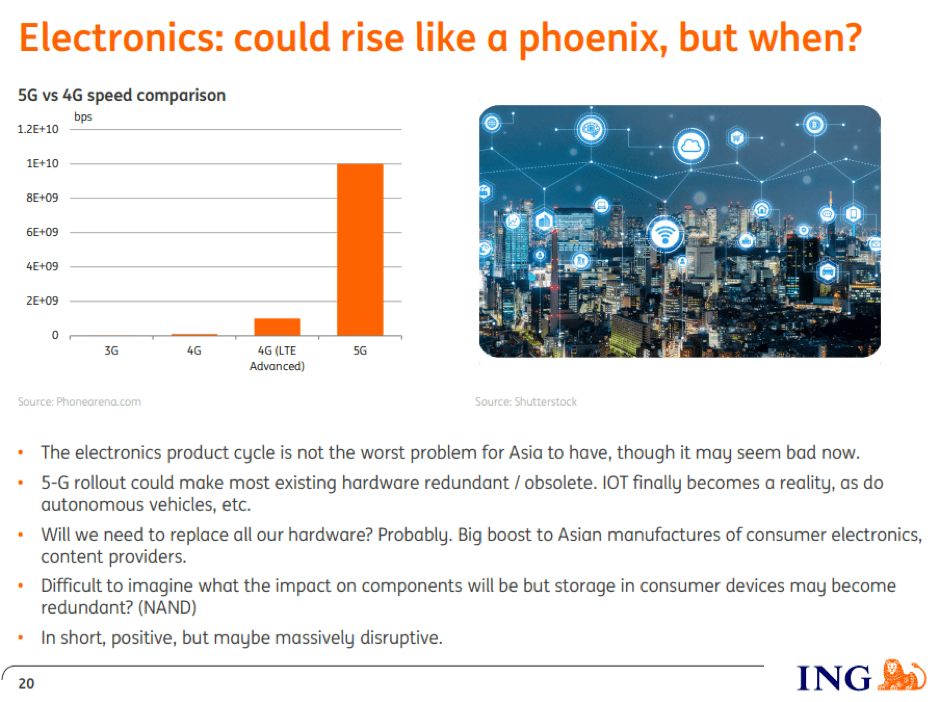

The data for handset shipments confirms the malaise in some areas of the tech sector, but there is a chance that the introduction of 5G technology will act as a driver of the next wave of consumer demand.

Tech firms know that the longer consumers hold onto their current handsets, the greater the demand for 5G ones when the shift to the new technology comes through. The step-up in service quality is set to be game-changing and might be the catalyst to the adoption of the ‘Internet of Things’. While industry site Lifewire.com excitedly considers the many quirks of the roll-out of the 5G network, it can still only report that “neither 5G service nor 5G phones are available everywhere just yet, and release dates are different for every carrier.”

Source: Lifewire