- The SP500 futures are feeling a bit of pressure but the Asian markets FXI and KWEB etfs are higher this morning. There is no reason to get short just consider current futures lows as change. Tech is still strong and QQQs are looking OK. Some sectors in Russel are strong in the pre-market.

- Europe mixed but with a bearish note. The US sectors which are the driver are looking ok so far, we might get a small pull-back but the technical remain bullish so far. Asia is helping. Its Wednesday so we might get some profit taking here and there. Shorter note as no entry points are clear this morning, just consider Russel RTY and IWM for a scalp longs.

- Commodities: Gold is steady and stocks mentioned yesterday are gapping up NEM, AEM, GOLD, GLD and GDX. Futures are 1800+ at the moment, don’t chase if you have no position as they can fade the chasers during this session. Watch price action closely. Crude is looking good so this will also help the market a bit. Oil inventories at 10:30 this morning.

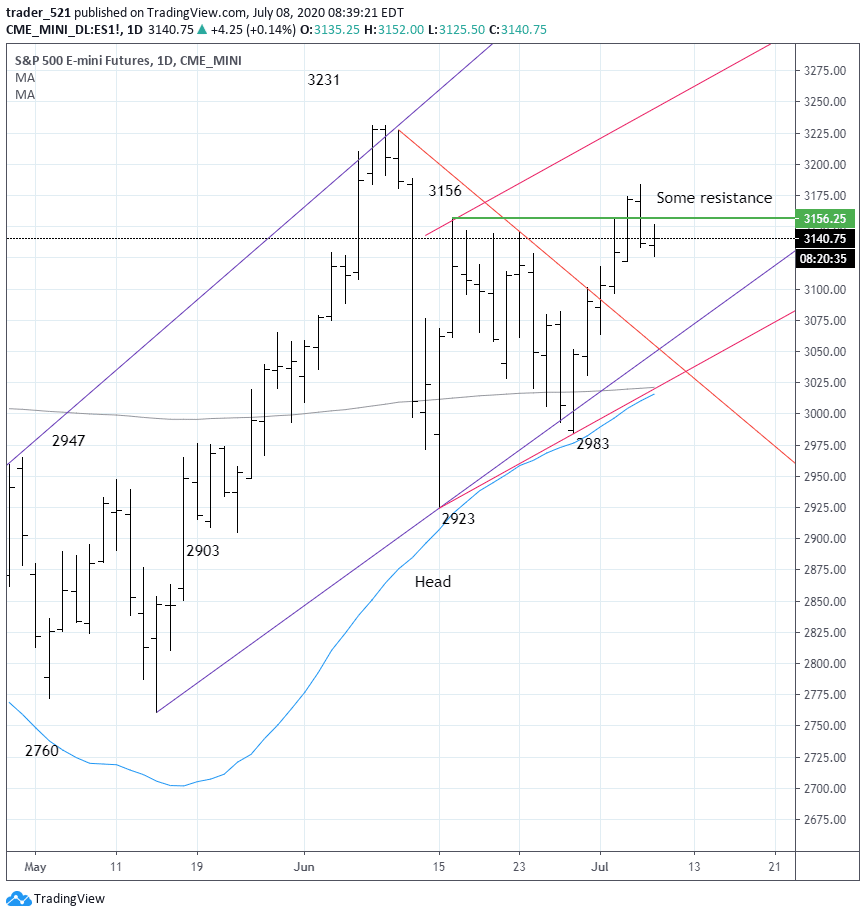

- Fundamentally we are in a rising zone and if the SPY/ES futures are holding this area 313-312 we may still attack 320 in the nearest future. Of course we can fade but the risk reward at the moment in non-tech stocks is good and shorts might be only in speculative sectors/stocks. Prepare and execute.

- The stocks that are making pre market moves are the following (Nikola, Apple, Biogen etc) more clues in the article.

https://www.cnbc.com/2020/07/08/stocks-making-the-biggest-moves-premarket-nikola-apple-biogen-intersect-ent-more.html

For more ideas, market videos and analytics, sign up to our premium room https://www.asktraders.com/stocks-live/