- With only days until the UK general election, the most recent polls still point to a Conservative Party victory, but history suggests that it might be prudent to adopt a cautious approach to the opinion polls.

- Indications are that Boris Johnson’s Conservative Party will take the most seats. Four polls released over the weekend put the Tories an average of 10 percentage points ahead of the pack. Whether the total number is enough to allow them to govern effectively is another question.

- Opposition parties, which are to varying degrees less pro-Brexit and less pro-business, might have an increased role to play – particularly if public opinion continues its recent move and brings about a hung parliament.

- Pollsters, bookmakers and traders all have a lot at stake on Thursday’s election day.

The Boris Johnson-led Conservative Party currently looks likely to win the most seats at Thursday’s UK general election. The incumbent leader’s manifesto proposes that his party will push ahead with Brexit ‘as is.’ The home-spun cooking analogies relating to the proposed deal appear designed to work on the doorsteps and high streets of the country. The EU-UK Brexit deal agreed by Johnson is invariably described by his team as ‘oven-ready’ and ‘just add water.’

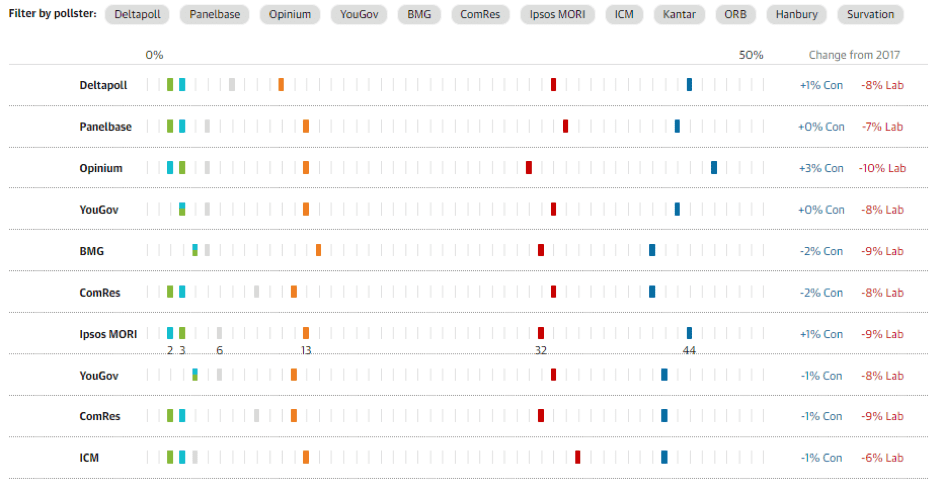

To date, the policy has been working, and the Conservative Party hold a lead in the opinion polls calculated to be between 7-15%, depending on which pollster you prefer to reference.

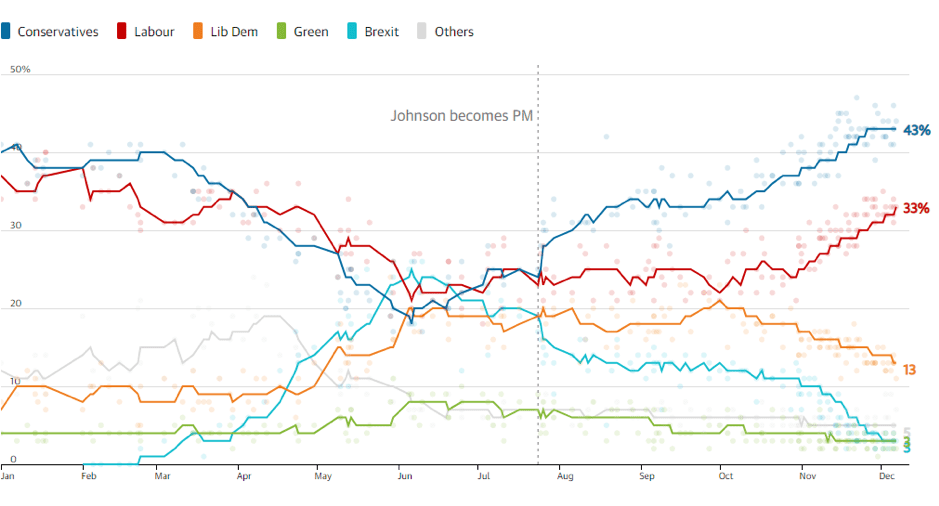

Thursday will tell if this was indeed the ‘Brexit election’ that many suggested it would be – the thinking being that the Conservatives would benefit most from that issue being at the forefront of voters’ minds. If other policies and other agendas caught the public’s eye – and their votes – then the result may be a hung parliament. Favoured topics of opposition parties have included the much-prized National Health Service (NHS), expansive fiscal expansion, and, to a lesser extent, how to finance it.

Voting Intentions Over Time

The Brexit, Liberal Democrat and Green parties have all seen their support wane over the course of the campaign but may still play a crucial role in the election. The option remains for the smaller parties to suggest that their supporters ‘loan’ their votes to one of the bigger two. Such a move could tip the balance in what is an increasingly uncertain run-in.

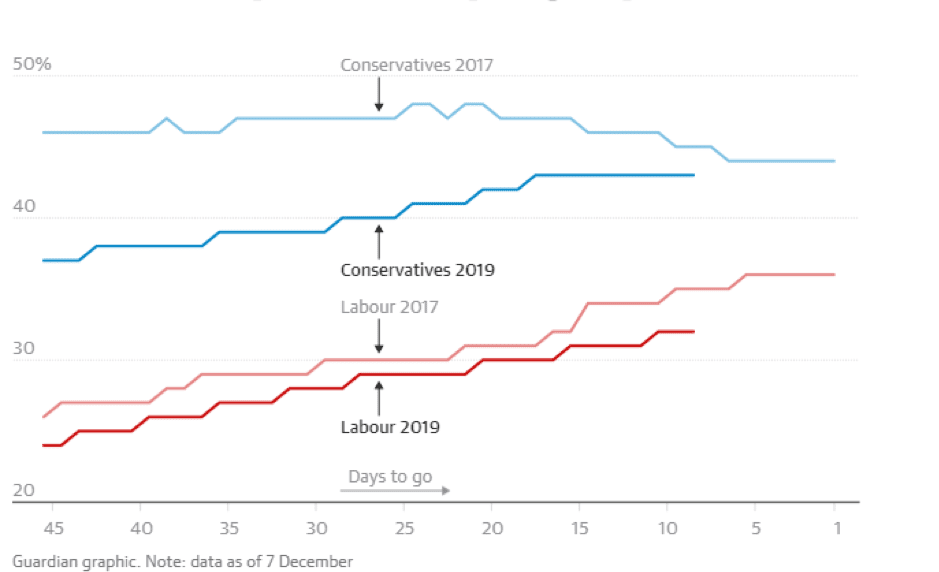

Convergence

The opposition Labour Party would welcome a last-minute surge similar in nature to the one that it benefited from in the 2017 general election. Pollsters who were caught out in 2017 have been primed to spot a similar move. They suggest that there is a Labour gain in popularity and that it is kicking in but from a lower base level. As a result, the Tories have managed to keep their lead in the opinion polls to date – a point demonstrated by the Guardian newspaper showing how the two main parties’ election polling compares with 2017.

How the two main parties’ election polling compares with 2017

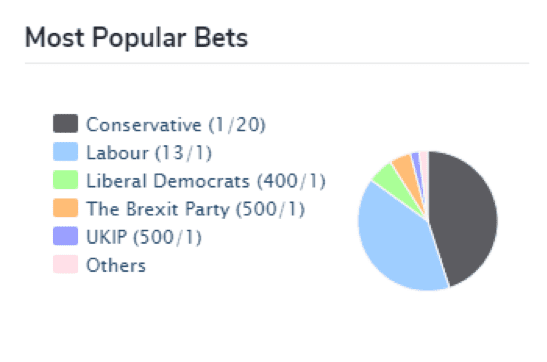

Bookies

The polling industry has incurred its fair share of bad press in recent times, and some of those looking for an insight into the election outcome have instead turned to the betting industry for guidance – the thinking being that following the money would offer a clue to a different degree of commitment. After all, talk is cheap and certainly cheaper than putting on a cash position.

Industry site spreadchecker.com flags up shortening odds in blue and drifting in red. After the last weekend of interviews, campaigning and breaking stories, it is the Labour Party that has momentum behind it. It is, of course, playing ‘catch-up’ from some way back, and the gap between Labour and the Tories is greater than in 2017, but the trend is noticeable.

Oddschecker states that the odds of a Conservative majority are still 1/20, a Labour win is priced at 13/1, and all other parties have odds of majority rule starting at a best price of 400/1.

The markets

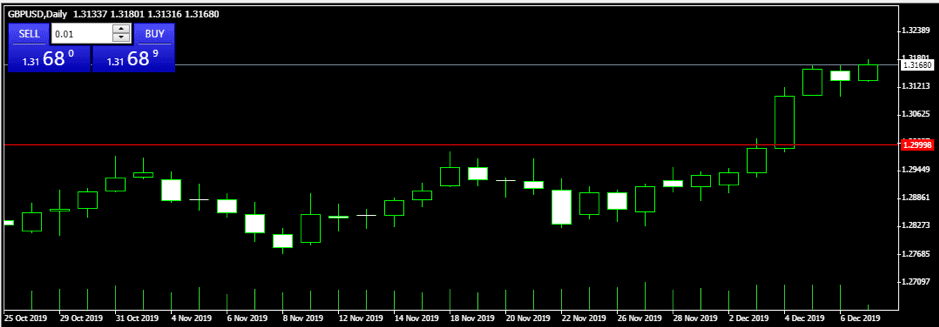

The financial markets have also been reacting to developments. The GBPUSD forex pair has become the de facto measure of how smooth the Brexit process might be. The lows of sub-$1.20 seen through the summer reflected market anxieties about a No Deal Brexit materialising. With ‘cable’ now trading near the $1.30 mark, many are suggesting that ‘good’ news is already priced in.

The $1.30 price level was seen as representing the resistance level that would not be breached until a smooth Brexit was agreed through October and November. Instead, with days remaining until the election, GBPUSD is trading at $1.3133. In December, it has traded more days above the psychologically important level 1.30 than below it.

GBPUSD – Daily Candles – 25th October-9th December

There was no clear catalyst for the break. The move seems to simply be an extension of the recent rally driven by the polls showing a likely election victory for the Conservatives. The extended time that GBPUSD traded in the 1.285-1.300 range could now represent price consolidation as part of a long-term upward trend. The question does remain of whether there is any room for GBPUSD to move from current levels to the upside – or would a voting surprise see sterling tank?

Risk on? Risk off?

With the election date approaching, both greed and fear will build, as whatever the indications may be, the final result could still spring a surprise. Pollsters, bookies and markets have all previously got their predictions drastically wrong.

David Smith, writing in the Sunday Times, suggested that the markets had already priced in a Tory victory:

“The reaction to a Boris Johnson win, for the pound and the stock market will be modest.”

He also warned that analysts saw more downside than upside from Thursday’s vote.

“If the Tories fall short, and there is a hung parliament … there will be a big sell off.”

Source: Sunday Times