- As widely expected, the US Fed cut interest rates when it delivered its report to the markets on Wednesday. The new target range is 1.75%–2.0%.

- The governing committee appears divided over what the next move should be. Some members of the committee had called for deeper cuts, but some for no cut at all.

- With no clear consensus on whether additional rate cuts are needed, there is a renewed emphasis on market reports.

- The approach is being described as ‘data-driven’ but there is uncertainty about what that actually means and what ‘data’ will do the ‘driving.’

Wednesday’s Fed announcement left the markets disappointed and a little confused. This was despite Chairman Jerome Powell and his team delivering broadly in line with expectations. The disappointment came from there being no real ‘surprises to the upside’. A 25 basis point cut was anticipated and delivered, but the markets are always looking for more. The confusion came from the underwhelming text of the report and post-event press conference. The detail of the responses and the future guidance showed the announced cut was, to some extent, papering over cracks in the Fed’s backroom operations.

The rate cut will take the headlines, but there are other important notes to draw from the report. The GDP forecast has been revised upwards. Household demand is ‘rising at a strong pace’, but trade and investment have both ‘weakened’. Surprisingly, recent reports that outlined inflationary pressures were little mentioned. Core consumer price inflation and average hourly earnings are both running at their fastest 3m annualised rates for a decade. During the press conference, Jerome Powell, Chairman of the Fed noted that inflationary pressures “clearly” remain muted. (Source: ING)

Whipsaw

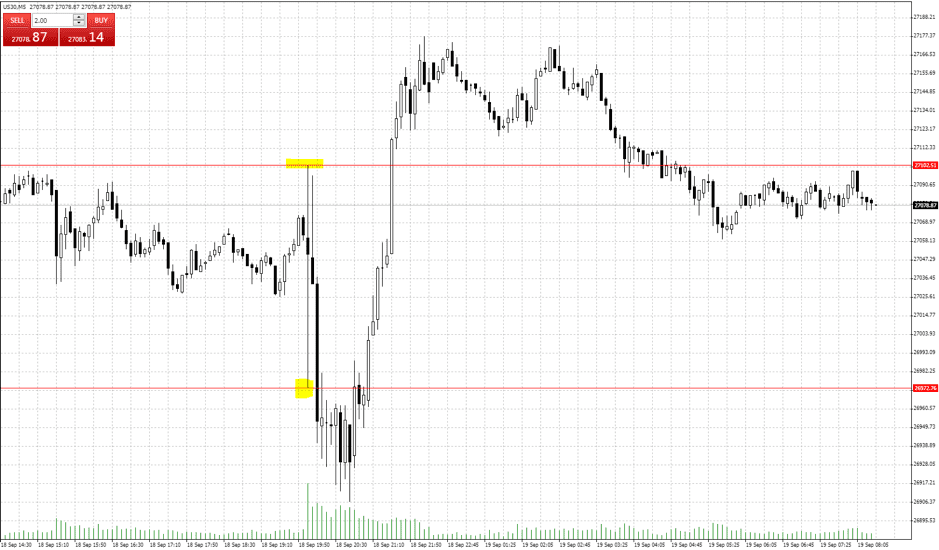

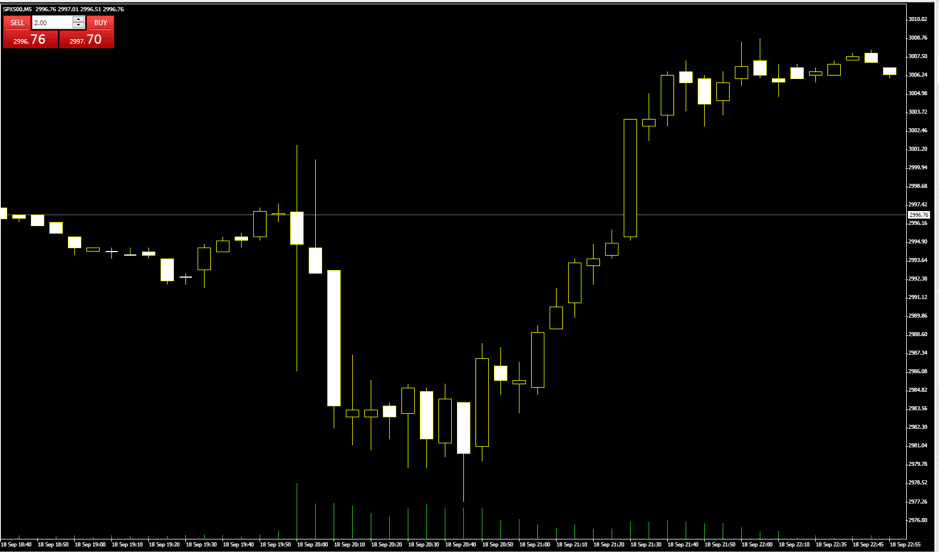

Running into the announcement, the markets were pricing the chance of a rate cut/no cut, at approximately 70/30. (Source: CME FedWatch). Immediately after the 25 basis point cut was revealed, stocks broke to the downside but then recovered into the market close. As expected, trading volumes also spiked on the news and remained strong as investors rotated in and out of positions. The whipsawing action in the five-minute candle covered a range of 50 basis points.

US30 Index — MT4 — Intraday Price Chart 18/9/2019

SPX500 — MT4 — Intraday Price Chart 18/9/2019

MT4 — Dollar M15 — Intraday Price Chart 18/9/2019

Behind the scenes

The announcement was interpreted by the markets as being to, varying extents, vague and confusing. It’s not a good look if analysts are delving into the detail of the committee structure to try to understand the process. David Kelly of J.P. Morgan Asset Management was speaking after the announcement when he highlighted the division between the overall Federal Open Market Committee (FOMC)and the voting members.

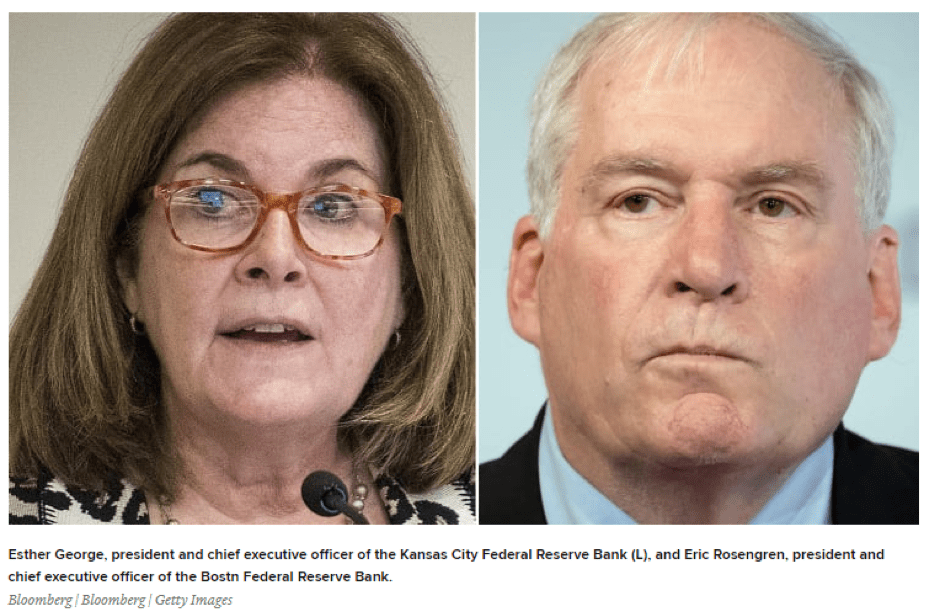

There are 17 members overall but only 10 who get to vote. Two of the 10 included Esther George and Eric Rosengren who both voted against the cut as they wanted rates held. James Bullard, President of the St. Louis Fed voted against the cut as he wanted the move to be deeper, 50 bps not 25 bps. The seven committee members who get to contribute to the discussion but don’t get to vote are all Fed bank presidents with a hawkish bias. This means Kelly interprets the committee’s position to be more hawkish than is being portrayed by the voting results, and suggests the Fed is failing to communicate this. Speaking on CNBC Kelly said:

“At the moment I do think they see it as a mid-cycle adjustment but they’ve got to at some stage say it. They’ve got to say, ‘this is the last cookie we’re giving you here and we really mean it this time’. Every time they cut and they leave uncertainty out there people are going to price in another rate cut.”

Source: CNBC

Data dependence

Mona Mahajan of Allianz Global Investors is not alone in thinking the Fed will base its next moves off data. Her argument for there being increased data dependency comes from the fact that the current moves do look like a ‘mid-cycle adjustment’. Historically, the average number of cuts associated with such a re-alignment is three or four. If there are to be four or five cuts, there will have to be data to support the extra interventions. Mahajan was speaking with CNBC when she said:

“We’re growing at a decent pace… Europe, China, not so much. So I still think treasuries, dollar, gold, you’re going to see that trade continue for some time… The markets are hoping for one to two more (rate cuts) this year and then one to two more next year.”

Source: CNBC

Mahajan signals that cuts may happen, but would have to be explained at a time when other analysts are showing concern that the Fed’s inability to communicate effectively is an issue.The markets are harbouring a growing disappointment that the Fed has not been clear enough about how it will interpret the data reports that will be released between now and October. Clear guidance on what the Fed and investors are looking out for in terms of data points can help investors move more quickly and effectively. Describing the benefits of clear guidance to CNBC, former Fed Governor, Fred Mishkin said.

“Some central banks do this and do it quite well. The Fed has been extremely disappointing on this. One of the reasons why that’s so helpful is that the markets will then do your work for you.”

Source: CNBC

Fast-changing

Recent strength in the equity markets signalled investors shifting to a more optimistic viewpoint. This means Wednesday was not a bad time to say to the markets that they would only be put through further cuts if they were needed. Whether the market is really digesting that message is another question. There is some momentum behind the doves, which appear to be winning the argument. The June median Fed forecast did, after all, signal no further rate changes in 2019. Since that time, the Fed has delivered two 25bp cuts within the space of three months.