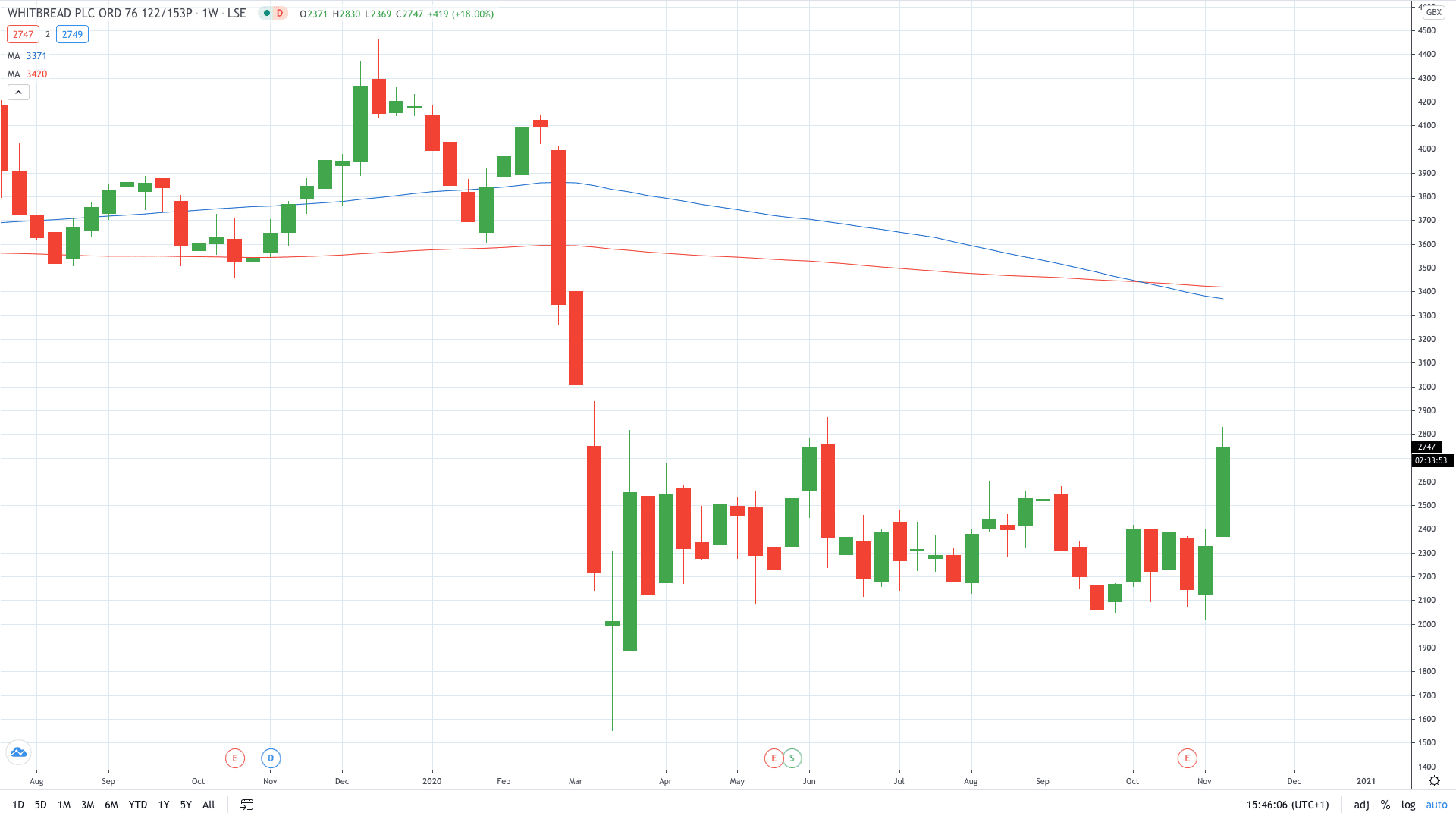

Shares of Whitbread PLC (LON: WTB) gapped about 2% higher this morning after Barclays upgraded the stock to ‘Overweight' from ‘Equal-weight'.

Barclays' analysts also raised the price target for WTB to 3,350p from prior 2,500p. Accordingly, they see Whitbread as “one of the most attractive recovery plays in the sector”.

“We now have a greater level of confidence that 2023 (calendar 22) can see RevPAR back close to prior levels. Operating leverage is high, with every 1% change in RevPAR representing c6% to group EPS in 2022/23, so we upgrade EPS by 43%, leaving us 19% ahead of Bloomberg consensus,” analysts wrote in a note sent to clients.

They see a plunge in the share price as an opportunity to get on the long side as WTB is “more attractive now than ever for its asset backing (31%-77% potential upside) and Germany optionality.”

“Whitbread becomes our preferred hotels name,” the analysts said in a note.

Whitbread share price is now trading at 2745p or 2.23% higher on the day. Shares of the owner of Premier Inn brand are up nearly 18% this week to trade at the highest levels since June following positive vaccine news.

PEOPLE WHO READ THIS ALSO VIEWED:

- BRITISH AIRWAYS: HERE’S WHY IAG SHARE PRICE SOARED TODAY

- Learn more on how to open a demo account

- Learn what is a Pip in trading