It is easiest to illustrate the meaning of pips by using an example trade as displayed on an online broker trade execution monitor. Studying the difference between the buying (bid) and selling (offer) price reconfirms that we want this difference to be as small as possible. The gap is measured in pips. If for example, we take a bid price in EURUSD of 1.1738 and an offer price of 1.1737, then there is a one pip difference between bid and offer. For most major currencies, the pips can be found in the fourth decimal place.

Working on enhancing our understanding of what a pip is in forex invites us to take another example from the GBPUSD forex market. If the spread between bid and offer was 1.3104 and 1.3106, then executed trades would be subject to a two pip spread.

Just to keep everyone on their toes, the forex pairs involving the Japanese yen calculate pips at the second decimal place (not the fourth). That is due to historical reasons, one dollar has, for a long time, traded close to 100 yen, so a one pip spread in USDJPY would be when bid/offer prices are 105.96 and 105.95.

What is a pipette?

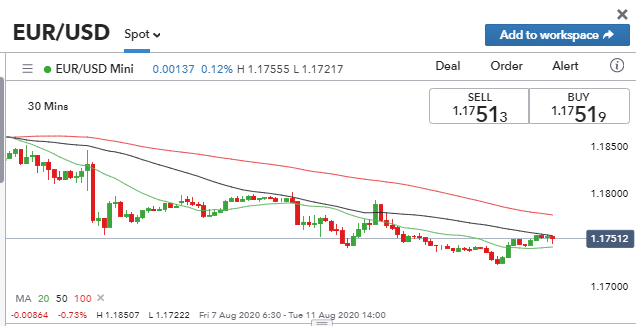

If you’ve seen a screen like the one below from IG, you’re probably wondering about the significance of the fifth decimal. Before breaking down this fifth decimal place — the ‘pipette,’ it’s worth noting that the intense competition between online brokers continues to drive down trading costs. Instead of competing on pips, brokers now compete on pipettes, each pipette being 1/10 of a pip and is good news for the forex traders who use their platforms.

Source: IG

Both the bid and offer are showing a four decimal place price of 1.1751. The difference between the two prices is six pipettes, whereby the difference is calculated using five decimal places: 1.17519 – 1.17513 = 0.00006.

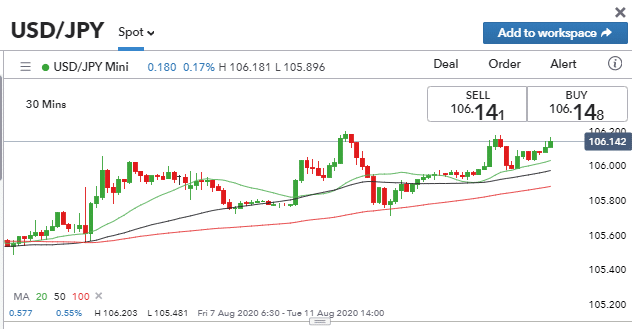

Circling back to the yen, the pipette digit on USDJPY is the third decimal place (not the fifth). The below screenshot from a trading monitor shows a difference between the bid and offer of seven pipettes. 106.148 – 106.141 = 0.007.

Source: IG

During periods when the markets are more liquid, the spread will tighten and be quoted in pipettes. At quieter times, they will widen and can be quoted in terms of pips.

How to calculate the PIP value?

So far, we’ve established how to identify and calculate the numeric value of forex pips and pipettes, but trading is about making money, so what is that number in cash terms?

In the above examples, we have screenshots that show a seven pipette difference in USDJPY, and a six pipette difference in EURUSD. What does this mean? Calculating the value of each pip involves putting the pip value through a formula. It is important to note that the currency pair will also influence the pip value. To put it another way, two pips in EURGBP will be a different value to two pips in AUDUSD.

Taking a one pip value as an example and basing it on the USDJPY example above, we calculate one pip as:

[.01 JPY] x [1 USD/106.14 JPY]

[(.01 JPY) / (106.14 JPY)] x 1 USD

= 0.01 / 106.14 = 0.00009422 USD

So, when trading 10,000 units of USDJPY, each pipette change in value is worth approximately 0.9422 USD

A quick sanity check is also beneficial as it confirms that the cost on the proposed trade is approximately one dollar, which sounds about right on a trade of that size and also doesn’t sound so large as to put us off trading. It’s our P&L which is our major concern and not the brokers.

If our account is denominated in dollars, then the above example, which has pips expressed as USD, is very easy to incorporate into our strategy modelling. In another instance, this might not be the case.

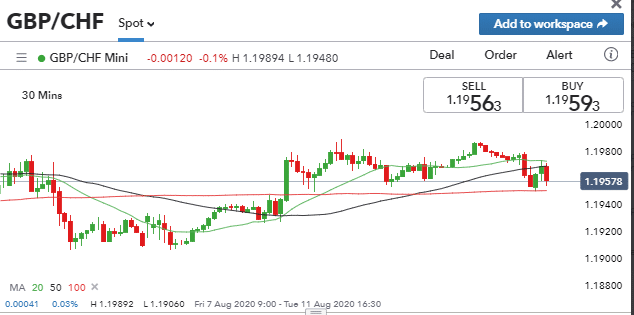

Source: IG

The pip value of the GBPCHF spread is 1.19563 – 1.19593 = 3 pips, or 30 pipettes:

[.0003 CHF] x [1 GBP/1.1956 CHF]

[(.0003 CHF) / (1.1956 CHF)] x 1 GBP

= 0.0003 / 1.1956 = 0.00025092 GBP

Note that as we’re not factoring in yen, we look to use the fourth decimal place. If we traded 10,000 units, then for every pip move in the above trade position, there will be a GBP 2.59 move in the value of the position. A quick sanity check flags up that this is greater than the pip value in the USDJPY example. It is, though, in line with the pip difference on GBP being three times greater than the first example — a reflection that there is less liquidity in the GBPCHF market.

As our account’s base currency is in dollars, this pound value is then converted by taking the market rate of GBPUSD = 1.31. That means a pip value in pounds = 0.00025092 x 1.31 = 0.0003287. On our position of 10,000 units, that’s a $3.28 move in value for each move of one pip.

Pips and making a profit

Now comes the time to apply this knowledge to the trading bottom line. By taking a situation where different brokers are quoting (non-JPY) forex pairs to four decimal points, we can establish which is giving us tighter spreads and better trading terms.

If you were trading EURUSD and bought the Euro for 1.17710 and exited the trade at 1.17790, you would make 80 pips profit.

The USD pip value of the GBPCHF position is continually changing and is subject to the influence of three variables: the spread between the bid and offer price which might change, the GBPCHF forex rate and the GBPUSD rate.

Converting the pip difference into cash terms is, of course, subject to position size. The larger the position, the greater the cash profit or loss on the same movement in terms of pips.

Pips, pipettes and hyperinflation

Things can get even more interesting when markets conditions change or even break down completely.

If you’re watching your position at about the time of that market closing, you can expect to see your trading P&L suddenly go against you. As liquidity drains out of the market, brokers widen the spreads to ensure they don’t get caught out holding an out of the money position should price move sharply. If you sell your GBPUSD position to them at 1.3122 and price moves to 1.3120, then they are left carrying the P&L loss. As a result, at quieter times, the difference between bid and offer can shift from pipettes to pips. Any position you are already holding will take the new (wider) price mark. For this reason, it's essential to keep up to date with market opening hours. Forex markets do trade on a 24/5 basis, but the spreads at most brokers are variable.

In the most extreme circumstances, the pip value of a position can become almost insignificant and trading technically impossible to do. Hyperinflation (monthly inflation above 50%) and currency devaluation can push exchange rates to the point where they become unmanageable. The history books about economics often contain a photo of German citizens wheelbarrowing piles of cash around during the Weimar Republic’s financial meltdown. Banknotes became so worthless that they were used to make children’s toys or to light fires.

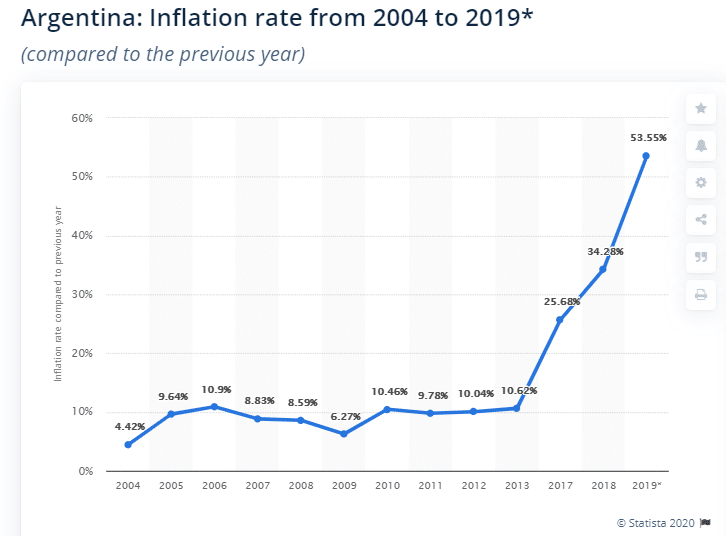

The hyperinflation in Germany dates back to 1923, but other countries have experienced moments of hyper-inflation/devaluation in more recent times. The situation in Venezuela is still unravelling and the average annual inflation rate in Argentina between 1975 and 1990 was 300%. It looks like that kind of price inflation could be coming back on the agenda again.

Source: Statista

In 2001 the Turkish lira, which reached a level of 1.6m per dollar, was untradeable on many trading systems, as the IT infrastructure was unable to accommodate such a large number of decimal places. The work-around put through by the government eliminated six zeros from the exchange rate and it was renamed the new Turkish lira.

The advice for beginners is to stick with major currency markets where there is most liquidity and to look for spreads that are measured in low digit pips or even pipettes.

PEOPLE WHO READ THIS ALSO VIEWED: