Shares of IAG PLC (LON: IAG) are trading about 4.5% higher on Friday after the owner of British Airways slashed costs as it fights to survive the pandemic-fueled crisis.

The company said says it has been forced to make cuts in operating costs by 54% during the last quarter to end-September. British Airways slashed 9,680 posts by the end of October.

“The group has made significant progress on restructuring and we continue to reduce our cost base,” new CEO Luis Gallego said in a statement.

After IAG reported a €1.3 billion loss last week, the firm has now said that the total operating loss for the quarter stands at €1.9 billion as it works to save its business. Losses have now totalled to a mouth-watering 5 billion pounds for the first nine months of the year.

“These results demonstrate the negative impact of Covid-19 on our business but they’re exacerbated by constantly changing government restrictions. This creates uncertainty for customers and makes it harder to plan our business effectively.

“We are calling on governments to adopt pre-departure testing using reliable and affordable tests with the option of post-flight testing to release people from quarantine where they are arriving from countries with high infection rates,” Gallego added.

IAG said it would take for the demand to normalize until at least 2023.

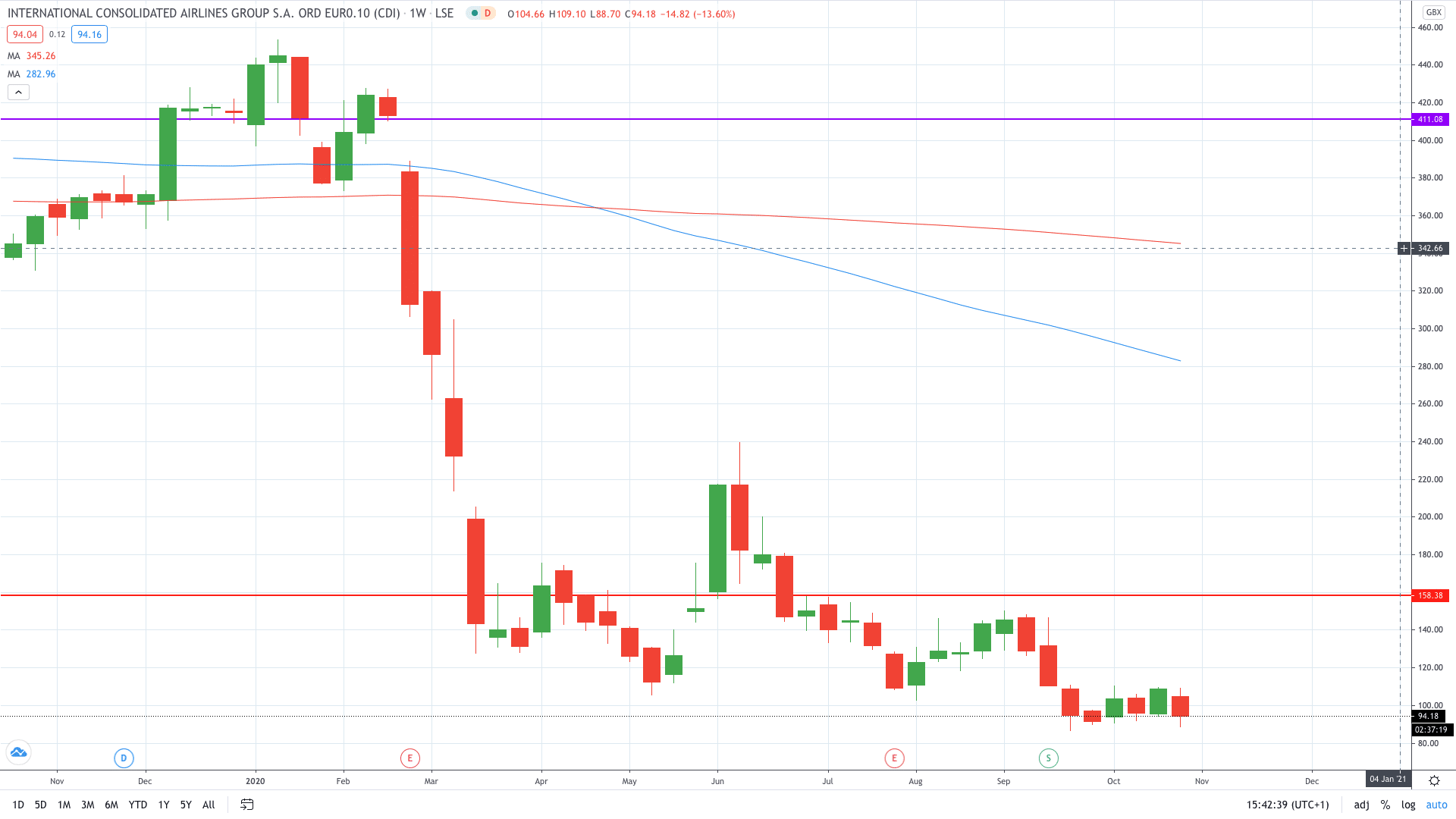

IAG share price rose 4% to erase a portion of weekly losses as it now trades 13% lower compared to the last week’s closing price.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here’s Why Just Eat Takeaway Share Price Just Soared to Fresh Record Highs

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan