CFD broker INFINOX has been operating since 2009 and now serves 15 different countries around the world. The company’s management team has over 100 years of financial markets experience and the firm has won awards for its customer service, forex broking and innovation.

The broker is authorised and regulated by the Securities Commission of the Bahamas, the Financial Services Commission of Mauritius and the Financial Services Conduct Authority of South Africa.

INFINOX has a good variety of accounts and payment options, with demo accounts available for all options. The INFINOX broker platform would appeal to the experienced trader or money manager due to the account types, high-quality trade execution and the lack of educational materials for beginners.

INFINOX offers trading in 300+ forex and CFD markets. Assets available to trade include single stocks, stock indices, commodities, and futures. There are also some instruments, such as the VIX (Volatility Index), that will appeal to traders running more advanced strategies. The broker has all of the tools required for experienced traders to access the markets in the office or on the move. INFINOX has competitive spreads and a trading infrastructure which will suit all kinds of activity, especially day-trading and other more short-term and speculative forms of investment.

The following assets are available to trade:

- 37 currency pairs

- 14 indices

- 20 commodities

- 38 crypto assets

- 10 stocks

- 5 future contracts

What can you trade?

Forex

| Min Deposit | App Support | Max Leverage | Trading Fees |

| $1 | Good | 1:1000 | Low |

There are 37 forex pairs to trade at INFINOX with major, minor, and exotic currency pairs on offer. Spreads in the EURUSD market start at 0.3 pips and the table of commissions and fees related to trading forex is laid out in a clear and transparent manner.

INFINOX offers five different trading platforms, including the market-leading forex platforms MetaTrader 4 and 5 and there is also a virtual private server (VPS) available for faster execution.

CFDs

| Min Deposit | App Support | Max Leverage | Trading Fees |

| $1 | Good | 1:1000 | Low |

CFDs are available to trade on the major indices with spreads on the US30 at 2.6 and on the FTSE at 0.9.

Investors can also get access to futures CFDs, which have low margin and cost requirements. These come direct from the exchanges with the same prices and quotes. Gold futures have a 2.8 spread and the Nasdaq index has a 1.5 spread. There is not a large selection of CFDs compared to other brokers, but the platform is more than suitable for experienced investors who likely trade FX whilst taking the occasional position on stocks or indices as part of a macro-style trading strategy.

INFINOX CFDs are available on all five platforms, with the focus being on MetaTrader 4 and 5.

The virtual private server is available for faster execution. Leverage of up to 1:1,000 is available to some clients but those signed up with the FCA-regulated entity in the UK will have leverage capped at 1:30.

Stocks

| Min Deposit | App Support | Max Leverage | Trading Fees |

| $1 | Good | 1:1000 | Low |

INFINOX only provides stock trading through CFDs and not the underlying instrument. This is suitable for investors who want to day trade or swing trade the stock market. CFDs have different commissions for different exchanges. For example, NYSE and Nasdaq commissions are $0.02 per share, and on the London Stock Exchange, it is 0.10% of the nominal value.

Investors who sign up to use the MT5 platform can get access to popular stocks such as Apple, Google or Tesla and all are at a flat trading commission of $0.02. The platform only lists six of the top US companies and is not offering information on European stocks. The rating for INFINOX stocks assumes that they will be used by day traders.

Social Trading

| Min Deposit | App Support | Max Leverage | Trading Fees |

| $1 | Good | 1:1000 | Low |

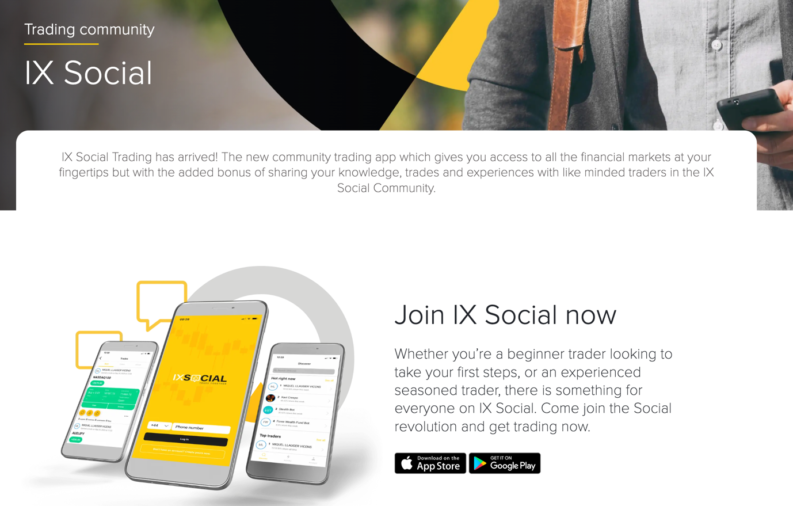

INFINOX provides copy trading in the form of the IX Social app. Functioning as a community platform, traders can share market knowledge, access financial markets, and keep up to date with the latest news, prices and trader leader boards. By interacting with others, INFINOX traders have the opportunity to become influencers, gain a following and share their strategies with followers. By doing so, INFINOX allows traders to monetise and earn commission from others that copy their trades. The platform is available in the form of a mobile phone application – downloadable from the Apple App Store and Google Play.

The broker has gone above and beyond other brokers with its unique IX Social app. Although this product idea is taken from social trading apps, it is rare to see a broker embrace the concept and bring it to a mobile device. It can be helpful for beginner or intermediate traders to learn from professionals, and experienced traders can monetise their strategies with a commission earned from followers.

Crypto

| App Support | Max Leverage | Trading Fees |

| Many | 1:2 | Low |

With a minimum deposit of $1, at INFINOX, you can trade up to 38 crypto CFDs, including Bitcoin, Cardano and meme coins such as Dogecoin. The spreads differ, with 0.69 on BTCUSD and 0.0015 on XRPUSD. Crypto trading is offered in CFD format meaning traders can sell short if they think the price of a coin is going to drop.

CFDs on crypto allow traders to speculate on the prices of different coins without having to buy or sell the underlying instrument. Traders have no requirement for wallets as traders don’t actually hold the crypto assets. This can also allow access to leveraged trading. Cryptocurrencies can be traded at INFINOX on MetaTrader 4 and 5, and TradingView provides a full range of charting for all your crypto needs.

What did our traders think after reviewing the key criteria?

Infinox Fees

INFINOX is very clear about its spreads on the main website and investors will know beforehand what to expect in the different trading products.

There are no hidden fees and to get started, investors simply need to register their details and fund their account. Fees at INFINOX are in-line with the market, but this is a broker that offers a high-quality service rather than competing on price alone. That being said, INFINOX did, in 2020, win the Professional Trader award for Best Margin Rates.

Clients who are eligible to upgrade to the IXO Prime accounts are offered improved terms with lower spreads and commissions traded.

Account types

INFINOX offers three different trading accounts – these are the Individual account, Joint account and Corporate account. There is also a MAM/PAMM account for money managers, which allows traders to manage money on behalf of their clients.

The Corporate account would suit firms that need to use hedging for foreign exchange or commodity prices or those where the management team want to invest some of the profits from their business operations in the financial markets.

Again, there is access to the IXO Prime services for registered professional investors.

To qualify for Professional Client status, you need to meet two out of the three following guidelines:

- You must have a portfolio of greater than $500,000.

- You must have a verified history of significant trading volume.

- You must have worked in the capacity of a professional in the areas of derivatives/speculation/trading.

The company targets a global client base and is particularly strong in the markets of Nigeria, South Africa, Malaysia, Thailand, Philippines, Dubai, and the UK. INFINOX Capital does not currently accept clients from the USA.

Demo accounts are available for beginner traders or for others to try out new strategies with a balance of $100,000. This is also available on the IX Social account.

The IX Premium and IX Lite accounts, which are available to some clients offer additional extras. These include a trader ‘Telegram’ service (IX Premium only) that offers monthly analysis, daily content and one-to-one sessions from INFINOX’s Market Analyst Richard Perry.

Both accounts also offer 20% deposit bonuses and cashback-style offers. IX Premium is available to clients with a minimum of $1,000, and $500 for those who opt for IX Lite.

Platforms

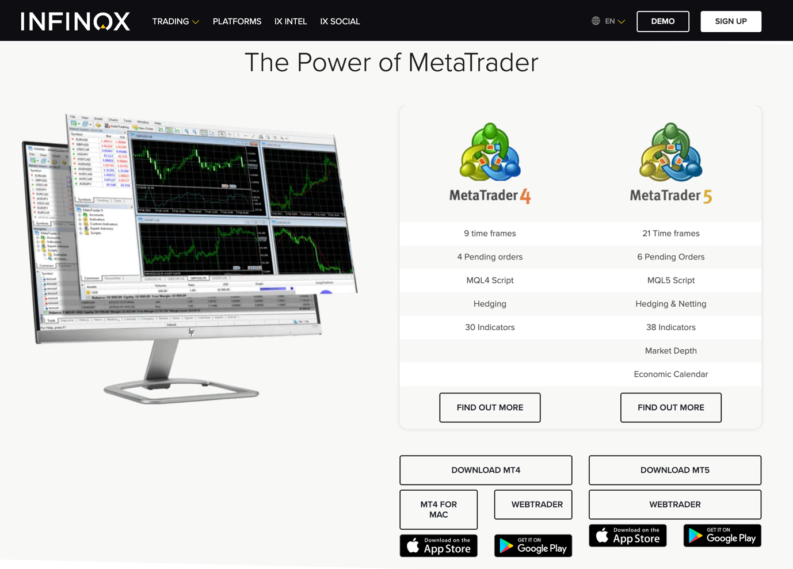

INFINOX provides access to the popular MetaTrader 4 and 5 trading platforms with MQL4 and 5 scripting for developers. The platforms can be downloaded from the website or there is a web-trader online option.

The MT4 platform supports FX, indices, metals and oil, but it does not support equities, and traders need MT5 access for the latter.

The platforms are easy to use with all of the features and tools required to support successful trading activity. Execution was also good with fast speeds and no delays and automating trades is also an option.

MT4 & MT5

The MetaTrader platforms are the industry standard for trading software and were created by MetaQuotes. This platform is now supported at most brokers, which means if you’re currently using MT platforms at another broker, you can easily open an account with INFINOX and port your trading dashboard to your new account.

INFINOX provides MT4, MT5, WebTrader, a desktop app for Windows and macOS, and also for mobile devices with Android and iOS. There is no cost to use the platform and traders will find the following features:

- One-click trading for scalpers.

- Fast connections to brokers and information providers.

- Multiple order types, including limit orders, stop loss and take profit.

- Access to charting and technical indicators, drawing tools, etc.

- MetaTrader Market for purchase of EAs, indicators, and other trading tools and services.

- Support for multiple languages.

IXO

IXO is an in-house designed trading platform, which has the feel of being designed by traders for traders. The platform is user-friendly and has a large selection of tools for trading and account management but is only available to professional-grade clients.

IX Social

A recent addition to the range of platforms on offer is IX Social Trading. This platform comes in app format and allows traders to be able to share knowledge and trading ideas.

It’s also possible to turn those ideas into real trades by using the IX Social copy-trading function. This allows traders to automatically copy the ideas of others and those lead traders who are followed by others can earn commissions for sharing their investment tips.

Usability

Once you are set up with INFINOX, the trading process is user-friendly and intuitive. It is good for the professional trader that MetaTrader 4 and 5 are supported as there is no need to learn a new system.

The IX Social platform is unique to INFINOX and requires some getting used to, but it is worth investing time in learning how it works.

Customer Support

Is INFINOX a good broker when it comes to customer reviews? During our testing, we found the client support to be more than adequate. The broker has 24/5 customer support and provides help in over 15 different languages with help numbers available for INFINOX in Thailand, Hong Kong, Singapore, Vietnam, Brazil, UK and Europe.

There is a help section with FAQs that covers the key themes such as account opening, deposits and withdrawals, and security. The help section is maybe not thorough enough for new traders, and a blank enquiry form and phone numbers are the only contact methods available.

The company provides help in over 15 languages and that would be helpful for traders in different countries.

The platform also lacks a thorough research and education service, which would make it unsuitable for beginner traders. The IX Intel section provides research from in-house analysts, but it is not updated frequently.

Payment Methods

INFINOX clients can open a trading account in USD, EUR, GBP and AUD and the minimum account opening balance is $1 or the equivalent in other currencies.

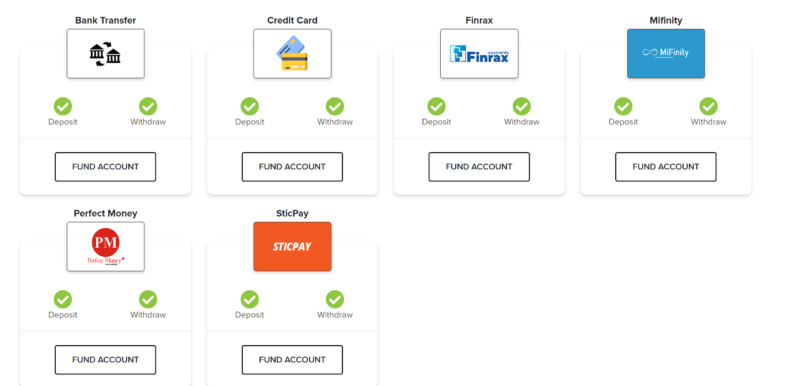

Clients can deposit funds into an account using a debit or credit card, Skrill, Neteller, or by making a bank transfer. Bank transfers take two to seven days to clear in your account, but the other options will be immediate or in the same hour.

Cash and cheque payments are not accepted. The bank account name must match the name of the trader using the trading account and any transfer from third parties will be rejected, which is standard procedure with most brokers.

INFINOX also offers a range of localised funding options suitable to the respective regions of the world. Crypto payments are also accepted by some entities within the INFINOX group of companies.

Notably, traders in the UK can opt for payment methods including bank transfers, credit cards, Finrax, MiFinity, Perfect Money and SticPay. In Thailand, users can select from Directa24, Neteller and AstroPay amongst their payment options. Dusupay, Finrax, Online Naira, Perfect Money and ZotaPay form part of the payment method options for traders in Nigeria, for example.

Best Offers

Access to offers is determined by the domicile of clients. Some won’t be able to access offers at all. Others will be able to access a trader messaging service, as well as low spreads, swap-free, tradable bonuses and cashback bonuses.

Regulation and Deposit Protection

Client protection is determined by place of residence. The primary regulator of INFINOX Capital, a registered trading name of IX Capital Group Limited, is the Securities Commission of The Bahamas (‘the SCB’), where the firm is licensed under registration number SIA F-188. It is authorised by SCB to deal, arrange and manage securities out of their registered office, which is located at 201 Church St, Sandyport, West Bay Street, P.O Box N-3406, Nassau, Bahamas.

INFINOX Capital Ltd SA is an authorised Financial Services Provider and is regulated by the Financial Services Conduct Authority under FSP No 50506 (INFINOX Capital Ltd SA acts as an intermediary for INFINOX Capital).

INFINOX Limited is authorised and regulated as an Investment Dealer by the Financial Services Commission (FSC) of Mauritius under License Number GB20025832.

INFINOX Capital Ltd (‘INFINOX’) is registered and located in the United Kingdom at Birchin Court, 20 Birchin Lane, London, EC3V 9DU, United Kingdom under company number 06854853 and is authorised and regulated by The Financial Conduct Authority under registration number 501057.

Some of the regulators INFINOX is licensed by have a more relaxed view on client leverage and offer margin terms up to 1:1,000, whereas the FCA and CySEC cap leverage at 1:30.

The regulatory cover applied to clients trading with the Bahamas entity includes best execution, segregated accounts, and negative balance protection.

Onboarding to INFINOX Capital requires providing soft copies of a valid international passport, National ID card or driver’s licence for identification purposes. For account setup, a copy of the client’s bank statement or utility bill is also required.

In 2021 INFINOX Capital introduced an innovative insurance scheme to cover client interests. The insurance policy became effective 1 May 2021 and continued until 31 May 2022 and provided up to $500,000 of cover per claimant. As with all insurance policies, terms and conditions apply and clients would do well to check what cover applies to them. At the time of this review, there was no indication as to whether the scheme will be rolled over to future years, but any additional customer protection is always welcome.

INFINOX also protects user data and will not share your information with third parties for marketing purposes. It may use your information to make enquiries about your identity or to prevent fraud. The company has an annual insurance policy of up to $500,000 per client in the event of insolvency. The company has gone to great lengths to give customers satisfaction that they are with a reliable broker and that their funds are safe.

Awards

INFINOX has been trading since 2009 and has won a selection of industry awards over the last five years. These include:

- ‘Professional Traders Award for Best Margin Rates 2020’

- London Stock Exchange Group – one of the ‘1000 Companies to Inspire Britain’

- ‘Best Customer service 2017’ – FX Reports award

- ‘Best FX Trader 2017’ – FX Reports award

- ‘Forex Broker of the Year’ – 2017

- ‘Most Innovative Forex Broker’ – 2018