On its website, the brokerage describes itself as an “advanced stock trading” platform specializing in “low-cost stock & options trading.” In this review, however, we will look at the brand from the perspective of an internationally acclaimed deep discount brokerage. First off, we would like to confirm that Lightspeed brokers operate under Lime Brokerage that doubles up as its introducing broker. The broker has been around for over a decade and currently maintains offices in New York and Chicago that process both local and international membership requirements and trades.

In the US, broker seeks to change how traders and investors interact with Equities, Options, and Futures markets. But as we shall soon reveal in this US broker review, this discount brokerage isn’t for everyone. It has its sight set on “Sophisticated, Active, and Professional traders” as evidenced in its restrictive minimum deposit and account operating balances as well as the lack of beginner trader support tools. And as its name suggests, the discount broker promises its clients speedy transaction processing on their proprietary trading platforms that embrace technology.

This broker review queries this speedy performance claim. It also analyses and details the effectiveness of the three products traded on the platform and rates the broker’s service delivery.

What to trade?

Lightspeed ETF Review

| Min Deposit | App Support | Max Leverage | Trading Fees |

| $10000 | 1000 | 1:1 | Mid |

Lightspeed acts as a discount broker for those who are trading large volumes of assets. This is what the entire platform works around, making a lot of trades. There is trading available for US markets, as well as over the counter markets.

The main type of tradable assets are stocks, options and ETFs. There currently are no commission-free ETFs on offer through Lightspeed, which is a downside. Thankfully, there are more than 1,000 different ETFs open for you to trade through the platform.

If you are not interested in the likes of equities, ETFs and options, then Lightspeed is not going to be an ideal trading platform for you.

Lightspeed Futures Review

| Min Deposit | App Support | Max Leverage | Trading Fees |

| $10000 | Good | 1:1 | Low |

Our Lightspeed broker review indicated that the US-based company gives its clients access to countless futures trade and investment opportunities. This, according to the broker website, is achieved by giving its clients access to futures traded in eight of the largest exchanges in the country and internationally. Our review also gathers that trading costs are both commission-based and also volume-based with active traders benefiting from the lowest fees.

You will, however, want to note that futures can only be traded on the CQG and Eze EMS Pro and Express trading platforms. These are available in web trader versions but also compatible with different mobile phone browsers. Additionally, supplies its clients with educational and research materials as well as webinars touching on futures trade. These are, however, advanced-trader oriented and aimed at helping them understand the market – not how to trade.

Lightspeed equities review

Broker claims to embrace the highest quality of service and technology when it comes to trading equities, also further claims to have integrated a wide variety of tools and resources like real-time quotes, automated traders and APIs as well as technical and fundamental analysis tools to help ease equity trades. And that it complements these educational, news and research reports required to make informed trade decisions. Trading costs are commission-based but active traders get to enjoy monthly discounts based on trade volumes.

Our review, however, indicates that apart from the basic quotes and stock screener tools, the company pays little emphasis to market research. Additionally, their range of equity products doesn’t take into account such tradable products as mutual funds. The broker review team further notes that the news and research reports, like in the case of options, are biased towards helping traders understand the market – not for newbies to learn how to trade.

Lightspeed options review

| Min Deposit | App Support | Max Leverage | Trading Fees |

| $10000 | Good | 1:1 | Mid |

Lightspeed brokerage hosts the highly acclaimed Livevol X trading platform. This refers to a graphically-appealing trading platform developed by CBOE and specially designed to evaluate and trade options. Traders are however not limited to using Livevol X as they can turn to equally speedy in-house options trading platforms like the web trader. Options trading costs are commission-based and pegged on a volume-based sliding scale where voluminous traders get to enjoy lower fees.

This broker review can report that the broker’s options trading system is rigged in favor of hedge funds and institutional investors. Apart from the high charges imposed on low options trading volumes, there aren’t enough educational materials to help beginner traders. And like in the case of equities and futures, Their trading platforms pay more emphasis to order execution speeds over in-depth market analysis tools.

What did our traders think after reviewing the key criteria?

Fees

Our Lightspeed broker review finds this broker’s fee structure quite complex largely due to the huge number of fees imposed on different trade categories. The trader fees for tradable products (equities, options, and futures) are commission based in relation to monthly trade volumes. But our review team also observed that the broker maintains several additional charges. Here is a breakdown of the fees we found most impactful:

Equities per share fees:

The per-share rate for trading stocks and ETFs on brokerage starts from $0.0045 for monthly trade volumes of below 250,000 shares. High volume trades that push over 15 million shares have a discounted rate of $0.0010 per share.

Equities per trade fees:

If you pursued less than 250 trades in a given month, every trade will incur a $4.50 charge. This dips to $2.50 per trade if you engage in more than 10,000 trades in a month.

Options per contract fees:

Broker maintains a base rate fee of $0.00 per options traded. You will, however, incur a per contract fee of $0.60 if you trade less than 500 contracts in a month, but this dips to $0.20 if you trade over 100k contracts a month.

Futures per contract fees:

Futures carry a fixed fee of $1.29 per side while futures options are charged $1.79 per contract per side.

Broker assisted fees:

Our review further observes that brokers help traders and investors complete trades over the phone at a cost of $20 per completed trade.

These charges do not take into account the trading platform’s minimum charges and regulatory fees. Our broker reviewers, however, contend that while the pricing mechanisms may be complex, the broker maintains some of the lowest trading fees for high volume traders. And it is in this recognition that it was recently honored with the best broker for high-volume traders award

Account types

Throughout this Lightspeed broker review you have probably seen that while the broker claims to accommodate both the beginner and advanced traders, they are hugely biased towards expert traders. On this platform, we found close to a dozen trader accounts. The most popular include:

Individual/joint accounts:

This is your typical standard investment account that can be opened by virtually anyone – both US residents and international clients. It can be either an individual account or a joint account for two or more persons.

Business accounts:

Business accounts is an aggregate term used to refer to all trader/investors accounts that enjoy certain tax benefits. These may include sole proprietorship, partnerships, corporate of a limited liability company account.

IRA/Trust account:

Broker also accepts account to account transfers from IRA and Trust accounts. You will need a minimum $2,000 operating balance to trade in conservative Lightspeed markets.

Hedge fund account:

This can only be opened and operated by a hedge fund that’s registered in the United States.

Separately managed account (SMA):

In our broker US review, we found the company to be one of the few that maintain highly flexible client-engagement rules. The SMA is, therefore, a customized account that takes the user’s need to arrive at a compromise concerning the per-share rates on voluminous transactions.

Trading platforms

At the discount broker hosts up to eight proprietary and third-party trading platforms. These differ not just in their order execution speeds and the number of integrated market and trade analysis tools. Our broker review observes that they also have varied operational capabilities against which the broker charges different access fees. The most popular include:

Lightspeed trader:

Their proprietary platform that’s specially designed to facilitate equities and options trades. Its key features include multithreading capabilities and over 100 routing destinations for hyper-speed order executions. It has a minimum commission charge of 100x the per share rate.

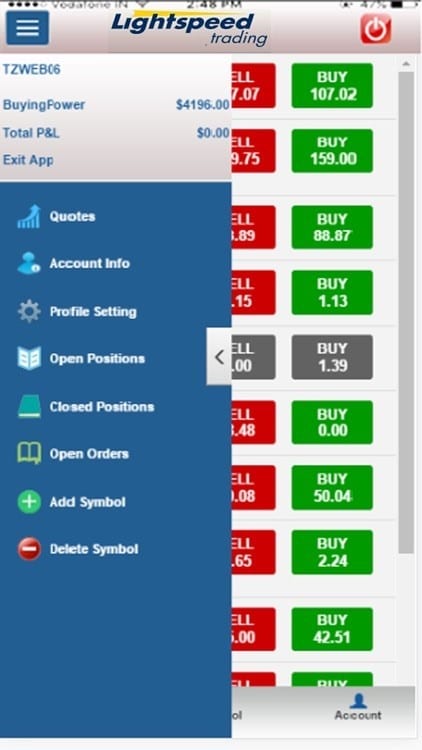

Lightspeed web and mobile traders:

This is a proprietary web-trader platform available for online traders. We found it better equipped to handle equities and options trades as well as after-hours trading. The minimum commissions for options orders on the web trader platform is $4.50 and it does not support the per-share equity pricing.

Sterling trader pro:

Sterling is a comprehensive platform with advanced charting and customization and features. We found it ideal for all types of markets and specially designed for professionals. Like the trader, it has a minimum commission of 100x per share rate.

Lime auto trader:

The Lime Autotrading Systems is availed by Lightspeed’s parent company Lime Brokers. It is a fully automated and programmable algorithmic trader that’s specially designed for professionals looking to automate and speed up their order execution speeds.

Specialized equities and options trading software:

Our broker review further observes that the brokerage hosts three specialist programs for equities and options trades. These include Derivix, Silexx OEMS, and WEX.

Specialized futures trading software:

Futures traders, on the other hand, have access to COEB’s flagship trading platform that’s specially designed to address futures trades – Livevol X. We also observed that Livevol X also maintains minimum commission charge of $1.50 per contract for US Futures and Futures Options. Other specialized futures trading software include Eze EMS pro/express (formerly RealTick) and the proprietary eFutures software.

Usability

In our Lightspeed US brokerage review, we found both the website and trader platforms relatively easy to use as they both post commendable loading speeds. We also found the downloadable trading platform packages easy to interact with. What we liked most about these platforms is their customization feature that allows traders to highlight and favorite different tools and features.

Customer support

In all our tests of the brokerage that helped inform this review, their customer support was the most interesting. You can access this team by calling in the numbers on their website, via email, raising a ticket on the website or via their different social media platforms. The broker stands out for its fast responsiveness.

Payment methods

There are three ways of funding your client account and withdrawing profits therein. These include an automated clearing house (ACH) transfers, bank wire, and checks. There are no deposit or withdrawal fees for ACH deposits and transfers. Deposits will be processed within one business day while withdrawals may take two business days.

Bank wire deposits are free and have an average processing time of 24 hours while withdrawals take 2-3 days and attract a $20 fee. Check deposits are processed within 24 hours after receipt of the check and withdrawals are processed within the same day but may take up to 5 days to reach the client.

Best offers

Like in the case of most other deep discount brokers we have reviewed, we didn’t find any offers or promotions on the broker website. There nonetheless is a free demo account available to both beginners and experienced traders looking to gain a better understanding of the broker’s platform.

Regulation and deposit protection

Our broker review team further observes that the brokerage is licensed and regulated by both the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchanges Commission (SEC).

When it comes to client data and deposit protection, Lightspeed has put in place a two-factor authentication technique for logins and embraced SSL encryption for website data. Its client deposits are also insured with the Securities Investor Protection Corporation (SIPC) that insures client deposits with a cover of up to $250,000.

Awards

In 2019, Lightspeed scooped two awards during Barron’s online brokers awards. Also was feted with the Highest Ranking Broker award as well as the Lowest Cost Broker for active traders.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here are our latest trending stories

- Trade stocks with top-rated eToro

- Learn everything about Plus500 Withdrawal