Attention: This broker is not recommended from AskTraders !!

Formerly managed by Hoch Capital Ltd, TradeATF is currently the trading name of Bayline Global World Ltd, a UK-based online forex CFD broker with over 10,000 clients. The other subsidiary of Bayline Global World Ltd includes Bayline Trading Ltd, a limited liability company incorporated in Belize, Central America.

Established in 2019 by a team of online trading experts, TradeATF offers a range of more than 300 CFD instruments across multiple asset classes from three account types, besides the Islamic account. Clients registering with the CFD broker have full access to all the trading features and analytical tools on the most widely used trading platform in the world, MetaTrader 4, across all computers and mobile devices.

TradeATF offers zero commission, several funding methods, multiple customer support channels, besides providing plenty of educational resources for beginners and experienced traders to enhance their skills. In this TradeATF review, you can get an insight into the various products and services offered by one of the newest CFD brokers in the industry, besides the regulation, and the extent of security on client deposits. Read on as we review TradeATF.

What can you trade?

Global.TradeATF forex review

| Min Deposit | App Support | Max Leverage | Trading Fees |

| $100 | Good | 1:400 | Low |

This Global.TradeATF forex review covers all the broker’s forex offerings. Individuals signing-up with Global.TradeATF can access a range of 50 FX pairs, including majors, crosses, and exotic currencies. With spreads starting from 0.7 pips and leverage of 500:1, in terms of volumes, users can experience non-stop trading five days a week on the world’s #1 financial instrument.

Global.TradeATF CFD review

| Min Deposit | App Support | Max Leverage | Trading Fees |

| $100 | Good | 1:125 | Low |

Global.TradeATF’s CFD product offering comprises 184 stocks, 33 cryptocurrencies, 20 leading global stock indices plus the US dollar, and the volatility indices. In commodities, clients can access the four primary precious metals. Trading in 20 commodities can be conducted, comprising energy, metals, soft commodities, grains, and precious metals.

Global.TradeATF stocks review

| Min Deposit | App Support | Max Leverage | Trading Fees |

| $100 | Good | 1:50 | Low |

Based on our review of the TradeATF stocks offering, clients signing-up with the CFD broker can trade in 184 stock CFDs across the web, desktop, and mobile MT4 platforms offered by Bayline Global World Ltd. These include 108 listed corporations on the various US stock exchanges, 70 from Europe, and six from Australia. The stock CFDs allow individuals to bet on the price difference on some of the leading global stocks with leverage as high as 50:1 and a fixed spread of 0.21 points.. Traders can gain 24-hour access to these markets and carry out cross-platform trading without the burden of holding the shares.

Global.TradeATF social trading

Some of the top CFD brokers also provide clients with the option of Zulutrade or the Myfxbook to carry out social trading. When conducting this Global.TradeATF review, it was apparent that this broker did not offer social trading platforms or any such option to its clients. However, the MT4 platform has copy trading options — individuals who wish to copy the strategies of other traders can do so by this method.

Global.TradeATF crypto review

| Min Deposit | App Support | Max Leverage | Trading Fees |

| $100 | Regular | 1:2 | Low |

For cryptocurrency enthusiasts, this Global.TradeATF cryptocurrency review covers all Global.TradeATF’s crypto offerings. The Belize-regulated broker’s cryptocurrencies range includes 33 top digital currencies such as bitcoin, ethereum, ripple, monero, stellar and Swisscoin. The product offering comes with floating spread and max leverage of 2:1. Besides the choice of trading these instruments in multiple currencies, you can access the markets 24/7 across all the MT4 platforms with 0% commission.

What did our traders think after reviewing the key criteria?

Fees

Global.TradeATF’s charges broadly comprise of its spread, commission and fees. While the spread and the commission is a component of the account type, the additional charges or fees are standard for all clients. This TradeATF review segregates the individual charges, as highlighted below.

Beginning with the spread, the broker claims a minimum spread of 0.03–0.07 and an average spread of 0.7–2.2 pips on the EUR/USD pair on the three account types. Platinum Account holders are entitled to the lowest bid-ask range of 0.7 pips, while clients signing up for the Silver Account are at the higher end of the range. In our Global.TradeATF CFD review, based on an MT4 demo account, we found the spread on the EUR/USD to oscillate between 1.9–2.5 pips, more or less in line with the average spread on the Silver Account.

On commission, Global.TradeATF is a zero commission CFD broker. Irrespective of the account type or the underlying asset, clients do not pay brokerage, thereby limiting trading costs to the spread.

With regard to additional charges or fees, Global.TradeATF has a swap fee in place for clients holding overnight positions. The fee can be positive or negative, depending on which side of the trade you are. Also, the charges vary from one product to the other. Clients signing up for a Gold Account are eligible for a 25% discount on the swap charges, and Platinum Account holders receive a 50% rebate on the overnight fee. To view the swap charges, right-click on the symbol in the watchlist panel and select specification.

Besides the swap fees, Global.TradeATF charges $100/ ¥10,000 for every withdrawal request.

Account types

Global.TradeATF, a No-Dealing-Desk (NDD) broker, offers retail customers the choice of three account types, besides the swap-free Islamic account. The multi-base currency accounts cater to individuals based on their market experience, trading style, and the preferred trading conditions.

In this Global.TradeATF review, we have included a brief description of the account types and their features. Retail traders registering with the CFD broker can choose from either of the following account types:

- Silver —This account type is for beginners new to the CFD market. Individuals can register for the account with a minimum deposit of $/€£100, access to over 300 products with an average spread of 2.2 pips in the EUR/USD pair, and a trade execution speed of 0.08 seconds. To ensure the safety of deposits, Global.TradeATF has curtailed the max leverage to 30:1 for retail and 200:1 for professionals. It has margin call/stop out levels at 100%/30%, and has limited account currency to the US dollar.

- Gold —This account type is for experienced individuals who are looking at more flexibility and better trading conditions than the Silver account. Users can set up the account with a minimum deposit of $/€£100, access over 300 products with an average spread of 1.3 pips in the EUR/USD pair, and a trade execution speed of 0.05 seconds. Individuals registering for the Gold account receive a maximum leverage of 400:1, are allowed to hedge positions, have a dedicated account manager, margin call/stop out levels at 100%/30%, and are eligible for a swap discount of 25%.

- Platinum —This account type is for professional traders with extensive knowledge of the markets and a significant portfolio. Individuals can set up the account with a minimum deposit of $/€£300, access to over 300 products with an average spread of 0.7 pips in the EUR/USD pair. The trade execution mode is MT4NDD, MT4NCC, MT4 Fixed, MT4 Cent, with a trade execution speed of about 0.05 seconds. Besides all the benefits of the Gold account, individuals signing up for the Platinum account receive slightly better leverage and are also eligible for free VPS, news alerts.

Leverage for Professional clients

Platforms

Global.TradeATF is a MetaTrader broker, offering only the MetaTrader 4 terminal across desktop and mobile devices. This trading platform is accessible on Windows, Linux, macOS, and supports manual, automated and copy traders. The MetaTrader software is compatible with all web browsers and also Android, iOS devices.

The primary features of the Global.TradeATF MT4 client terminals include:

- Support for 39 languages, including English.

- The platform supports all order types — instant, market, pending, and trailing orders.

- Users can place one-click orders from the chart and market-depth windows.

- Technical analysts can access three chart types in nine time frames — ranging from one minute to one month.

- The MT4 client terminal comes with 30 in-built technical indicators and 24 graphic objects.

- One of the key highlights is the automated trading feature, where traders can execute orders with the assistance of EAs or robots.

- MT4 also provides the choice to download, purchase, or rent indicators and trading robots.

- Users can connect with the MQL5 community of traders and developers to exchange ideas and views.

- Experts can provide various services and monetise their programming skills.

- The trading terminal meets the highest security standards, with encrypted data exchange and an RSA digital signature.

For the purpose of this Global.TradeATF broker review, we logged in to a demo account and scrutinised the spread and the order execution speed on MT4’s WebTrader account. While the spread on EUR/USD was in the 1.9– 2.5 pips range — which is more or less in line with the average spread on the Silver account — the order speed was undoubtedly higher than the CFD broker’s claims of 0.05–0.08 range.

However, there were a few other drawbacks:

- Global.TradeATF does not provide an MT4 Android-based application.

- The Global.TradeATF MT4 WebTrader demo account supports only 24 FX pairs along with spot gold and silver.

Usability

When it comes to the MT4 trading terminal, Global.TradeATF offers its clients a state of the art broker platform that comes loaded with in-built features and analytical tools to support all categories of trade.

However, when it comes to Global.TradeATF’s website, we have mixed views. On the positives, the appearance, design and educational resources are handy and informative. On the other hand, the user is sure to come across conflicting and confusing information regarding the account types, range of markets, trading platforms, and the trading conditions of the spread, leverage.

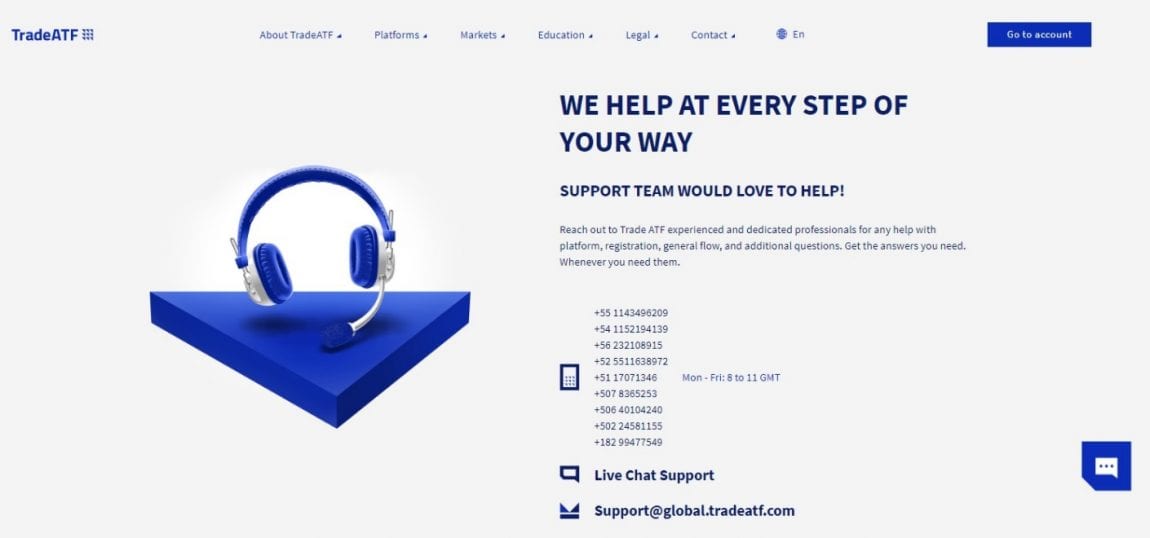

Customer support

Customer support is the first point of contact for any individual browsing a CFD broker’s website, or an existing client looking for information.

The customer helpdesk at Global.TradeATF comprises live chat, support via phone, email, a request form and an FAQ section. If your question or clarification relates to account opening, trade, or the verification process, you would probably find it in the FAQ. For anything else, it’s best to get in touch with the support staff to resolve your concerns. However, we should warn you that even though TraGlobal.TradeATF deATF claims to offer full support 24/5, we were unable to reach the members of the live chat after trying to get in touch with them for several hours. We also left many messages, but none of them were answered, even after 16 hours.

Despite the broker showing a registered office in the United Kingdom, none of the support telephone numbers correspond to the UK.

Payment methods

When it comes to funding methods, our extensive Global.TradeATF CFD review covers all the funding approaches provided by the CFD broker. Clients registering with Global.TradeATF have the choice of a number of funding methods, comprising cards, wire transfer, and e-wallets.

In terms of cards, Global.TradeATF accepts Visa/Mastercard. However, if you prefer e-wallets, the broker offers the choice of Skrill, Neteller, and Moneybookers. We did not find any information on the fund deposit front, such as the processing time, deposit fees, and other information relating to funding the account.

When it comes to withdrawals, the broker has a withdrawal policy in place, which states:

- The CFD broker would return the funds to the deposit source.

- Global.TradeATF could take up to five business days to process a withdrawal request.

- Once the request is approved, it could take another 5–7 business days for the funds to reflect in your account.

- Global.TradeATF does not charge withdrawal fees, but clients have to pay a minimum withdrawal amount of $100/¥10,000 for every request.

Best offers

When it comes to the best offers provided by this broker, we were able to pick a few from our Global.TradeATF review:

First — The low minimum deposit on all the account types offered by the broker.

Second — The cutting edge MT4 platforms with in-built analytical tools and trading features to support all categories of investors.

Third — Global.TradeATF provides several educational resources catering to beginners and experienced traders. These comprise video on demand, ebooks, courses, and MetaTrader tutorials.

Regulation and deposit protection

Global.TradeATF is the trading name of Bayline Trading Ltd, a limited liability company regulated by the Belize International Financial Services Commission (IFSC) with license number 60/322/TS/19. The brokerage has a registered office on Cork Street, Belize City, Belize.

With regard to the Belize regulations, Bayline Trading Limited’s licence states that the broker is ‘trading in financial and commodity-based derivative instruments and other securities.’

The standard conditions of the regulator state:

- Licence holders shall not accept, receive, or hold any client funds in any circumstances without the written approval of the watchdog.

- The firm should fully disclose all the charges for its services with securities transactions to customers and not discriminate between them.

- All written customer complaints, allegations of forgery, theft, fraud, misappropriation of funds, securities, named as a defendant/respondent in any criminal, regulatory, or civil proceedings exceeding $25,000, whether in Belize or abroad should be conveyed to the IFSC within five business days.

However, unlike some of the tier-1 regulators who impose stiff penalties on broking firms, besides ensuring that investors come under the protection of a compensation fund, the IFSC has no such framework. The maximum that the regulator does is suspend the license of the firm and impose a maximum penalty of $5,000.

As part of this Global.TradeATF review, we also analysed the measures taken by the CFD broker to ensure the safety of client deposits, including risk-management procedures:

According to Global.TradeATF:

- All client deposits are in segregated accounts, separated from the company’s funds.

- The moderation of all transactions is from Level-1 PCI compliance services.

- All client accounts come with compulsory margin call/stop out levels to ensure protection during market volatility.

While the Global.TradeATF broker has modest risk management systems in place, we could not find any information, even in the risk disclosure document, to validate if the forex broker offers negative balance protection to clients.

Awards

Unlike many other CFD brokers who have received several rewards for their services, platforms, trading conditions, investor protection, transparency, and other causes Global.TradeATF is yet to collect an award or receive recognition.

PEOPLE WHO READ THIS ALSO VIEWED: