Core Spreads are a Contract for Difference (CFD) and spread betting broker owned by the UK-based Finsa Group Ltd. Finsa Group is a company that was formerly under the name Trader Management Company Limited.

They have their headquarters in London and are regulated by the Financial Conduct Authority in the UK.

The company provides its clients with access to thousands of markets via its two trading platforms: CoreTrader or MT4. Either of these platforms can be utilised to trade a wide range of shares, market indices, commodities, and currencies.

The company accepts clients from the majority of countries around the world. However, there are some exceptions due to their strict regulations. The countries excluded are the US, Canada, Belgium, Russia, Iran, and Israel.

The company has excellent and competitive pricing for their traders. One of their primary objectives is reliability which they strive to achieve by providing excellent customer service and an easy to use platform.

Core Spreads Review Navigation

What can you trade?

Core Spreads Forex Review

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £1 | Mid | 1:30 | High |

The company offers you the ability to trade forex on either one of their platforms. However, they do offer currency pairs in different formats: its CoreTrader platform is for spread betting (exempt from Capital Gains Tax*), while its MT4 platform is for CFDs.

The platform has over 30 currency pairs available on both trading platforms. These include all of the major and minor pairs and some exotic pairs.

Core Spreads Spread betting review

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £1 | Good | 1:30 | Low |

Spread betting is a type of trading account that is only available in the UK and Ireland. It offers traders the opportunity to speculate on price moves without owning the underlying product. Any profits made from spread betting are not liable for capital gains tax.

Within the spread betting platform, the company has a wide variety of assets available. These include commodities such as oil and precious metals, along with a wide range of stocks and indices. In total there are 1550 different assets available to trade (not including currency pairs).

The spreads will vary depending on the instrument you are trading. At the time of writing, the current spread for the AUDUSD pair is 0.6 pips. However, these are variable and can change depending on liquidity.

Minimum trade sizes can be determined by a trader based on the account type and a couple of other factors, but, when trading currencies, a margin as high as 0.05 can be used.

CFDs are very similar to spread betting in that they allow traders to speculate on the price of assets without actually owning them.

WHAT DID OUR TRADERS THINK AFTER REVIEWING THE KEY CRITERIA?

Account Types

The company offers two different types. However, the difference between them is minimal. There is, however, a difference in trading instruments depending on the platform you use, but we will get onto that shortly.

As mentioned before, spread betting is only available in the UK and not liable to capital gains tax.

The minimum deposit to open an account is £1, but you will need a larger deposit to be able to cover the minimum trade size, which is £0.50 per point/pip. The maximum leverage available for both is 30:1.

To open an account, you will need to fill in your name, email, phone number, a username, and a password.

For UK residents, your employment experience, financial status and National Insurance number are required.

Meta trader 4 account

To be able to cover the smallest trade’s minimum margin, you will need a minimum deposit of $10.

This account is strictly for CFD trading.

CoreTrader Account

CoreTrader is the company’s web-based and app-based spread betting platform. A beautifully simple, rock-solid platform offering tight fixed spreads.

Just like with meta trader 4, the minimum margin requirements mean a deposit of at least $10 is needed.

The platform is only for spread betting.

Demo Account

The company also offers a demo so that you can practice, learn, and familiarise yourself with the platforms and broker.

The demo doesn’t expire but is restricted to a maximum of 500 concurrent open transactions.

Platforms

The company has web-based and downloadable trading platforms, along with mobile apps available on iOS and Android, making it easy to monitor trades while you are on the move.

The core trader platform enables the efficient execution of trades, conduction of extensive research and a variety of risk management tools. As you can see below, the chart layout is easy on the eye and offers a plethora of technical analysis indicators. It can be accessed via a web browser without the need to download any software.

The MetaTrader 4 platform is used by a large number of platforms and is very popular amongst retail traders in the forex industry. The company is one of several brokers who provide access to this platform for their clients.

The company doesn’t offer any educational material on its website.

Usability

The website is simple and straightforward to use, making it easy to find the information you are looking for. There are no extra, unnecessary features, and the interface is user-friendly. The site’s blue and white theme is presented professionally, giving every component value.

Their aim is to have a website and trading platform that provides reliability coupled with the ease of use and speed, which they have so far achieved.

This is not surprising because most brokers tend to have well-built websites.

Customer support

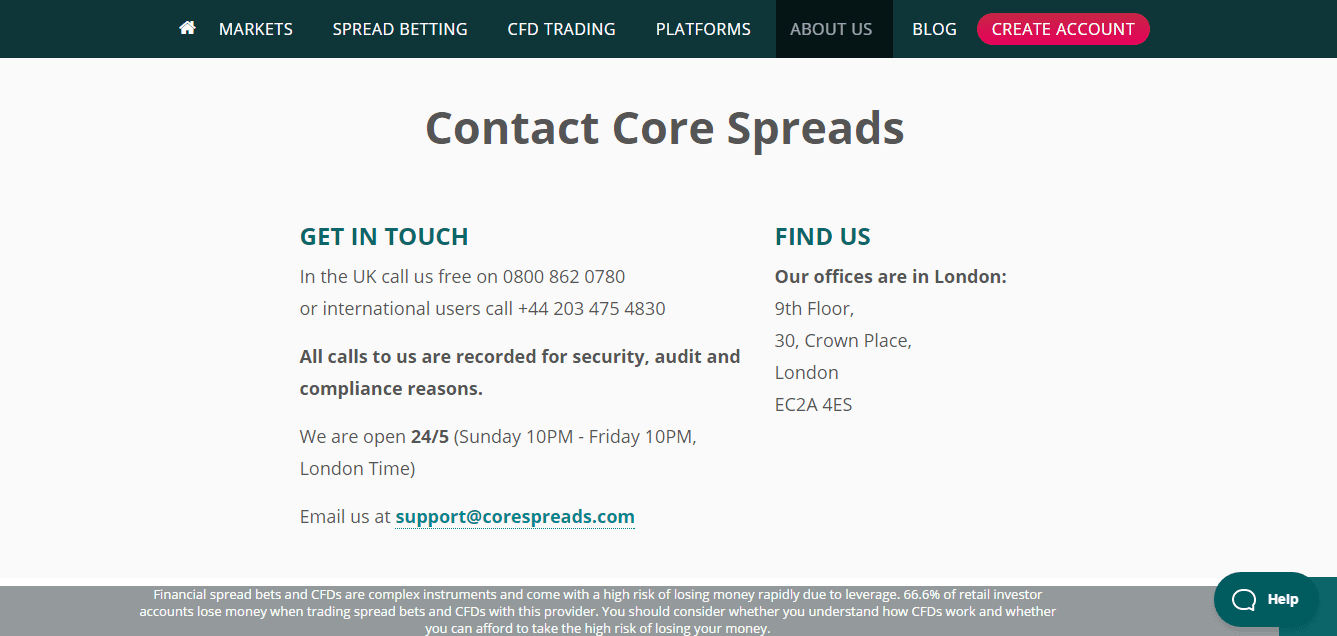

The company offers a comprehensive customer support service where you can get in touch with a member of their customer support team on a 24/5 basis from 10 pm on a Sunday to 10 pm on a Friday. The support team seems to have a lot of experience in dealing with issues or problems as they dealt with our queries with no problem at all. While they are based in London, they support several languages.

You can contact the team via email, phone, or their live chat function.

Their email is [email protected].

You can call the support team in the UK at 0800-862-0780, and international calls can be made to +44 203 475 4830.

It is worthy to note that calls made to the company are recorded for quality assurance purposes.

For an immediate response to resolving issues, the best way to contact them is via their live chat. They also hold a presence on social media platforms which is another way to contact them if needed.

Payment methods

Payment methods such as MasterCard, Visa, wire transfer, and popular e-wallets such as Neteller, Payoneer, and Skrill are all supported by the company.

Robust security protocols are put in place to ensure the safety and security of transactions. Priority is placed on keeping the personal data and financial info of their customers safe and sound.

They charge no fees for either withdrawals or deposits.

- E-wallets: This is the fastest means for depositing or withdrawing funds. The processing of funds can take up to 24 hours. The company supports popular e-wallets such as Neteller, Payoneer, and Skrill.

- Debit/Credit Cards: Credit and debit cards can be used for making deposits or withdrawals. Their transactions, however, can take up to a couple of hours to be processed.

Bank Wire Transfers: These payments may take up to 5 days to be processed but can be used for both withdrawal and depositing funds.

Best Offers

As a customer, it is essential to research the best deals that the company has on offer.

They have a demo available that allows traders to practice their trading strategies without having to risk real money. That’s ideal for traders new to trading as they can develop simulated trading plans and enables them to get familiarised with the trading platform.

More experienced traders can use it to try out new trading strategies. Traders receive $10,000 in virtual trading funds when using the demo platform.

The company also regularly provides bonuses and promotional offers for its customers.

New customers will benefit from a 50% discount on spreads in the first month when they sign-up, which is only available on the CoreTrader Platform.

There is also a loyalty program available on the Core Trader Platform which allows users to build up points while trading which can be redeemed to gain a discount on spreads of up to 20% in the next month of trading.

The company doesn’t offer any educational material on its website or platform, which is a negative, especially for new or inexperienced traders.

Regulations, Deposits & Protections

The company is regulated by the FCA in the United Kingdom, which is one of the leading financial regulatory groups across the globe and also one of the most stringent in Europe. Their registration number is 525164.

Because they strictly obey the rules and regulations set by the FCA, the company has built a solid reputation in the industry since its inception in 2014 till present.

Clients’ funds are kept separately from the platform’s operational funds in Barclays Bank, a notable bank in the UK.

This guarantees that customers’ funds are not affected in the event of insolvency.

Customers can also receive up to £50,000 in compensation as a part of the Financial Services Compensation Scheme.

Awards

The company won the award for the Best Value Broker in 2017 at the UK Forex Awards. This is a notable feat for a young brooking company that started in 2014 as the industry is a particularly competitive one.

All in all, we are confident that the company is reliable and trustworthy. In our opinion, while they do not bring any added extras to the table, they do their job well and are a dependable, stable broker.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here are our latest trending stories

- Trade stocks with top-rated eToro

- Learn everything about Plus500 Withdrawal