Trading breakout stocks is one of the most popular methods used by stock traders. It is excellent and easy to understand for new traders – you identify a precise level and capitalise on a break of that area.

YOUR CAPITAL IS AT RISK

If the price falls below that level, it may be a good time to offload or short the stock, but it could provide an excellent opportunity to go long and benefit from some upward momentum if it breaks above. Here we will take you through breakout trading and identify the four best breakout stocks to watch.

What Is Breakout Trading?

Breakout trading is trading a stock that trades outside of a defined support/resistance or range.

The support range is the level at which the stock price does not fall any further, and the resistance level is the level at which the stock price does not rise any further. Usually, stocks move between these two levels. If they go beyond the support or resistance line, it becomes the new support or resistance level. If a stock breaks a defined level, it usually indicates that the price will continue in the direction of the break.

Breakouts that occur on high volume provide more significant momentum and indicate that price is more likely to trend in that direction. When the price breaks through the resistance and support level, the traders who were waiting immediately jump in and those who did not want the price to break out exit the position to cut down on their potential losses.

One thing to be aware of is that not all traders will use the same support and resistance levels, and so a breakout on low momentum can indicate that the move has less chance of success.

Top 4 Breakout Stocks

Shopify (SHOP)

Shopify certainly gained during the pandemic, and it has become a popular name today. It supports businesses of all sizes and aims to reach the top of the e-commerce industry. As long as e-commerce continues to dominate, Shopify has a solid potential to grow.

Shopify allows business owners to launch an online store with everything needed to run it, from shipping solutions to payment processing systems. It has impressed investors with solid financials and a massive rise in revenue. The company has seen a steady increase in merchants and the gross merchandise volume, contributing to the revenue. Its share price was once as high as $1,700, but it has dropped significantly to $390, slowly inching closer to the 52-week low of $308. The stock has lost more than 68% in the past year and is testing lower levels. At the time of writing it was as low as $318 and could be ready for a breakout.

Source: eToro

- Price has consistently dropped since the end of March 2022

- There is a possibility to see another run after it hits rock bottom.

- Price is trading above its 50- and 100-day moving averages

- Price is continuing to test the lower level of its range

- As the stock inches closer to the 52-week low, it is an excellent opportunity to take your position. There is the potential for ample upside from here

Upstart Holdings (UPST)

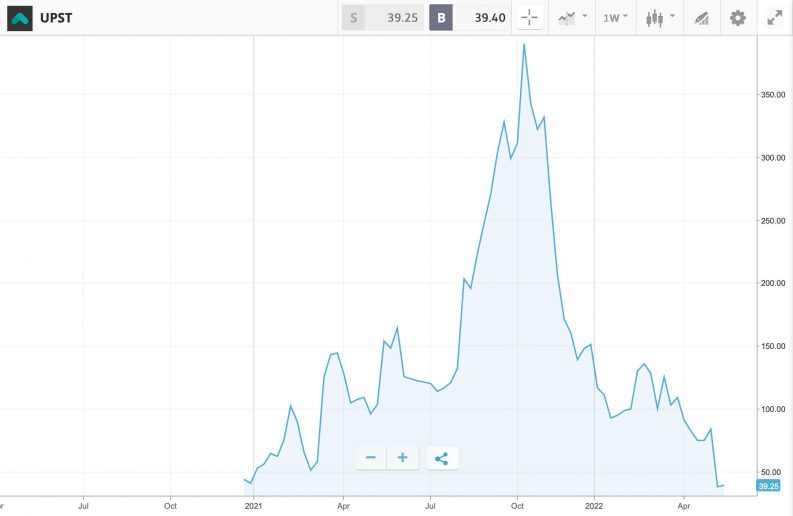

Upstart Holdings is an artificial intelligence company that offers loans and uses AI to make lending decisions. The stock has been highly volatile recently after the management reduced the revenue expectations from $1.4 billion to $1.25 billion.

The company has expanded its network of banking partners from 10 in 2020 to 42 in 2022. It is already making solid moves by capturing a large percentage of the loans on its platforms, and the loan conversion rate was as high as 23.7% in 2021. Over the past five years, the company's growth has been impressive, and the stock is just getting started.

UPST stock is falling continuously due to disappointing earnings and an analyst downgrade. Significantly down from its 52-week high of $400, the stock is trading at $51 at the time of writing, making it an attractive entry point. It is continuously testing the lower level and could have hit rock bottom.

Source: eToro

- Reported a massive dip in May 2022

- The stock is trading below the 100- and 200-days moving average

- Upstart has a solid balance sheet

- Stock is ready for the upward trend after hitting $28

MercadoLibre (MELI)

MercadoLibre is an e-commerce company located in Latin America. It has a shipping division as well as a digital payment solution. The company made the most of the pandemic and saw a massive surge in revenue. MELI stock went as high as $1,970 in 2021 and is trading much lower today. It has a market cap of $38 billion, and the stock has gained more than 170% in the past five years. It is sitting close to $800 today, after a steady dip over the past six months.

The stock is dropping consistently, due to concerns about the slowdown in e-commerce, and the trend might continue in the near future. There is a potential for an upside once it hits rock bottom, which makes the current level a good entry point.

Source: eToro

- The stock has been consistently dropping since November 2022

- Price is trading below the 100 day and 200 day moving average

- There is a possibility of a breakout soon since the stock has been down more than 40% in the past year

- The stock hasn't dipped this low since May 2020

BioNTech

BioNTech is a German company that focuses on personalised cancer treatments. However, the company gained immense recognition and riches in the pandemic by creating Comirnaty, a COVID-19 vaccine developed with Pfizer. One might be worried about the state of the business since the pandemic is subsiding, but interestingly, the company has the financial ability to invest in research and achieve growth.

BioNTech already holds $1.85bn on the balance sheet and will be spending about 85% of the money on research and development activities this year. It is currently researching new products to fight diseases to ensure revenue and growth after the pandemic has ended. The stock has gained more than 1000% in the past five years, but it could break down. This year, it is down 38% and is continuously testing the lower level. There is also immense pressure on the stock since analysts think the earnings will shrink.

Source: eToro

- Slowing momentum

- Price is continuing to test the lower level of its range

- Declining volume