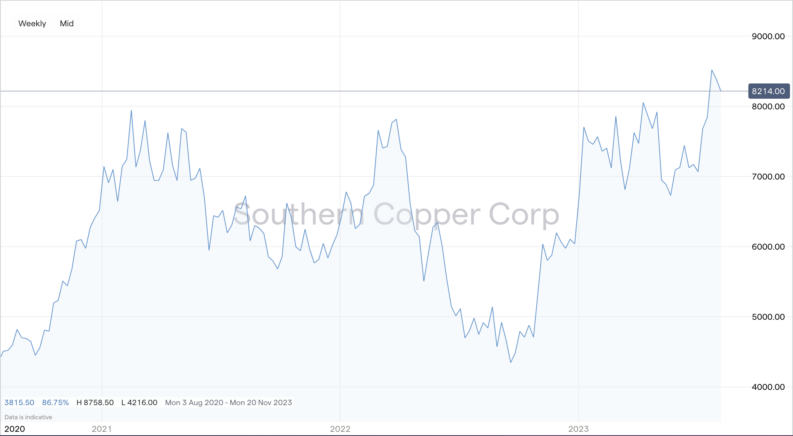

Southern Copper stock (NYSE: SCCO) has built a reputation as a consistent dividend payer, and with the share price increasing almost 50% in 12 months, there is certainly been growth on the charts. If you are wondering whether Southern Copper is a buy, that is no simple answer. Those looking for miners could certainly do worse, but there are some nuances to this recent trend that might be hard to sustain.

For a long time, buying mining stocks, such as Southern Copper Corporation, has been a way for equity investors to make a play on the commodity markets. The prices of the metals and minerals they extract are driven by macroeconomic trends, which can sometimes run for years, and which can result in significant returns on equity investments. There are also risks to consider, and specific characteristics of the market need to be factored in.

YOUR CAPITAL IS AT RISK

To answer the question, this stock forecast will apply technical analysis and fundamental analysis to outline the short-term and long-term prospects for the firm. Southern Copper offers something slightly different from the rest of its peer group.

Where Will Southern Copper’s Stock Price Be in 12 Months?

Shorter-term price moves in mineral markets are driven largely by demand factors. A change in view on the health of the global economy can lead to a sudden rise or fall in demand for copper, and as new supply takes years to come online, the price of the metal can surge as manufacturers scramble to maintain stock levels. With so much of SCCO’s revenue being based on copper demand, it’s unsurprising that the price of SCCO stock closely mirrors the price of the metal on global commodity exchanges.

One factor to consider is global economic growth. Growth has certainly picked up since the COVID-19 pandemic, and while other headwinds have arisen in the past year or so, things do seem somewhat positive at the moment (although that could always change in a heartbeat).

The electric vehicle sector is one source of growth, with the industry continually looking to scale up its demand for copper. Further policy measures or corporate announcements on how far and fast that makeover of transport networks is proceeding are also something to look out for. One report states that electric vehicles use up to four times more copper than regular gasoline vehicles.

Focusing on a 12-month time horizon, mining companies have more opportunity to adjust their supply capacity to navigate ever-changing commodity price levels.

The mining network operated by Southern Copper is concentrated in certain areas and in existing mines. This means that scaling up production levels is about building on expanding infrastructure and is a business model that can take advantage of spikes in copper prices faster than one that is based on expanding supply in new or virgin mines.

A lot will still depend on the cocktail of demand factors. Meanwhile, commodity assets are traditionally seen as a hedge against inflation, which has been a positive for the Southern Copper share price.

However, TradingView data shows that Wall Street analysts are currently Bearish on SCCO shares, with 10 assigning the stock a Sell rating, five a Hold rating, and three a Buy rating. In addition, the average price target of $88.91 represents a potential downside compared to current prices (as of June 19, 2024).

Southern Copper News

In June, Reuters reported that copper’s record-high prices were likely to pause US scrap shipments to China.

In April, Southern Copper reported its first quarter earnings, posting a profit of $0.95 per share, above the consensus estimate. Revenue for the quarter came in at $2.6 billion, also topping the consensus estimate.

Morgan Stanley lifted its Southern Copper price target to $135 from $123 in April, keeping its Underweight rating on the stock after updating estimates following the company’s Q1 report.

Meanwhile, Southern Copper was downgraded to Reduce from Hold at HSBC in April, with the firm keeping an $80 price target on the stock.

Who is Southern Copper?

The first way that Southern Copper differs from a lot of other mining stocks is the extent of its exposure to mining in South America.

The firm’s stock can be traded in the same way as any other shares, but the complex corporate structure shows that the firm is majority owned by Grupo México, which owns 88.9% of Southern Copper stock. The operations of Southern Copper are run out of head offices in Phoenix, Arizona and Lima, Peru, and most of its mining activity is carried out in Mexico and Peru.

There is some debate as to whether having resources located in South or North America is a big deal. Geopolitical uncertainty has historically led many US investors to favour firms that have a stronger foothold in the US or Canada. Attitudes towards political risk are changing, though, and Peru, in particular, is where a lot of the world’s copper is situated.

Southern Copper is among the world’s largest copper mining companies. It operates mining, smelting, and refining facilities in Mexico and Peru. Its major mining operations include Peru’s Toquepala and Cuajone mines and Mexico’s Buena Vista del Cobre (formerly known as Cananea) and La Caridad mines.

The firm also extracts, refines, and processes molybdenum concentrate, refined silver, gold, and other materials.

The stock is listed on the Bolsa de Valores de Lima and New York Stock Exchange under ticker SCCO.

By size, Southern Copper is in the same bracket as some of the bigger global players. Its mining resources may be geographically concentrated, but the amount of copper it has rights to is particularly appealing to many investors.

Even a cursory scan of the firm’s Net Income and Cash Flow charts illustrates the strength of the balance sheet and explains the firm’s ability to pay a healthy dividend.

SCCO’s proven and probable copper reserves mean that it is well-positioned to increase capacity if the price of the metal goes on a bull run.

Southern Copper Long-Term Forecast

Any Southern Copper long-term forecast will still be heavily reliant on the state of the global economy. The copper sector is currently one of the hot global markets. The construction and electronics sectors are long-term buyers of the metal, but they now have to compete with makers of electric vehicles, battery manufacturers and renewable energy companies. These last three areas of the economy are all growth sectors.

Strength in commodity prices, and in Southern Copper’s case, the price of copper, can bring about exponential gains in mining company shares. Like the rest of its peer group, a lot of SCCO’s cost base is made up of fixed rather than variable costs. Investment expenditure on exploration projects and the setting up of the infrastructure required to extract minerals is largely front-loaded. Once a mine is opened, a small increase in the price of the material being extracted can lead to a larger increase in the price of the company’s share price.

SCCO currently records a strong dividend yield, but it has declined slightly recently. Many have speculated and will be waiting to see if the payouts climb once again. If they do, then buy-and-hold interest from big funds could be expected to support the SCCO share price.

Earnings predictability can be an advantage and attract investors in some sectors, such as insurance and banking. With the mining sector being more speculative in nature, a lot of investors are looking for a bit more in terms of surprises, which explains why SCCO sometimes flies under the radar of a lot of potential buyers.

Corporate social responsibility (CSR) is a big and increasingly important issue for mining firms. They’re never going to rank highly among green investors, but those firms that are most adept at damage limitation open up the door to increased interest from big institutional investors. In terms of Southern Copper, CSR issues could go some way to explaining the firm’s relative underperformance but, at the same time, could be a catalyst for improved future returns.

Southern Copper’s CSR ranking at CSR Hub has recently improved to above 60% but is still below many peers. Big funds that are obliged to invest in basic materials but also keep an eye on ethical issues will be drawn to firms such as Newmont Corporation, which has a rating of 85%.

The mining sector can be hazardous. Finding new ore reserves to replace depleted ones is increasingly hard to do. Exploration costs, the availability of skilled resources, infrastructure constraints, and political risk all threaten the future pipeline of production and bump up near-term costs. However, investors have been confident in the company’s recent performance, and it has shown in its share price so far this year.

Is Southern Copper a Good Buy?

Southern Copper offers something different from some of the other names in the sector. Its strong Latin American presence is considered a negative by some in terms of political risk and distance from the North American market. However, against this is the fact that the areas where Southern Copper is based appear more promising than US ones in terms of future supplies coming into the pipeline.

The copper market bull run could be a long-term trend, and if a commodity super-cycle is about to form, then any copper firm would be a good proposition. However, many market analysts aren’t convinced, and SCCO’s broker rating currently lags behind others in its peer group.

Those wanting to take the opposite view of analysts, and buy Southern Copper stock, should consider risk management as key, regardless of how the stock and company performs.