Momentum trading strategies thrive on capturing strong price movements, aiming to profit from assets on an upward or downward tear. Momentum goes both ways in markets however, before you jump in, it's crucial to understand the various characteristics of this dynamic approach.

In this article, we will take you through:

Table of contents

Momentum Trading Strategies

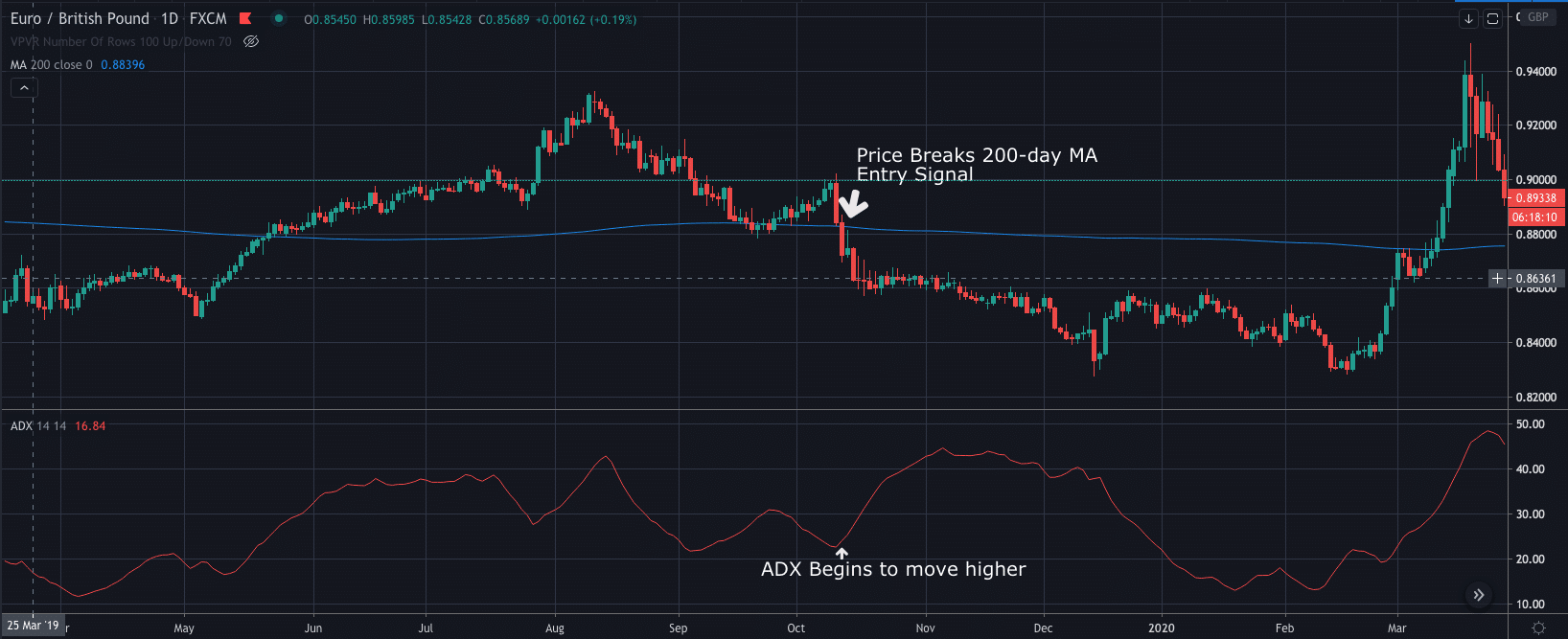

Strategy 1: Determining the Trend Momentum of an Asset With the ADX

What is needed:

- ADX

- 200-period moving average

- Daily chart

The Average Directional Index (ADX) is a popular trading tool used to determine an asset’s trend momentum.

As the ADX level rises, it indicates a strengthening trend. In other words, the trend might be bullish, or it might be bearish — all we know is that the underlying trend is gaining strength.

To the left of the price chart, we can see that the EURGBP price begins moving higher.

As the ADX value rises towards 100, we can see that the underlying trend is also strengthening.

In this example, the ADX strengthens as the EURGBP price moves above the 200-period moving average. This essentially gives us two independent pieces of evidence that suggest strength is building in the underlying price trend.

How to enter a position:

- Wait for the ADX to trend higher

- Wait until the price breaks the 200-day moving average

Once you have entered your long position, your stop-loss should be placed under the most recent swing in price, while your target is 2x that. Giving you a 2:1 profit ratio.

Strategy 2: Spotting Divergences in Price Action

Another strategy traders can use to spot divergences in price action.

What you will need for this strategy is:

- RSI

- Four-hour chart

Divergence is when price trends in one direction, but the indicator (in this case, the RSI) starts to trend in the opposite direction.

In the example shown above, we can see that the S&P 500 price is rallying to reach record highs. However, we can also see that the RSI indicator is making lower highs, signalling divergence.

So, to enter a position, we would look for:

- Price trending in one direction

- RSI Trends lower

- Enter in the direction of the RSI (in the above case, this would be a sell position)

Similar to the first strategy, the stop-loss would go above or below the recent swing in price, while the take-profit target will be the next key level, which is at least 2x our stop.

Some significant aspects of momentum trading can help you to make quick profits. However, there are also negative aspects, as well.

What Is Momentum Trading?

Momentum trading is a financial market strategy approach that capitalises on big and strong trends in the underlying price of a security. Traders will look to buy securities when they are rising and sell them when they are falling.

When an asset reaches a higher price, it usually attracts more attention from traders and investors wanting to get in on the action, which pushes the market price even higher. This continues until the move begins to run out of steam.

Various factors can impact the shift of momentum. However, when the conditions do change, the asset's price will tend to move sideways or pull back in the opposite direction.

In essence, momentum is the speed at which market values are changing in an asset.

Momentum readings can be further classified into two distinct categories: Absolute Momentum and Relative Momentum.

YOUR CAPITAL IS AT RISK

Absolute Momentum

When using the absolute momentum strategy, an asset's historical performance is analyzed to predict its future movement, regardless of the performance of other assets. It comes down to the belief that trends tend to continue in the same direction.

Relative momentum

Relative momentum is when market behaviours in individual securities prices are compared with one another security (showing relative strength that differentiates between strong-performing assets and weak-performing securities). This is usually within a defined group, like a sector or index. Rather than just relying on an asset's own past performance, it aims to determine assets that are outperforming or underperforming their peers.

YOUR CAPITAL IS AT RISK

Key Factors of Momentum Trading

Volume: This is the number of assets being traded in a particular time frame. Momentum traders need to enter and exit the trade quickly, so a steady stream of buyers and sellers in the markets is required.

Volatility: Volatility is a statistical measure of a market’s tendency or security to rise or fall sharply within a short period. It is essential for momentum traders to Momentum to find volatile markets to take advantage of short-term rises and falls in an asset’s value.

Timeframe: Momentum trading strategies rely heavily on short-term market movements such as day trading and scalping. However, the duration of the trade can depend on how long the trend maintains its strength.

How Is Momentum Calculated?

First, traders must understand what the word “momentum” actually means in practical terms. For these purposes, a straightforward definition of the concept can be interpreted as follows:

Momentum = Underlying Trend Strength

Let’s consider market price activity using three different examples:

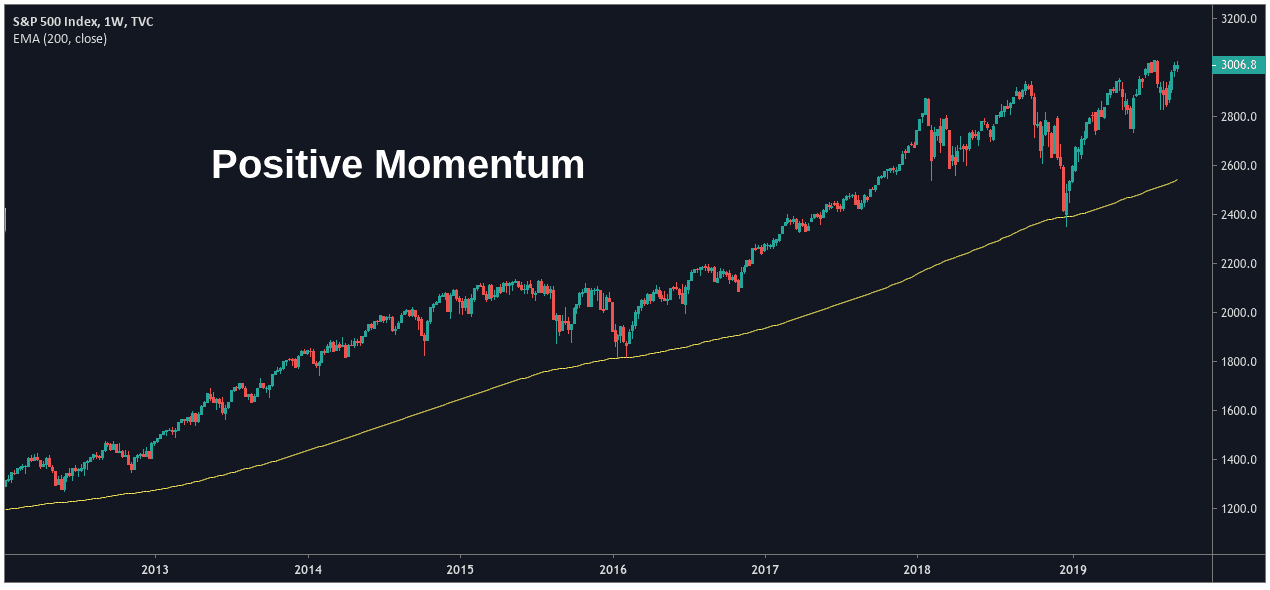

Positive Momentum

In our first example, we can see a market showing positive price momentum. In this case, the asset is consistently holding above its 200-period exponential moving average (EMA) while its trend continues moving higher.

For example, this type of momentum may be built up in a strong bull market in equities. Scroll back to 2016-2018 on an S&P 500 chart, and you can see a market with strong positive momentum. In addition, a recent USDJPY chart will show bullish momentum in action.

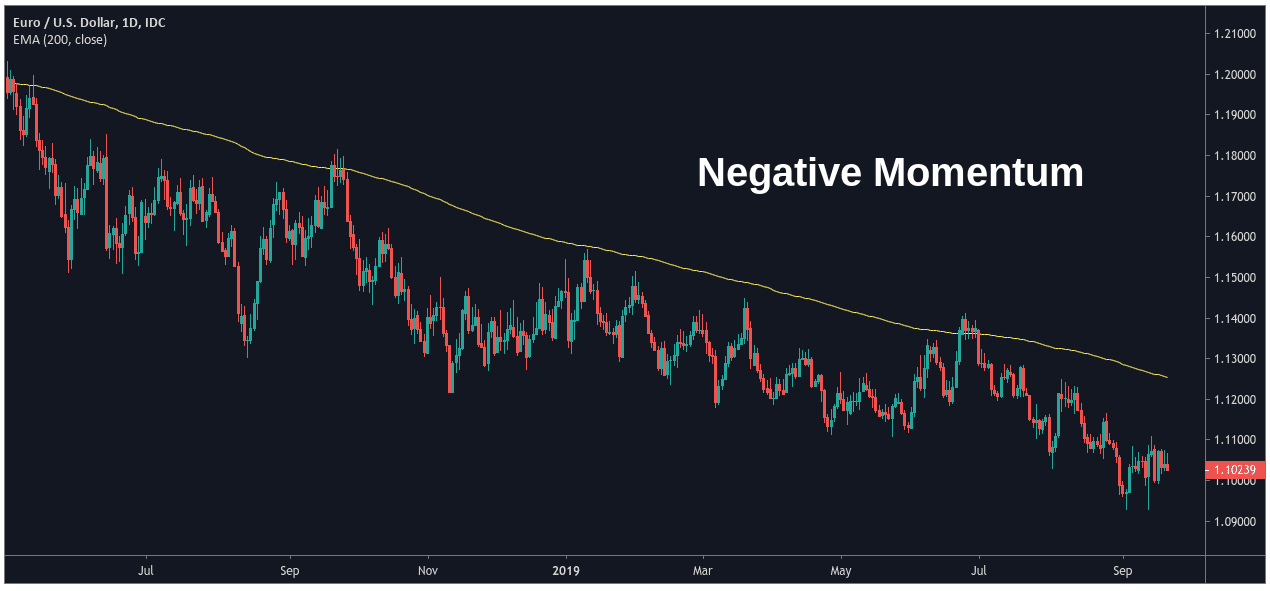

Negative Momentum

In our second example, we can see a market showing negative momentum. In this case, the asset consistently holds below the 200-period EMA while it continues moving lower.

For an example of negative momentum, take a look at a EURUSD chart from May 2021 to September 2022. We can see a strong move lower, in favour of the USD, which gains significant momentum.

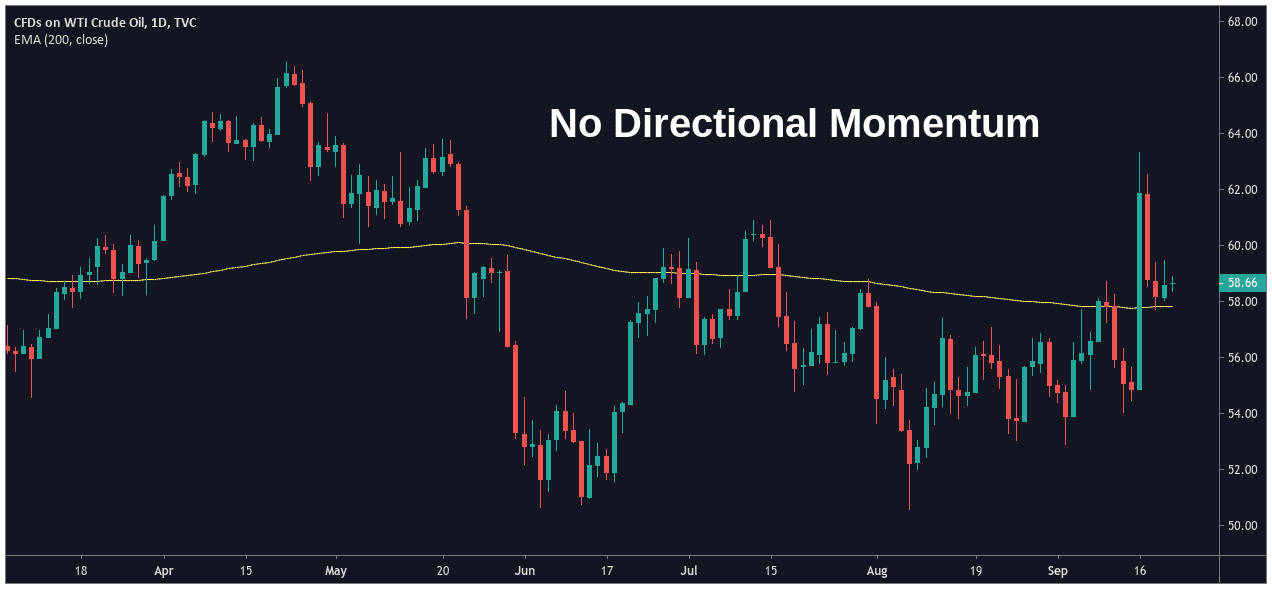

No Directional Momentum

In our third example, we can see a market with no clear directional momentum. In this case, the asset price consistently oscillates above and below its 200-period EMA. Prices are trading erratically (while moving sideways), and there is no significant trend dictating the asset’s value.

Take a look at the current (early 2024) FTSE 100 daily chart. This is a prime example of a current asset that has no directional momentum. It is constantly chopping and changing direction.

Best Momentum Trading Indicators

Many technical indicators can be used to judge the momentum of an asset. Some of the best momentum indicators are:

- RSI

- Stochastic

- ADX

- CCI

- MACD

Advantages and Disadvantages of Momentum Trading

| Advantages | Disadvantages |

|---|---|

| Big profits in a short period: fast moves as momentum builds. | Can take up a lot of time: As moves are usually fast, you need to monitor your charts continually. |

| Great for day trading: As profits can be taken quickly, you can take short term trades (although it can also be used on longer timeframes as shown in the strategies above). | Potential for quick losses: With the potential for fast profits also comes the potential for immediate losses. |

| Take advantage of the volatility: you can capitalise when markets surge in one direction. |

YOUR CAPITAL IS AT RISK

Risk Management in Momentum Trading

Momentum trading thrives on chasing trends, but it comes with risks. Without proper risk management, a winning strategy can quickly turn into a losing one. When putting together a risk management plan for your momentum trading strategy, make sure to consider:

False Breakouts: While the trend may seem like it will never end, it will, and more often than not, it will catch many traders out. Try to minimise the impact of false breakouts., and analyse how you can pinpoint entries so you aren't opening positions too early.

Mean Reversion: Be prepared for pullbacks and set realistic exit strategies.

Volatility: Momentum often coincides with increased volatility. Implement position sizing and stop-loss orders to limit potential losses.

Emotional Trading: Given the fast-paced nature of momentum trading, it can trigger impulsive decisions. Ensure you stick to your pre-defined rules and avoid letting emotions dictate your actions.

Furthermore, make sure you implement stop-loss orders, trade with the correct position sizing, lock in profits at pre-determined levels and continuously test and assess the momentum trading strategy you are utilising. Risk management is not a one-size-fits-all approach. Tailor your strategies based on your individual risk tolerance, trading style, and market conditions.