The moves in Bitcoin over past days are huge and continue to create big p/l pain among most “fundamental” long crypto players. The main problem with cryptos is how you price them. Irrespective if you believe or not believe in the fundamental story, the moves are at times so volatile, that you simply must have the most rigorous approach to risk management. If not, you will for sure get killed.

Parabolic moves always attract inexperienced traders and “investors”. If they get onboard at a relatively early stage they end up with the classical problem of overconfidence. Earlier this year a good friend of mine got into Bitcoin and made 100k USD in no time. This is not a day trader, just a guy that suddenly thought he knew a lot about the new blockchain technology and happened, by luck only, to buy bitcoin when it started going parabolic.

I went to visit him at his normal job one day and he had set up a few extra screens to trade Bitcoin on his otherwise regular job. He actually believed he was the new king of Bitcoin and had bought more and had made even more money. This was of course much easier than doing a normal job. The problem is he refused listening to rules of money management. His entire Bitcoin trading career ended abruptly when the first moves lower occurred this summer.

The point is when we see assets start parabolic moves usually it attracts large amount of novice traders, all thinking they are gods. The first move lower is usually met with more buying that eventually becomes averaging down and ultimately it often ends in tears when the big leg lower occurs. This is exactly what has happened in Bitcoin over past days.

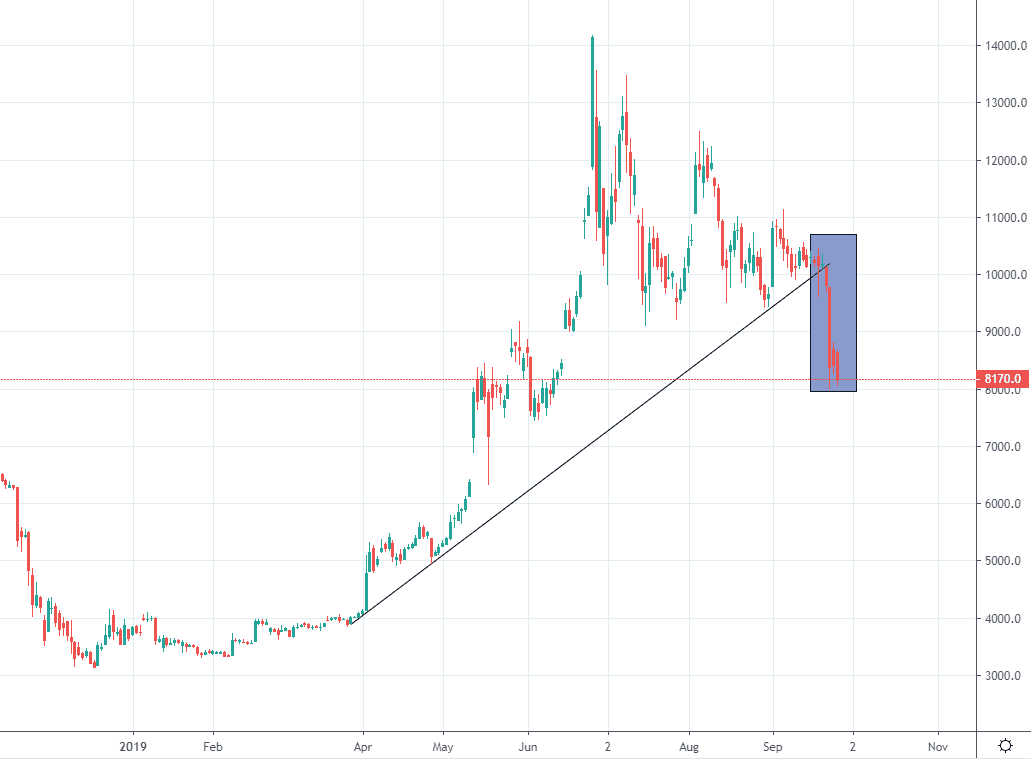

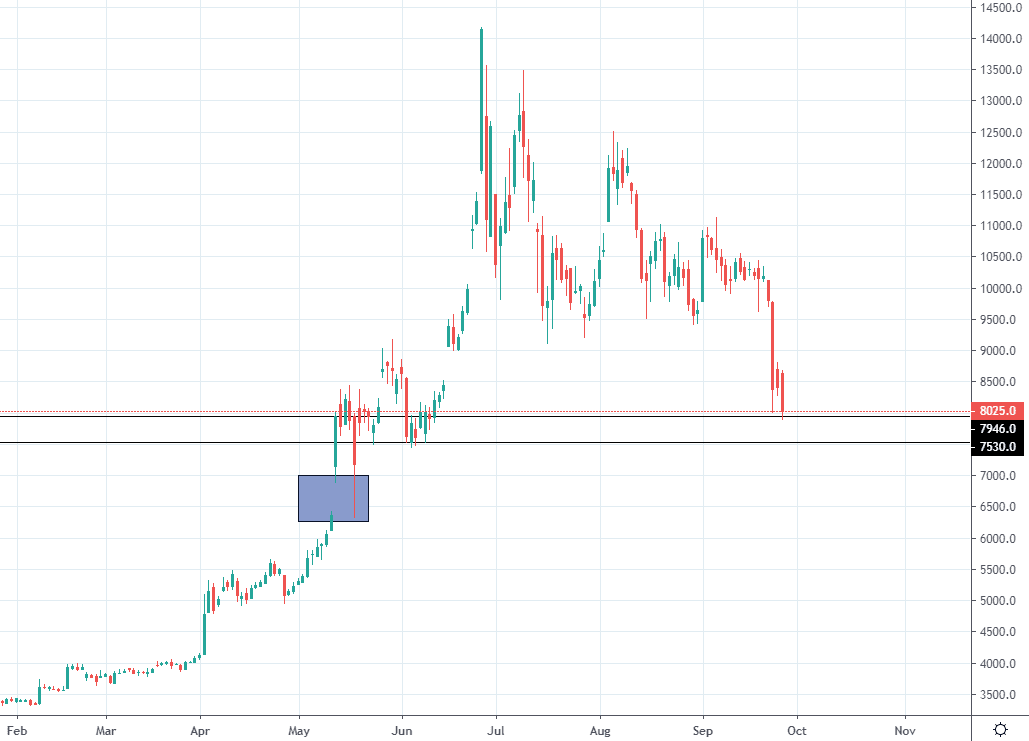

It is impossible to say where Bitcoin is going next, but below are a few charts worth reviewing.

The trend from April is definitely broken.

There is some sort of support area below the 8000 mark (around the 7500 level), but there is also a gap down at 6000 that was never really closed after the entire parabolic move started. Gaps are usually closed, but not always, but this is definitely something to bear in mind.

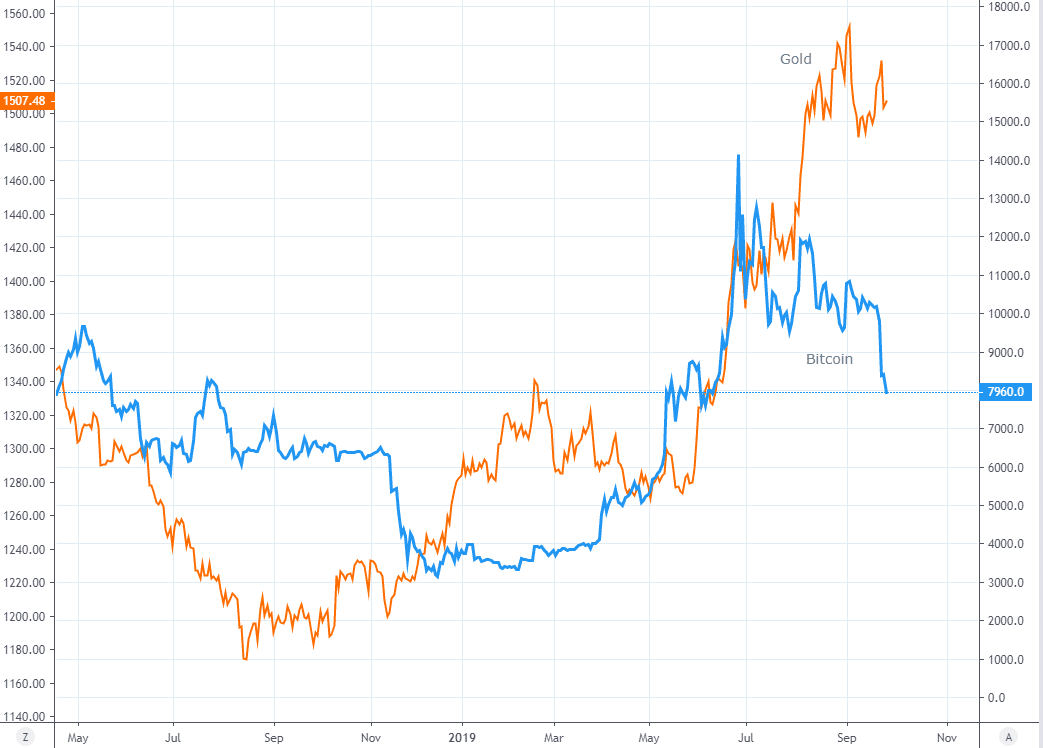

Another “problem” when it comes to Bitcoin is the fact several “prominent” investors have called Bitcoin the new global macro fear hedge. People have compared it to VIX, Gold and a function of falling yields. This has obviously proved to be wrong, but the more important factor, irrespective if you believed in the global Bitcoin hedge, is that when “pros” state things like the above, many retail punters believe in the story, get onboard the Bitcoin trade and lack the money management tools to get out before the margin call.

Bitcoin might bounce soon or not, but the biggest lesson for the people that did not manage to get out when the move started is to spend more time on how they manage their risk and profit/loss.

Below is the chart of Gold and Bitcoin.