- US-China animosity threatens a global slowdown

- Equity markets fall away from highs as investors turn to defensive assets

- Price of both gold and Bitcoin rise

- Longer-term price moves still driven by regulatory acceptance, or otherwise, of cryptocurrencies

- Recent report by Bitwise Asset Management digs deep into trading data in an effort to measure the size of the move into the mainstream

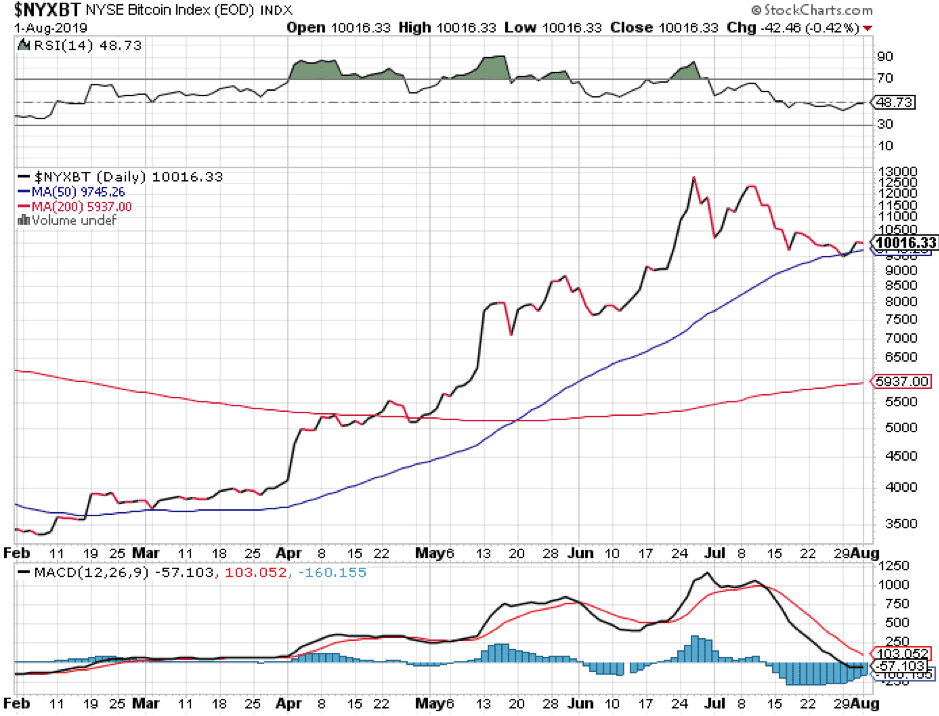

The announcement by President Trump that he is escalating the trade war with China has caused more traditional asset markets to show weakness, and equity markets have seen price falls in the region of 1-2%. As happens at times like this, investor attention has turned to more defensive assets, including gold and Bitcoin.

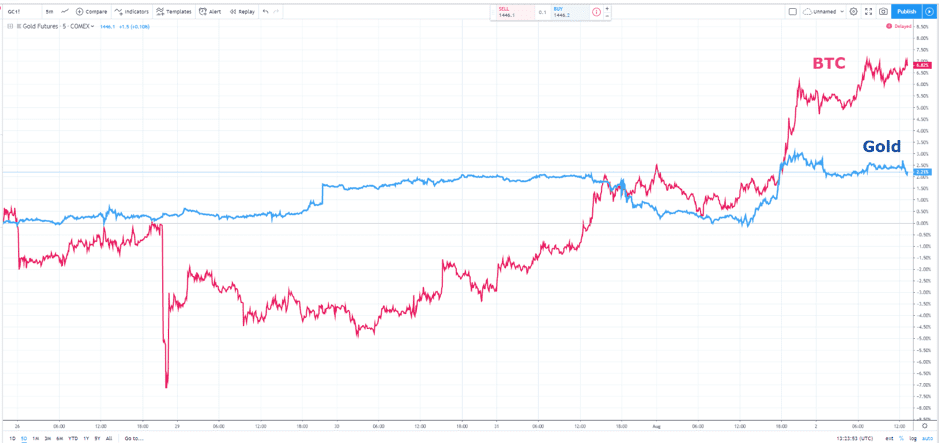

The prices of both gold and Bitcoin have fluctuated this week as one news story followed another. The US Fed’s decision to cut interest rates by “only” 25 basis points formed a platform for Fed officials to give more hawkish guidance regarding future moves. Gold prices slid as a response. The breakdown of the US-China trade talks triggered a rise in prices of both gold and Bitcoin.

One key driver of Bitcoin price has been its use as “virtual” gold, and Bitcoin fans will be pleased to see how it established itself as something of a barometer of the global geopolitical outlook.

Gold – Five-day price chart

The below chart confirms that short-term price moves of BTC are much more volatile, but to some extent correlated to gold.

The driver of the long-term BTC price trend continues to be, to what extent will BTC be recognised by social and market institutions as a bone fide asset?

Pump up the volume

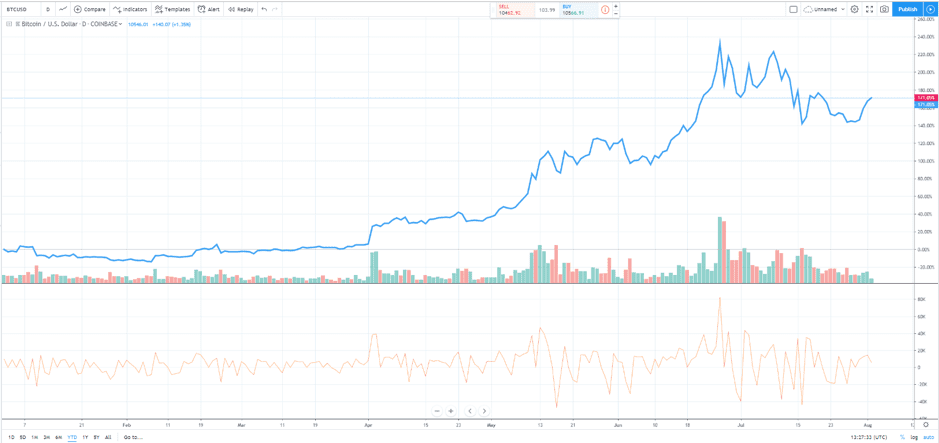

One key indicator of Bitcoin’s acceptance is trading volumes – the greater the volumes, the stronger the signal. The trend through 2019 has been for increased volumes. Trading of BTC on crypto exchanges increased to $445bn in April 2019, when the average over the first three months of the year was $220bn per month. By May 2019, reported volumes had stepped up again to $420bn.

BTC – YTD price with net volumes

The above increases suggest wider acceptance of the asset, but interpreting the volume data needs to factor in several key issues that are key to analysis of the market.

Trading volumes, such as the price of BTC, are very volatile. Although the volumes this year are increasing in size, the most recent peak in volumes occurred in January 2018, when volumes traded were $685bn.

Another factor is that the January 2018 data is also skewed to the upside because that was the time when BTC reached record price levels. Buying one BTC at $1,500 would record three times the volume as buying one at $500, but in each case, there would be only one transaction. An analysis of how many transactions are taking place – that is, to what extent it is being traded by more people – would need to factor this in.

A big concern is that the data provided by the crypto exchanges can be challenged. Any trading model needs reliable data input or else it falls into the “rubbish in, rubbish out” pile of loss-making strategies.

Bitwise Asset Management published an extensive report on the subject in May 2019 titled “Economic and Non-Economic Trading In Bitcoin: Exploring the Real Spot Market For The World’s First Digital Commodity.” Analysts Matthew Hougan, Hong Kim and Micah Lerner wrote:

“The Prevalence (And Irrelevance) Of Fake Data: This paper will demonstrate that roughly 95% of reported trading volume in bitcoin is fake or non-economic in nature and show why fake volume does not influence price discovery in the real bitcoin spot market.

“The volume numbers reported by CoinMarketCap.com (and other data aggregators in the space) are surprising because they are wrong, wildly inflated by a combination of fake volume and wash trading that dramatically skews the public’s view of the bitcoin market in a negative way.”

Source: Sec.gov

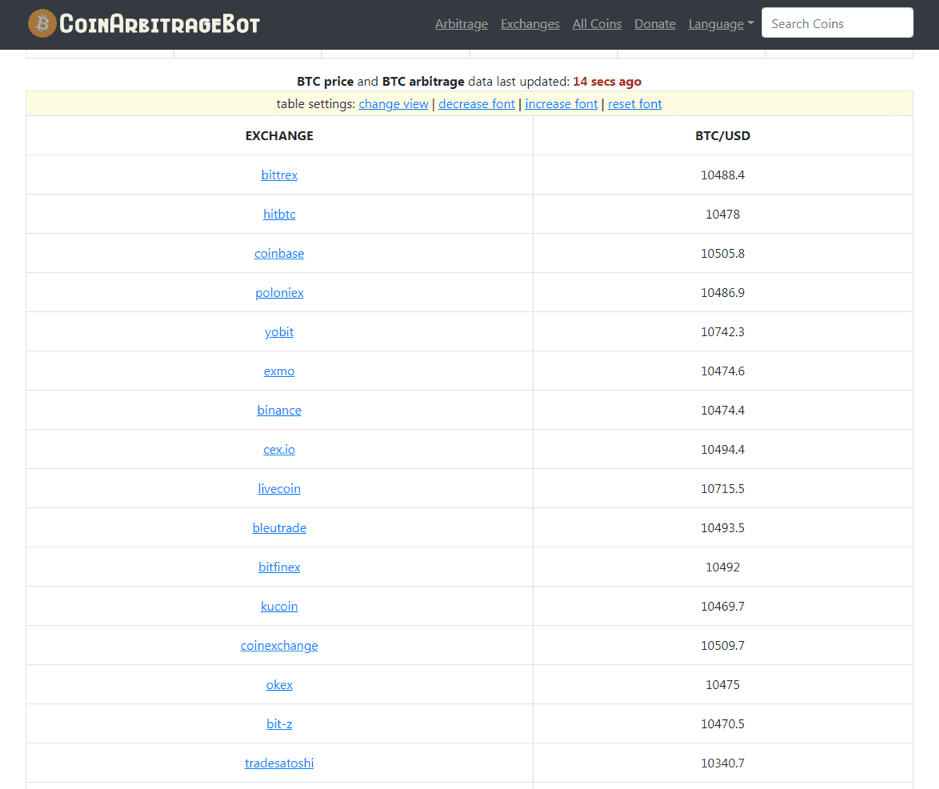

The data pinpoints one of the key obstacles to BTC entering the mainstream. The current public perception is that the market is disorderly, pricing is inefficient, and reported volumes are dubious. The situation is made worse by the fact that the exact opposite should be the case. As cryptos are based on blockchain technology, are globally fungible, and have near to zero storage costs, the market should be an example of super-efficiency, but it is not. The below table from the industry site CoinArbitrageBot lists the prices that some of the exchanges are quoting on Bitcoin.

Looking into the future(s)

The smoke and mirrors of crypto exchanges continue to act as a significant deterrent to widespread involvement, but cross-referencing to the CME and CBOE futures markets sheds some light on the situation. The data from these regulated exchanges doesn’t go too far back in time and only captures a small section of the market, but it is reliable. JP Morgan puts May trading volumes on these exchanges to be approximately $12bn. April’s volumes are estimated at $5.5bn, and the average over the first three months of the year was $1.8bn. Even factoring in the distortion created by the price rise during this time period, it’s clear to see the volumes increasing. More significantly, the trading on the exchanges is driven more by institutional rather than retail investors.

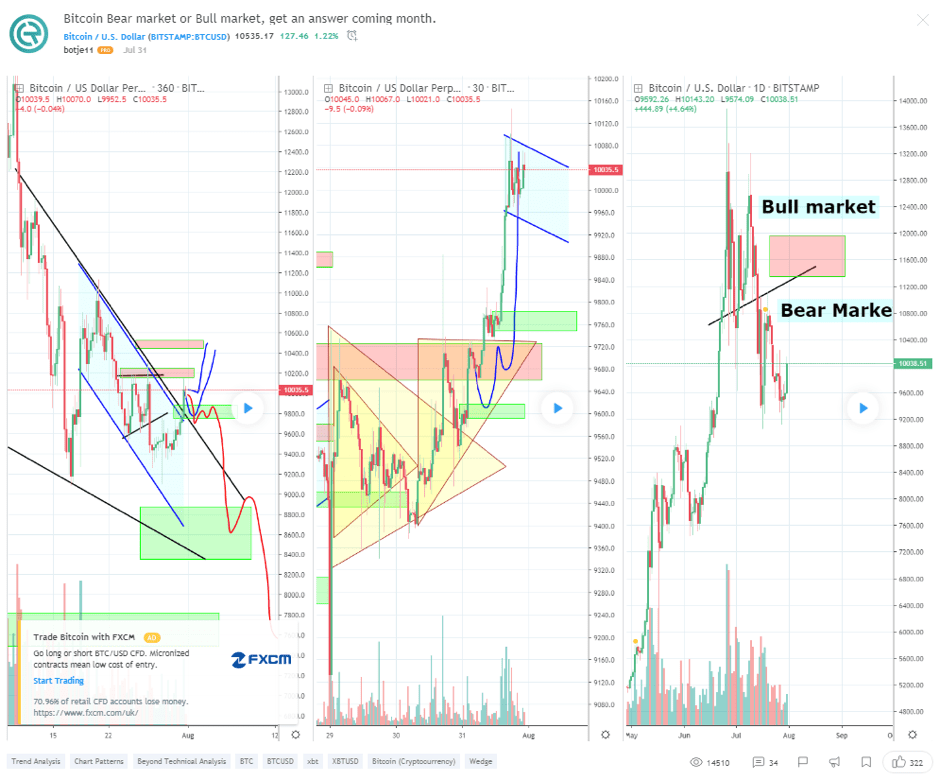

Trading View Ideas: botje11

This past week has seen BTC cement its role as a barometer of geopolitical risk. The above analysis looks more towards long-term price targets and puts BTC currently at something of a crossroads. With the earnings season nearly over and the next Fed announcement not due until September, the news flow should die down. If we do see a slow summer market for BTC, then analysis of the longer trend might be easier, particularly if the data available is reliable.