Shares of BP PLC (LON: BP.) are likely to plunge on Monday after the oil giant has been forced to shut its production facilities and commence evacuation of staff ahead of the announced tropical storms.

BP joined Chevron, Shell, BP, Equinor, and other major oil producers in announcing the closure of production facilities. The British oil giant will temporarily close its four operated US Gulf platforms — Thunder Horse, Mad Dog, Atlantis and Na Kika.

“The entire Gulf remains under the gun for a historic weather event featuring two hurricanes,” said Jim Rouiller, lead meteorologist with the Energy Weather Group. “Widespread shut-ins are likely.

Tropical storm “Laura” is heading towards eastern Louisiana/Mississippi, while the second storm “Tropical Depression 14” is moving to strike southeast Texas or western Louisiana.

“It is really unprecedented to have two storms make landfall within 24 to 36 hours in the essentially the same spot,” said Aaron Carmichael, a meteorologist with commercial forecaster Maxar.

Both tropical storms are likely to arrive in the Gulf of Mexico on Monday, as scientists see Laura becoming a Category One hurricane.

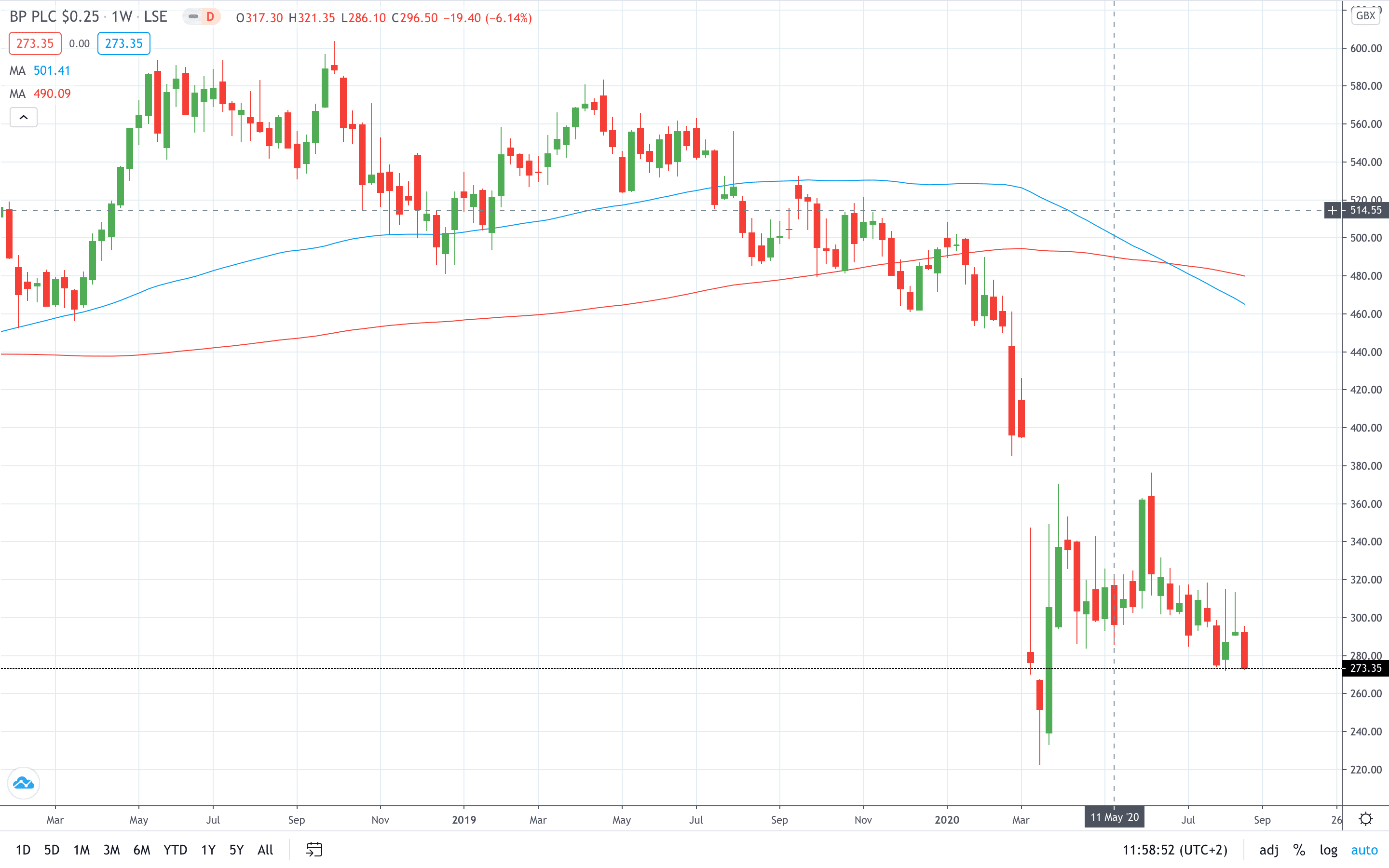

BP share price closed the week 6.59% in the red and therefore approaching the 5-month low below 270p.

- Read more about why BP share price soared earlier this month

- Explore stock trading strategies

- Learn from experts on risk management in trading