- The UK is now due to leave the EU on 31st January 2020.

- The extension, which was approved by EU members on Monday reduces the risk of a no-deal Brexit, but the UK looks set for a general election and the new faces needed to push any deal through.

The EU has approved the UK’s request for an extension to the Article 50 deadline, which denotes the day the UK and EU officially part company. The deadline has shifted from 31st October 2019 to 31st January 2020, and this version of the extension comes with the option of an early break clause being triggered. The optionality of the agreement has earned it the name ‘flextension’. This most recent of delays comes at a time when the Westminster political landscape is at its most dysfunctional. There is little hope that the three-month extension will necessarily form time well spent and Tuesday brings the increased likelihood of a December general election.

The business community has expressed relief at the news that a Halloween no-deal Brexit has been avoided, but the political gridlock at the palace of Westminster appears to be missing the mood of business leaders who now want Brexit done. The deal, any deal, would be welcomed as it then allows them to focus on other issues. Reports suggest that across the UK, and parts of the EU, companies are in a holding pattern. The stockpiling of goods, which was carried out to manage risks associated with the 31st October deadline will likely be rolled over to the next deadline as it is only three months away. This process involves tens of millions of pounds worth of working capital being tied up in inventories — the management of which is a further drain on resources.

Some business leaders have reported a switch in focus towards domestic-led growth. This appears a sensible option in light of the fact that the UK government has published no less than 750 separate documents on the subject of how to carry out business in the new environment. ‘Sensible’ appears to be something of a buzz word, and business leaders appear eager for a deal to be agreed, and for the start of a more expansive phase of business growth. Five out of the last six quarters have seen negative investment expenditure by UK companies.

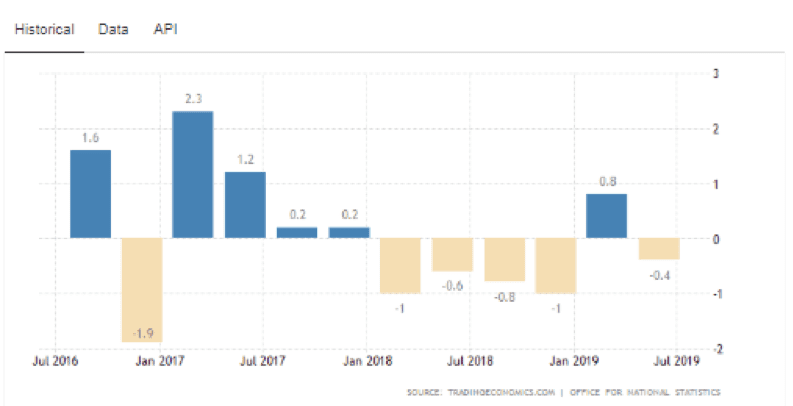

UK business investment per quarter:

The forecast levels of business investment show a tail rising to the right-hand side of the chart. This bright new dawn, however, depends on a deal being agreed and the extension means the pick-up in investment will now be delayed.

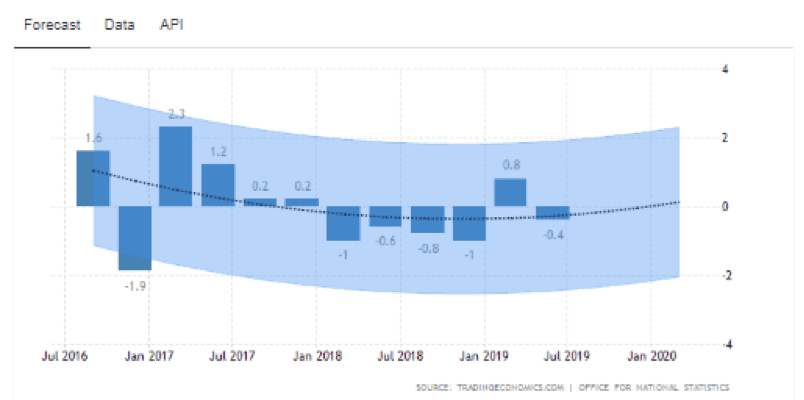

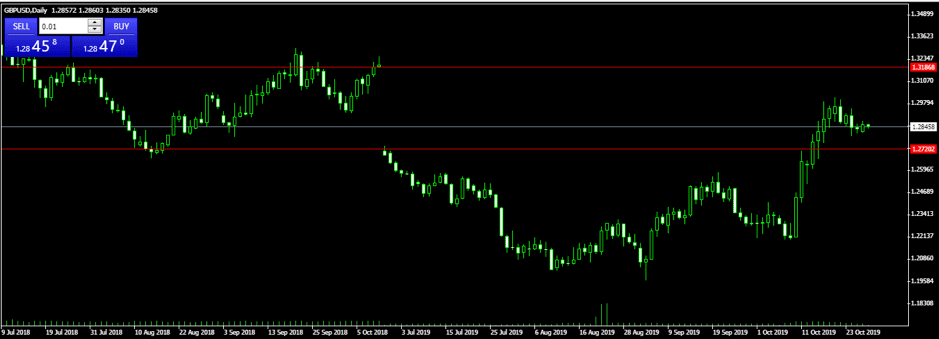

Sterling and especially the GBPUSD currency pair usually indicate how the financial markets have interpreted the latest developments. Tuesday sees GBPUSD trading slightly higher. The slightly apathetic move appeared little more than a polite nod to the fact that a no-deal Brexit on 31st October was definitively off the table.

GBPUSD daily candle — July 2018–October 2019:

GBPUSD 5M candles — 28th October–29th October:

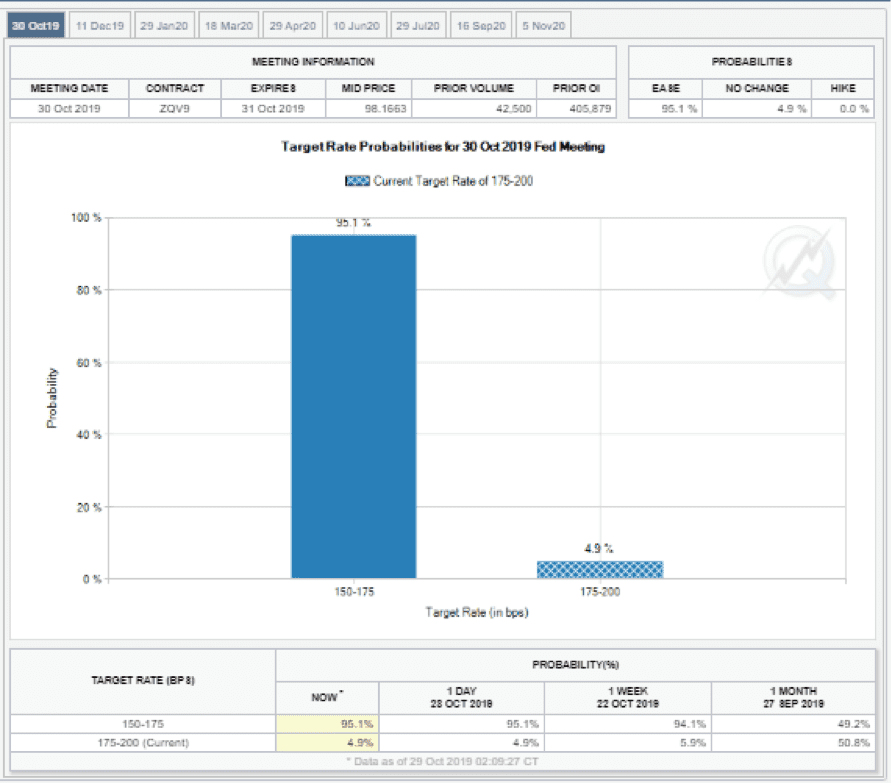

The muted move possibly also reflects that this week the USD side of the currency pair, rather than the GBP side, will be the key driver. This week sees the release of US GDP figures and the all-important meeting of the US Federal Reserve’s, Federal Open Market Committee. The CME FedWatch tool shows markets are currently pricing in 95% probability of a 25 basis point cut to US interest rates.

The next major news event likely to come out of the UK is the announcement of whether there will be a general election prior to the 31stJanuary deadline. Monday evening saw Prime Minister Boris Johnson try and fail for the third time to have the House of Commons approve his request to go to the people. The Fixed Term Parliament Act lays out a clear calendar of election dates and these can only be amended if two-thirds of the House agrees to the change.

With the three-month extension in place, the smaller opposition parties such as the Liberal Democrats and Scottish Nationalist Party appear willing to join the PM in bringing about a general election. One route to securing an earlier general election date involves passing an act through more Houses of Parliament votes but requires only 50% of MPs to approve it. This approach looks set to be adopted.

On Tuesday, MPs will begin to debate a second reading on a vote for a 12th December election. The intention of the government is that MPs should debate all the stages of the bill in one day. Jacob Rees-Mogg, Leader of the House of Commons, said the legislation would be “extremely short, simple, and limited in scope” (source: BBC).

The price that PM Johnson is paying for gaining enough votes for an election is that he has had to sacrifice the Withdrawal Agreement Bill (WAB), which is unpopular with the Liberal Democrats and SNP. The agreement that was considered was almost impossible to achieve. Instead, it will sit and wait to see if any of the political parties pick it back up after the election.

The most likely date of a general election is 12th December. Frustrated business leaders face more uncertainty, and they and the government continue to hold off on making decisions on issues such as digital infrastructure and green issues. For now, those more exciting projects remain shelved and instead they have to address and revisit more pressing questions such as, will the election even resolve the gridlock? Will the UK leave on 31stJanuary?

Reuters took to the UK high street to report on the mood of the general public. Brian Watkins, 58, who works in a building supplies shop piled high with paintbrushes, drills and saws, said: “the MPs aren’t going to let us out, are they?” (Source: Reuters)

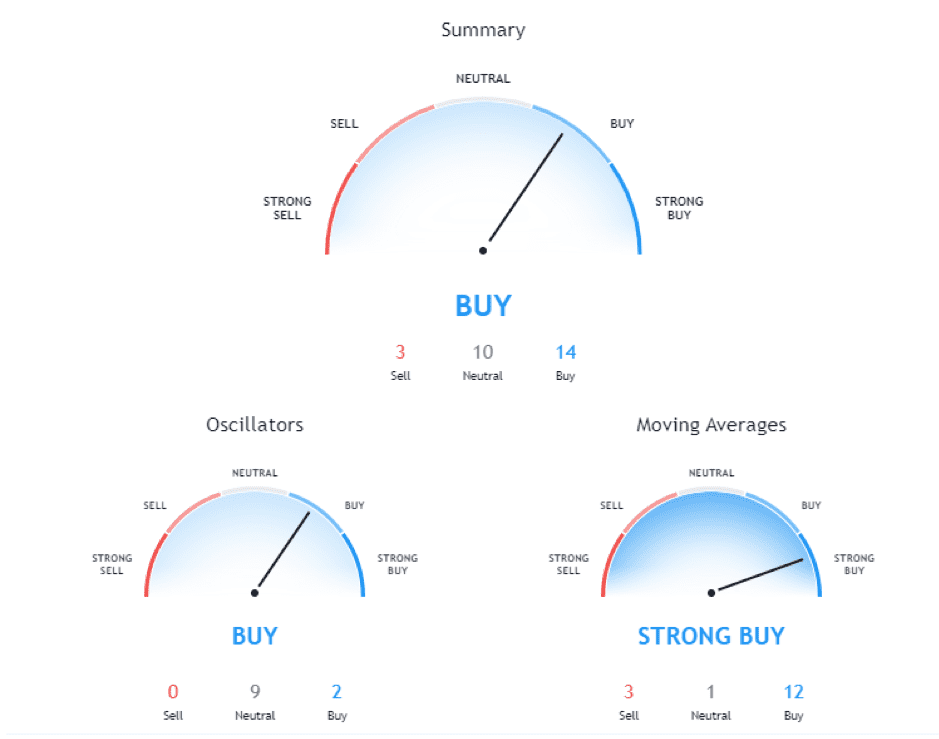

TradingView — daily technicals:

The agreement (or not) of a UK general election should be the biggest Brexit related event in the UK this week. If there is to be a vote in December, then those trading the forex markets will still have opportunities to make profits, although there could be volatility in GBPUSD if it drops away. A sideways market isn’t guaranteed, but cable might hold a tighter trading range — albeit one influenced by the ups and downs of campaigning.