- New car sales during the COVID-19 lockdown stalled on a scale never previously seen.

- Italy, Spain and the UK saw car sales drop by more than 95% in April. India posted a 100% drop in sales in the same month.

- Some manufacturers are, however, somehow stepping out of, and walking clear of, the literal car-crash in sales.

- The global pandemic has acted as a catalyst for years of societal change to be crammed into months.

- The easing of lockdown has highlighted those firms that look set to prosper in the new environment.

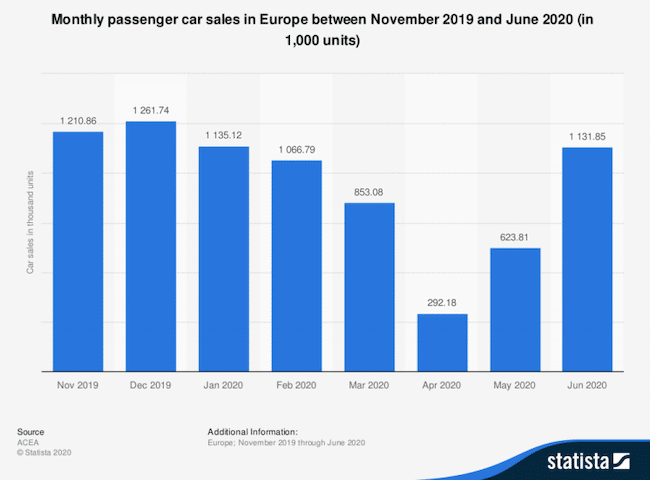

A big rise in orders for new cars since the easing of lockdown is catching the eye of investors. In April, UK vehicle sales plunged by 97%. It was a similar story across the rest of Europe where the volume of new car sales dropped from 1.34m in April 2019, down to 293,000 in April 2020. The good news for investors is that the UK and other European nations are already showing signs of recovery as consumers return to showrooms and spur on demand for new cars. There is also a chance to try and profit from a realignment across the sector as certain firms look set to benefit more than others.

The headline figure for the recovery is that following the slump in April, the sales figures for May and June have seen month-on-month increases, with the June total of 1,131,850 sales being in line with sales before the COVID crash.

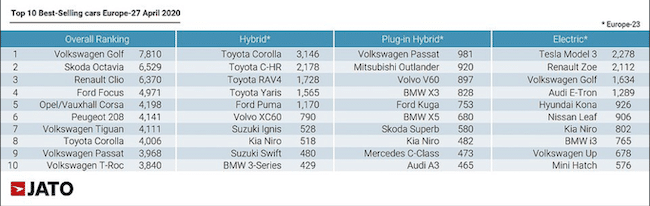

Showroom sales teams may not want to linger on the appalling sales figures from April, but investors would do well to give them extra thought. Analysis shows that in Europe, 419 out of 433 vehicle models saw lower sales in 2020 compared to 2019. The diamond in the dust is identifying which models managed to hold up even during the pandemic driven bloodbath in sales. The answer is largely electric vehicles, with EV models giving an indication of which part of the industry will see future growth.

The road ahead

Consumer preference is shifting towards greener vehicles but is also being given a push-start by government subsidies. Tax perks for EVs offer ongoing benefits to those who own them. To get them over the initial bump, European nations including France, Italy, Sweden, Spain, and the UK all offer bonuses of up to €6,000 to those purchasing a new EV.

Felipe Munoz, global analyst at JATO Dynamics commented on the situation when he was speaking with This Is Money:

“Not a single manufacturer was prepared for this scenario or expecting a crisis on such a large scale. The only silver-lining from this turbulence is that it has created an opportunity for automotive players to reassess their operations and become more agile.”

Source: This Is Money

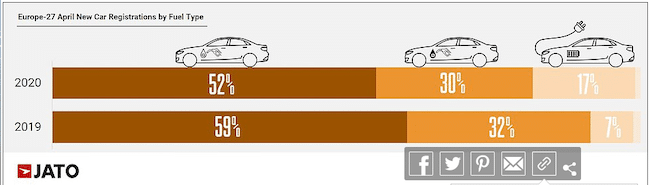

The fall in car registrations in April saw electrified cars — pure electric and hybrids — improve their market share to almost 1 in 5 new motors bought in the month.

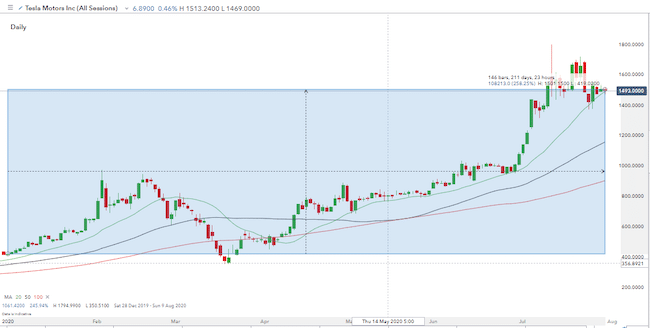

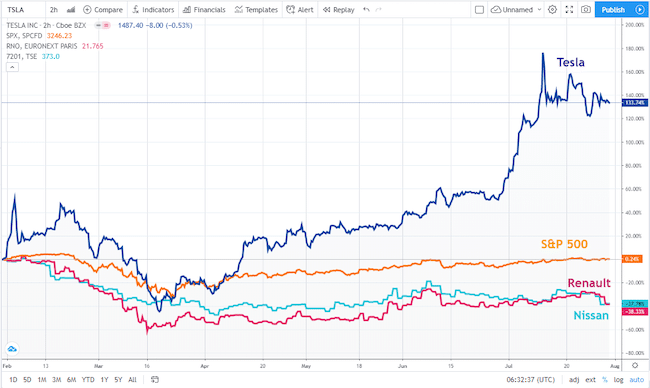

The shift towards EV has had massive repercussions for share prices of the car manufacturers. Tesla Inc’s (Nasdaq:TSLA) expansion plans finally came good in December of 2019 when it gained the title of the world’s biggest producer of EVs. Since then, then the share price has increased by more than 250%.

Tesla Inc share price – year to date.

The price chart of the Tesla share price compared to the broader market and a near rival outlines how the firm has become the standard bearer for the move to EV. Tesla’s outperformance compared to the S&P 500 can be justified if you think the firm is going to become the world’s largest auto manufacturer. The scale of Tesla’s outperformance of Renault and Nissan shares is harder to explain.

Tesla share price vs S&P 500 vs Renault share price vs Nissan share price – January–July 2020

The Renault-Nissan Alliance, which dates back to 1999, has seen both companies invest in and excel at producing electric vehicles. The French-Japanese business has also joined forces with China’s Dongfeng Motor Group to form eGT New Energy Automotive, a 50:50 joint venture.

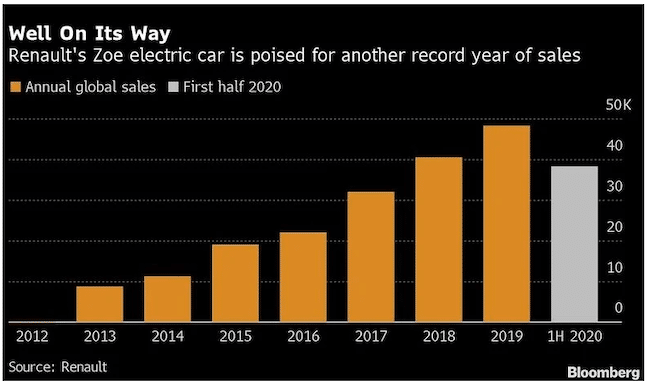

While the markets have been watching the Tesla price chart Renault has been selling EVs, lots of them. The French automaker’s all-electric Zoe out-sold the Tesla Model 3 and took the title of Europe’s best-selling full-electric vehicle in the first half of 2020. The Zoe's first-half sales growth was close to 50%, suggesting it is the model that is on the up. Half-way through the year, the Zoe has almost matched the total sales for the whole of 2019.

Renault Zoe Sales:

In January, Renault’s Japanese partner Nissan reached the milestone of 450,000 sales of its LEAF vehicle. That makes the LEAF the world’s most popular EV and Nissan deserves credit for acting early in the EV market. The firm is seen as having taken its foot off the pedal to some extent, but Autocar magazine reports that “the Ariya is leading Nissan’s fightback” (source: Autocar).

Gareth Dunsmore, Nissan Europe’s vice-president of marketing for digital customer experience and connected cars said.

“The Ariya is the perfect vehicle for the perfect time in Europe. And the broader need to bring customers to zero-emission vehicles is where our focus is.”

Source: Autocar

The high-profile nature of Tesla’s enigmatic founder Elon Musk has kept the firm’s share price in the spotlight. There is a risk that this is building in additional price volatility. Exuberance on the way up and over-reaction on the way down. Reports from the key China market show that state subsidies there will be directed at cheaper, home-grown models. Tesla may well have built a new factory in China but the government there has been quite clear about its desire to cultivate home-grown champions.

Industry site Electrek reported in April:

“China announced today that it cut subsidies for electric cars by 10% this year, followed by further reductions in the next two years. The reduced subsidies are now only available to passenger cars costing less than 300,000 yuan ($42,400). Tesla’s China-made Model 3 sedan is currently priced at 323,800 ($45,800).”

Source: Electrek

This potential pricing anomaly opens the door to trading opportunities as investors are being asked the question of whether Tesla shares are overvalued or Renault-Nissan shares are undervalued. Those with a strong view on the situation could even consider taking a market-neutral ‘Pairs Trade’ and shorting Tesla and buying Renault-Nissan. This should iron out any bumps in the road caused by the general market rising or falling but generate profits if the relative spread between the firms converged.

Buying into the sector with a straight-forward long position is another option. There are signs that the sector is moving from an experimental stage to a more commercial one. Costs are being driven down, as explained by Jean-Paul Drai, Renault Group's product development director for EVs, who was speaking at the latest Automotive News Europe Congress Conversations and said:

“We have achieved a 30 percent reduction on the platform cost, we have reduced the battery cost by 30 percent and the e-motor by 20 percent.”

Source: Automotive News Europe

Seth Metzger, senior vice president of electrification at the US supplier Dana, was speaking at the same event and said:

“If you look across all automakers that we are working with, most of them are going in a similar fashion by trying to create a common platform in order to significantly reduce cost through the scale benefits.”

Source: Automotive News Europe

These cost improvements are hot off the press. The Automotive News Europe conversation was held on 23rd July and it will be interesting to see how the share prices of the firms react as the news filters through.