-

- The UK travel and leisure sectors are undergoing dramatic changes due to the COVID-19 pandemic

- If the need for some kind of break wasn't so pressing, it's highly likely the risk factors involved with 2020 holidays would see the industry grinding to a halt.

- As it is, bookings and profits are still being made.

- The upheaval signals an opportunity for investors to play various strategies designed to pick out the winners and losers from a very uncertain situation.

Changes to UK holiday patterns look likely to impact the share prices of firms in the travel and leisure sector. The partial relaxing of COVID-19 regulations has allowed the UK's population to plan trips away – however, the continued threat of infection has tempered consumer appetite for foreign trips. The immediate impact is fewer trips abroad being taken and more ‘staycations'. That suggests there will be short-term price changes in the firms that are set to pick up extra business. There are also potential changes that might prove to be longer-term in nature, creating the opportunity for longer-term returns.

Anecdotal evidence is that many UK citizens are shunning trips abroad. A more detailed analysis has been provided by the insurance firm Schofields.

“The first note to consider is that a trend for more domestic holidays started before the COVID-19 outbreak. In fact, the share of people taking holidays exclusively within the UK in 2019 was 8% higher than those who take holidays only abroad. The Global pandemic has given that shift more momentum with Schofields' research revealing that confidence in the travel industry, the number of people who feel “very unfavourable” about travel rising from 3% to 9% since January 2020.”

Google Trends results for ‘Staycation' searches

The reluctance to travel abroad was studied in granular detail and reveals fear factors which, while variable, appear unlikely to disappear in the short term. The primary concerns of those polled stated they were most concerned about:

- Travel companies going bust – 51%

- Risks to personal health when travelling – 35%

- Travel being more expensive – 9%

- Difficulties in finding good value travel insurance – 3%

- The effects of Brexit – 2%

Source: Schofields

A complicated affair

The shift in domestic customer demand is also matched by a reduction in the number of incoming tourists. London usually attracts 30 million visitors from around the world each year. Some of the visitors do disperse to areas outside the capital but the reduction in numbers looks set to hit London hardest.

Attractions such as the London Science Museum is one such tourist destination that has borne the brunt of the UK's COVID restrictions. Stating its intent to reopen its doors to the public on the 19th of August, the museum's directors announced:

“British museums and galleries are the anchor of our cultural life, both a key draw for inbound tourism and a central pillar of the UK soft-power strategy abroad… Only a forward-looking, ambitious partnership with Government, extending beyond the immediate crisis, will ensure our ongoing capacity to promote a truly Global Britain and spread opportunity.”

Source: Science Museum

The industry site Visit Britain released projections of UK visitor numbers pre-COVID.

“The final IPS figures showed that there were 40.9 million visits to the UK in 2019, with these visitors spending £28.4 billion. The above forecast, therefore, implied 42.1m visits and £30.3bn spending in 2020 in a counterfactual no-COVID scenario.”

Source: Visit Britain

Visit Britain applied some British understatement when it said: “Forecasting at this time is difficult… Our central scenario for inbound tourism to the UK in 2020, as of the 3rd of June, is for a decline of 59% in visits to 16.8m and 63% in spend to £10.6bn. That would represent a loss vs the pre-COVID forecast of 25.3m visits and a £19.7bn spend.”

Source: Visit Britain

The report by Schofield echoed the same thoughts that the fast-moving situation and the unique circumstances meant that, “The state of the travel industry in 2020/21 is a complicated affair”.

Source: Schofields

This makes picking market winners an interesting task.

Campsite manager, Tom Beynon, is one who has spotted a change in current demand and one that might bring about lasting changes. Speaking with BBC News on Tuesday, he said:

“We've seen probably about double the bookings of where we’d normally be for October already, so it might be that people enjoy this October and then might all of a sudden give us a seventh month… You never know, COVID may turn this year into a positive going forward.”

Source: BBC News

The demand cycle for UK holidays was already extending into the months that aren't seen as peak-season. All businesses in the travel and leisure sector would benefit from fewer peaks and troughs in visitor numbers.

Hotels are also receiving bookings for more extended periods. Two-night stays are turning into seven-day bookings — a factor that would help some of the big operators cut down on some variable costs associated with managing change-overs between residents.

Opportunities to buy

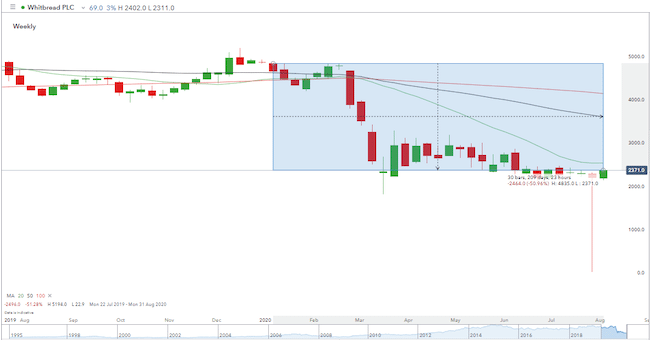

One way to play the staycation theme is through Premier Inn owner Whitbread PLC (LSE:WTB). Premier Inn is predominantly focused on the regions (as opposed to London). The share price of Whitbread has halved during 2020, offering investors a buying opportunity.

Whitbread PLC – share price – weekly candles – year-to-date.

Picking up on the staycation trend and also the ‘Eat Out to Help Out' government-funded offer is Marston's PLC (LSE:MARS). The firm offers a mixture of accommodation and dining experiences. Neither of which are entirely out of the woods yet, but both are set to benefit from upticks in UK consumer demand. Simply Wall Street is a fan of Marston. Its analyst's report in June stated:

“Good news, investors! Marston's is still a bargain right now. My valuation model shows that the intrinsic value for the stock is £0.86.”

Source: Simply Wall Street

The stock is currently trading at almost half that, at £0.46, meaning there is still an opportunity to buy now. The share price is also quite volatile, its high beta offering traders the chance to work into a position at a lower average price. Earlier this week Marston's shares were trading at prices as low as £0.36.

Marston's PLC – share price – daily candles – year-to-date

Up 10% in the morning session on Wednesday, Marston's share price is now above the 20 and 50 daily SMA's and doesn't meet the resistance of the 100 SMA until it gets close to £0.60.

That gives us more opportunities to buy since the share price could sink lower (or rise higher) in the future. Based on its high beta, that is a good indicator of how much the stock moves relative to the rest of the market.

Budget airline operator EasyJet (LSE:EZJ) surprised the markets on Tuesday when it announced it would be scaling up its operating capacity. The UK based company reported a 99% drop in revenue in the first quarter of the year but it senses that the tide could be turning. It will be returning more of its fleet to service than previously planned this summer thanks to stronger bookings than anticipated. Going forward, it plans to fly at 40% rather than 30% of its capacity. Firms in the same sector, Ryanair and Wizz Air are also looking to scale up their services in the coming months.

EasyJet – share price – hourly candles – May to July 2020

EasyJet's share price rose by more than 8% on the news of increased bookings and broke a multi-month downward trend line. The risk of being quarantined on returning from a holiday is very apparent but is one that increasing numbers of people are willing to take. It could be cynical to suggest that those in secure salaried positions may be 'embracing' that risk. After all, it could mean an extra two weeks off work should they return from a country that the UK blacklists during the period of their holiday.

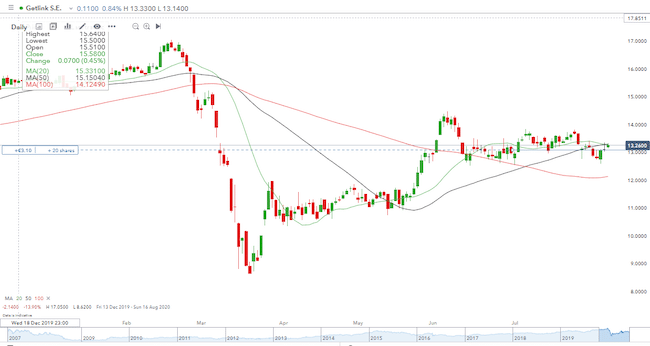

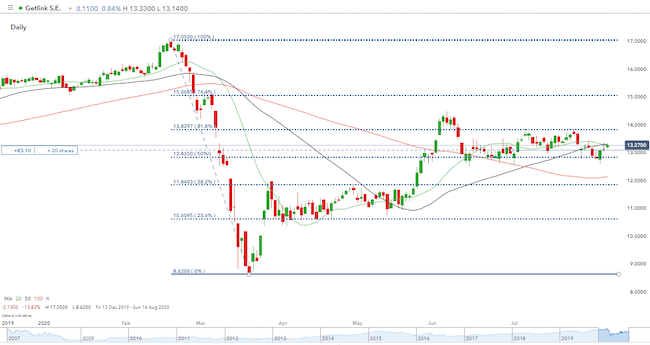

Somewhere in between the staycation and EasyJet strategies is Channel Tunnel operator Getlink (GET:PA). The firm offers relatively low-risk travel to the continent as passengers on board the train have to remain in their cars. The lack of social interaction might be appealing to many who still yearn for a trip to a continental villa, located away from the crowds. Getlink's booking website crashed in July when online demand spiked and the share price has, since the easing of lockdown, picked up some extra volatility.

Getlink – share price – daily candles – year-to-date

From a technical perspective, the Getlink share price is trending between the 50% and 61.8% Fibonacci retracement levels. This could represent an opportunity for bulls of the stock to work into a position with a lower average price. The recent intersection of the 20 and 50 SMAs means a degree of caution might be required.

Picking the right firm could return a healthy profit as the COVID pandemic has hammered share prices in the sector. Virgin Atlantic's decision to file for bankruptcy on Tuesday highlighted the degree of the turmoil being experienced in the industry.