Key points:

- Ethernity Networks announces a repeat and larger contract with a Far East customer

- This is not dispositive, in that more needs to happen as well

- But it is a good sign of advancing the company and the economic structure of it

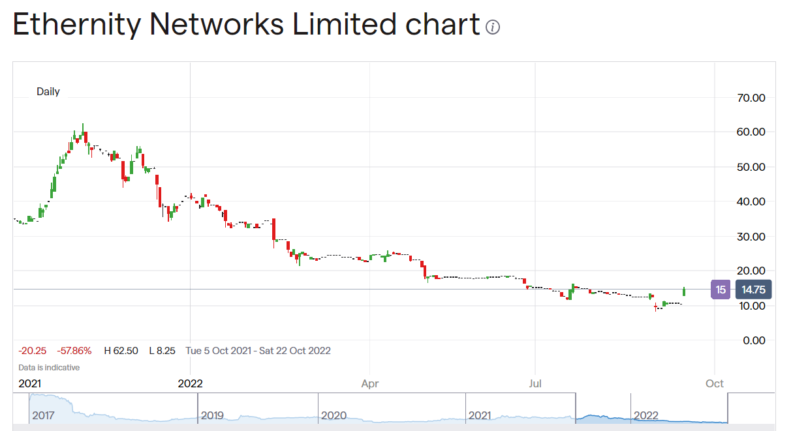

Ethernity Networks (LON: ENET) has not done well by shareholders this past year, the stock's down by 80% and change over the year from 60 pence to lows of 10p and the like. This is now turning, at least a bit, with a 35 to 40% (the price is changing) rise this morning. The trigger for this is the announcement of the continuation and upgrading of a contract with a Far East buyer. One little thing to grasp about this particular corner of the economy is that success does tend to breed success. Gaining the one customer is not just about having gained that one customer, matters can be accretive.

The specific announcement is that a follow on contract has been won: “is pleased to announce that it has signed a new follow-on contract with its existing customer, a Chinese broadband network OEM” and that's nice. Given that the contract is worth, from the release, $4.6 million to a company with a £8 million or so market capitalisation like Ethernity, that's very nice in fact. That's not the whole valuation of what's going on though.

This sort of design work is accretive. What that means is that the more of it you do then the better at it you get. At a trivial level this is like riding a bike – the more that's done the better we get at it. But there's more of it in this particular field than there is in many others.

Also Read: The Best Artifical Intelligence Stocks Under $10

The specific issue here is about designing and making chips that bring fibre connections into the room. Stripped of jargon, it means that instead of copper from the exchange to the client, or the client spreading the Wi-Fi through the building, the system ends up with fibre to the desktop. As download speeds increase this is an increasingly compelling story.

But that's just the specific of this one contract. The point about all such development is twofold. Firstly, one now has a customer for the specific workout of the particular technology. That's good. But this then multiplies, as others looking for either that tech or some variation of it see that you can do it. Further, you've already done most of the development work for any variations of it. This is what is meant by such contracts being accretive. The first client pretty much pays the bills for development, future roll outs to other customers are markedly cheaper to perform – but not necessarily charged at any less. That is, margins tend to increase in the chip business with every additional customer.

So there's a triple effect on the Ethernity Networks share price here. The first is another contract, well done, that's good. But gaining a repeat contract does also mean that the first one must have been performed well enough, that's also a good sign. Then we've that overarching economic effect of how this sector of industry works. The intellectual capital of designing these chips is now capital within Ethernity which can be – and probably will be – deployed again to some other customer. Where it will be charged for, again, but won't have to be paid for, again.

That is, for chip design companies margins go up with succeeding designs for more customers, it's a happy and profitable spiral.