Despite the FTSE, and the broader UK market settling down at new highs this week, it is hard to get away from looking to the future, and nothing says future more right now than tech.

In the high-stakes ecosystem of tech IPOs (initial public offerings), London's market is not as attractive as it once was for companies considering going public. Arm Holdings, previously a stalwart of the LSE launched back on the NASDAQ this year, and it is not the first UK firm to look stateside.

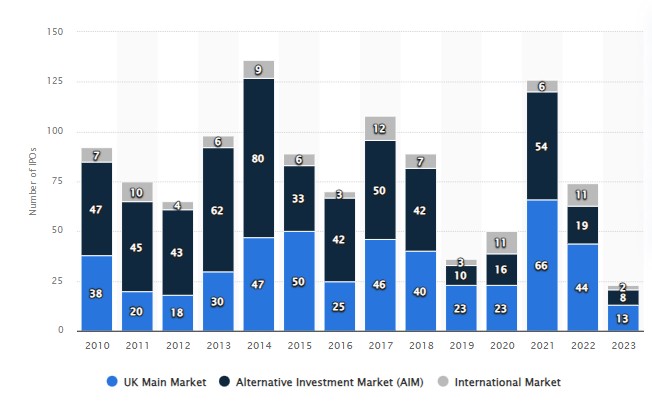

Year by year the number of firms listing on the UK markets have been on the decline. Pent up demand from the Covid lows in 2019/2022 can be explained in part by the large rise in 2021, but broadly, London has now shown the same scope for growth as US markets.

Darktrace, a UK-based cybersecurity firm, recently accepted a substantial $5.3 billion U.S. takeover bid. This strategic shift came after the AI-driven company vocalized its dissatisfaction with London's market response, even amid reports of performance improvements.

This sentiment is reflective of a broader hesitation within London’s tech business community. Presently, only a select group of tech companies, each valued over a billion pounds, are contemplating a list on the London Stock Exchange (LSE). The reluctance stems from a perception of unfavourable market conditions, which has proven to be a serious impediment to the LSE's efforts to become a global tech hub.

Statistics shed light on why the American stock markets have a more alluring sheen. Over the past decade, the U.S. markets have significantly outperformed those of London, chiefly propelled by the monumental growth of big tech stocks. This stark contrast underscores the challenge faced by LSE to attract and retain high growth potential tech firms.

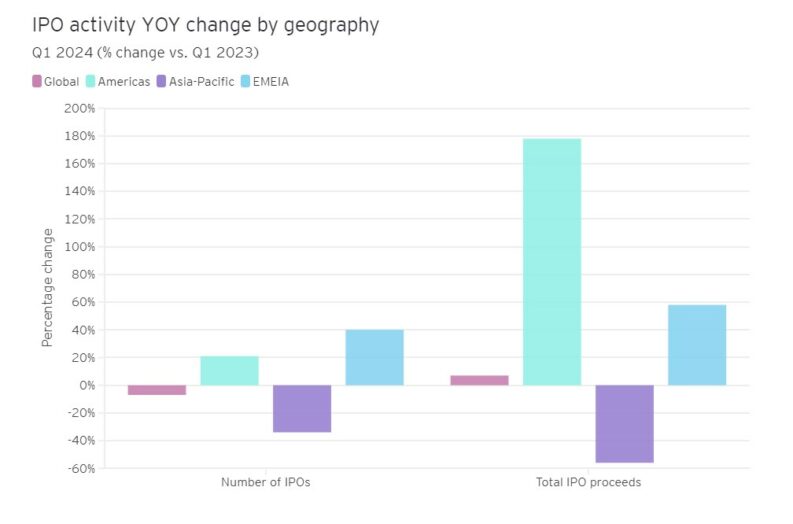

As you can see from the graphic above, both the volume of listings in the Americas, and the significantly higher proceeds from the offerings in the Americas paints quite a different picture from that of the UK lists. When we would expect to see activity heating up, we are seeing declines, but whether that is part of a longer term pattern post Brexit and the change in business dynamics brought as a result, or a short term blip as markets get used to the landscape now is yet to be determined.

Addressing market dynamics at the LSE, its CEO, David Schwimmer has been tasked with the rejuvenation and competitive strengthening of the stock exchange, potentially rendering it a more compelling option for tech IPOs. Schwimmer, who has led LSEG since 2018 after a 20-year career at Goldman Sachs, earlier this year said that UK companies needed to pay their executives more in order to compete with US businesses.

Shareholders of the London Stock Exchange Group voted to approve the CEO pay rise, potentially doubling total remuneration to £13.1m, including significant performance bonuses. Almost 90% of shareholders approved the plan. In recent comments the LSEG added

“We have also aligned executive compensation with the median of our global sector peer group and reinforced a pay-for-performance philosophy,”

It will take some shifting of momentum to pull firms back to UK listings, but if innovation and growth are part of the plan, it is a necessity. Raspberry Pi are one rumoured tech firm looking to list in London in 2024, and if this comes to pass, there will be plenty of eager watchers.