We have had some big moves in oil, yields, gold and other assets, but general equity indices have stayed extremely calm. Equity sectors have moved (momentum space, oil names etc) but overall index levels have remained stuck doing nothing.

Next event is the Fed. Market is pricing a cut of 25 bps, but it is rather many of the Fed members that are not voting for the cut or have not made up their minds yet. From a trading point of view Fed provides uncertainty, all things equal.

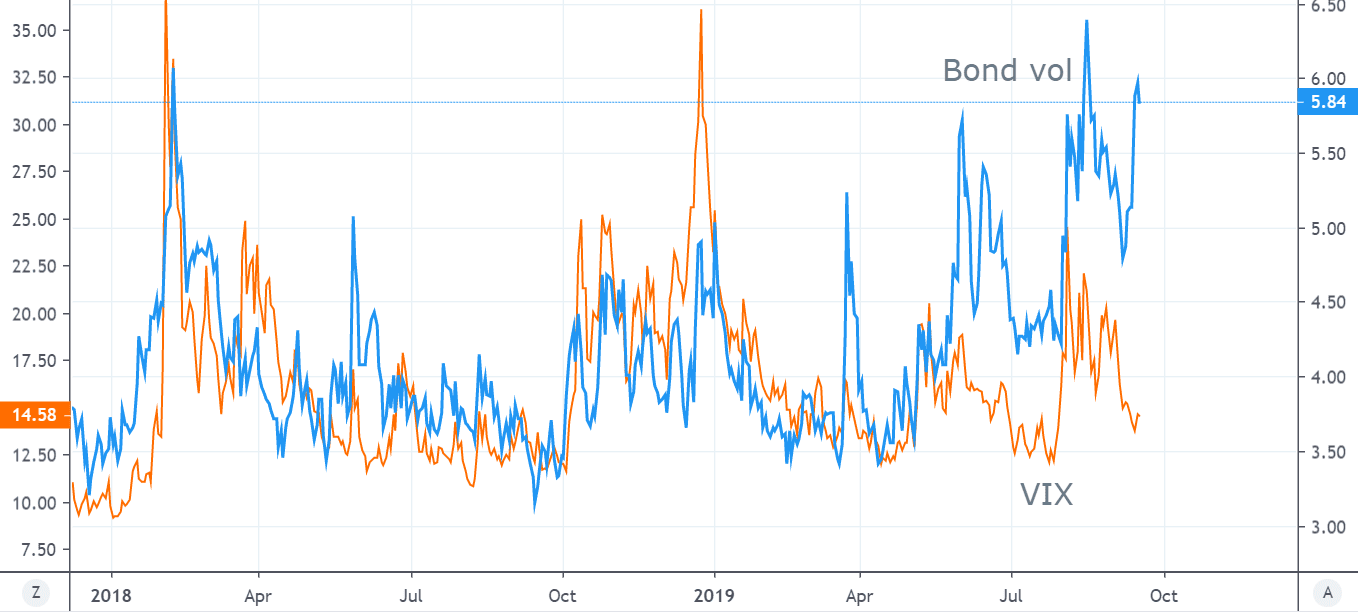

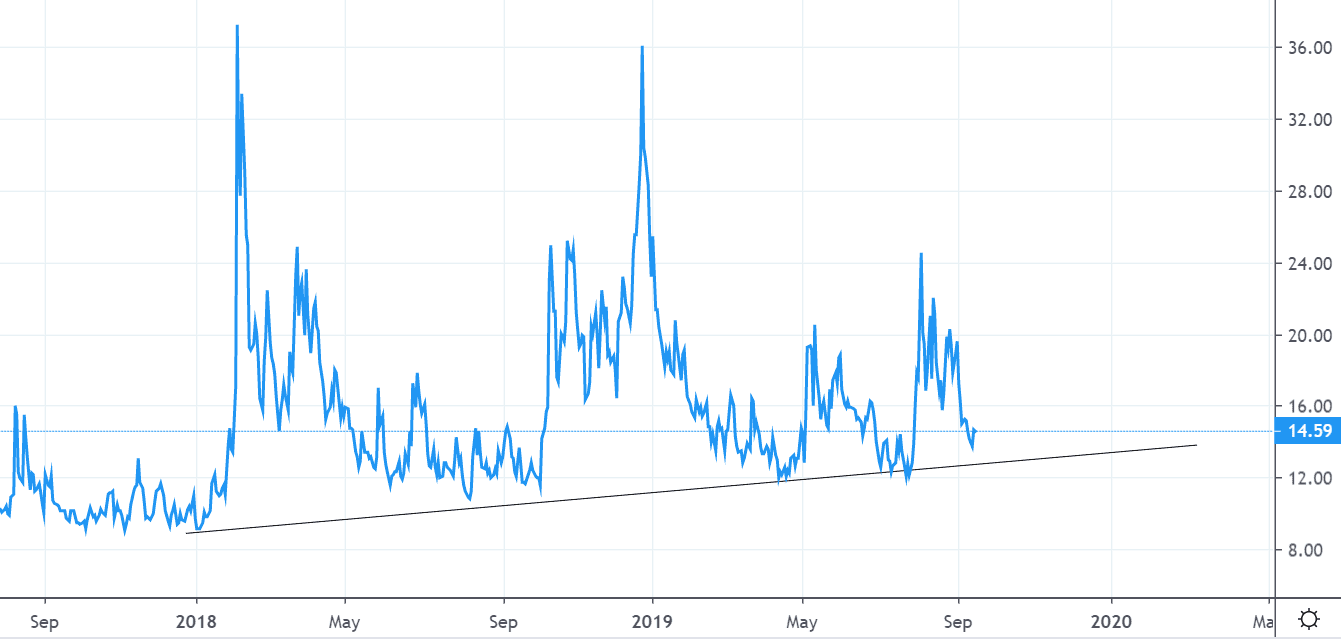

Past Fed events have seen relatively low levels of VIX going into the event and then VIX has tended to move higher post the Fed meeting. VIX is down again to some sort of mean reverting relative lows. VIX does not trend as a normal asset due to obvious reasons, but VIX has been putting in higher floors over past years. VIX at these levels as an overall equity hedge or speculation on Fed makes good sense.

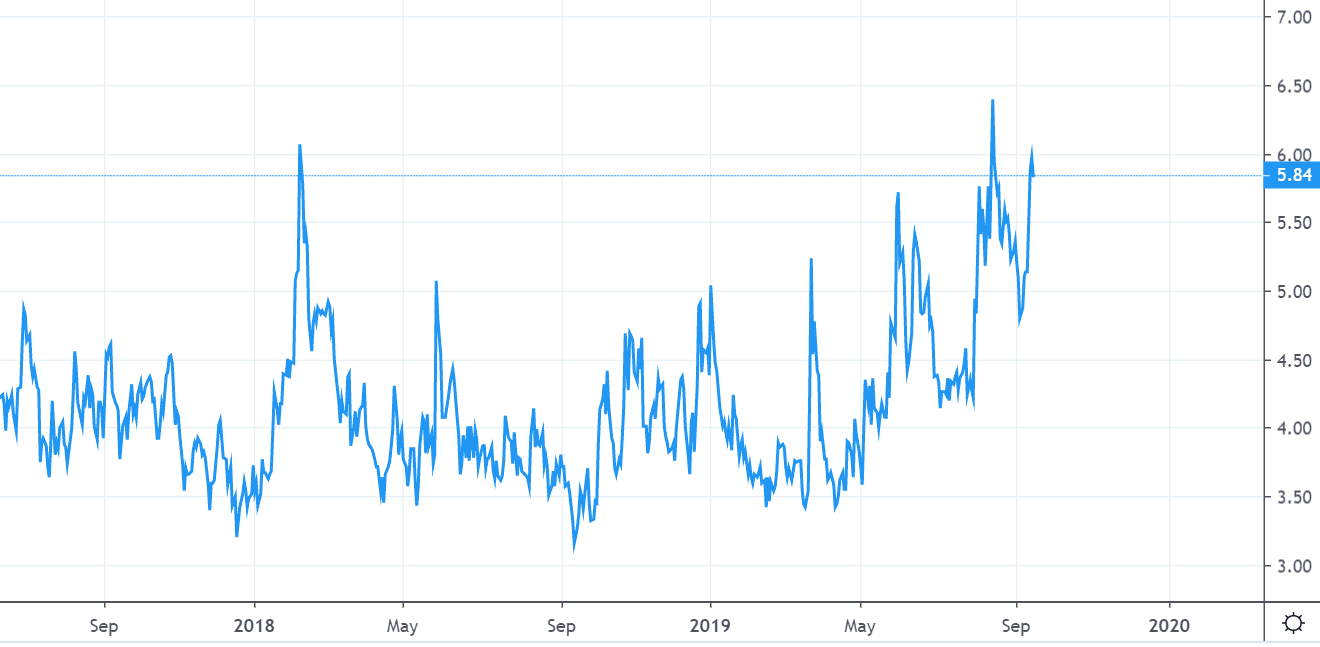

Many other macro assets have seen rising volatilities. Below is the chart of Treasury volatility, the TYVIX index. Rates have the convexity factor which has contributed to the wild moves we have seen in yields recently but seen through the lens of a global macro observer, Treasury volatility should eventually affect the VIX.

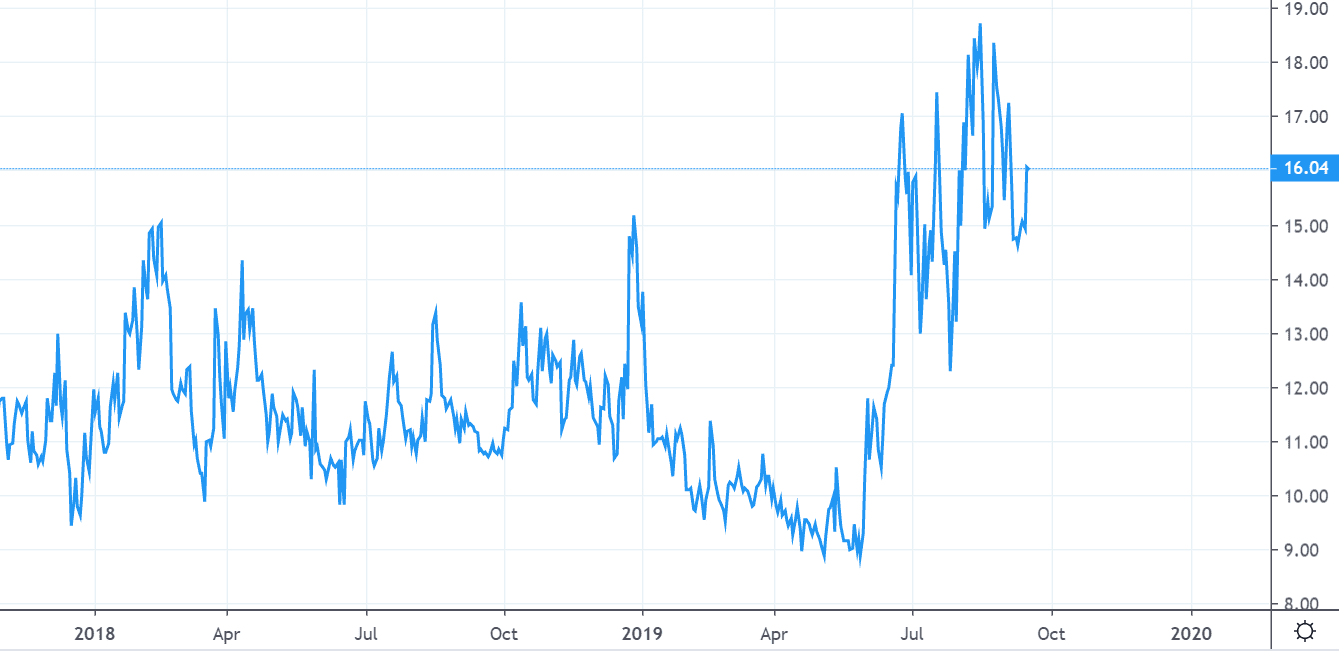

Another related risk asset is gold. Gold itself is hedge, so gold volatility tends to move somewhat counterintuitive to some people. Below is gold volatility, moving higher as well.

The case for long VIX hedging strategies here makes sense. Levels are not high, there are many macro events taking place now, cross asset volatilities have risen, so in my view VIX and relatively cheap equity index volatility offers a good hedge or cheap bets on Fed. Below is VIX versus Treasury volatility.

Hedges are always “painful” as you give up money, but in case of renewed uncertainty post the Fed, current levels of VIX are offering relatively attractive hedges. See it as a house insurance.