Shares of Infineon AG (ETR: IFX) soared more than 4% today on the surging revenue. Still, the Germany-based tech reported an after-tax loss of €128 million in the third quarter. A year ago, Infineon earned €224 million.

A surge in revenue helped the firm to partially offset the pandemic-fueled quarterly loss. Infineon saw its revenue increase to €2.17 billion, higher than €2.02 billion the year prior.

“The pandemic continues to have a significant impact on our target markets, resulting in weaker demand in many product areas,” Chief Executive Reinhard Ploss said.

Despite a loss, Infineon reiterated its full-year guidance of revenue coming around €8.5 billion. As for the fourth quarter, the German tech giant expects revenue to be in the range of €2.3 billion to €2.6 billion.

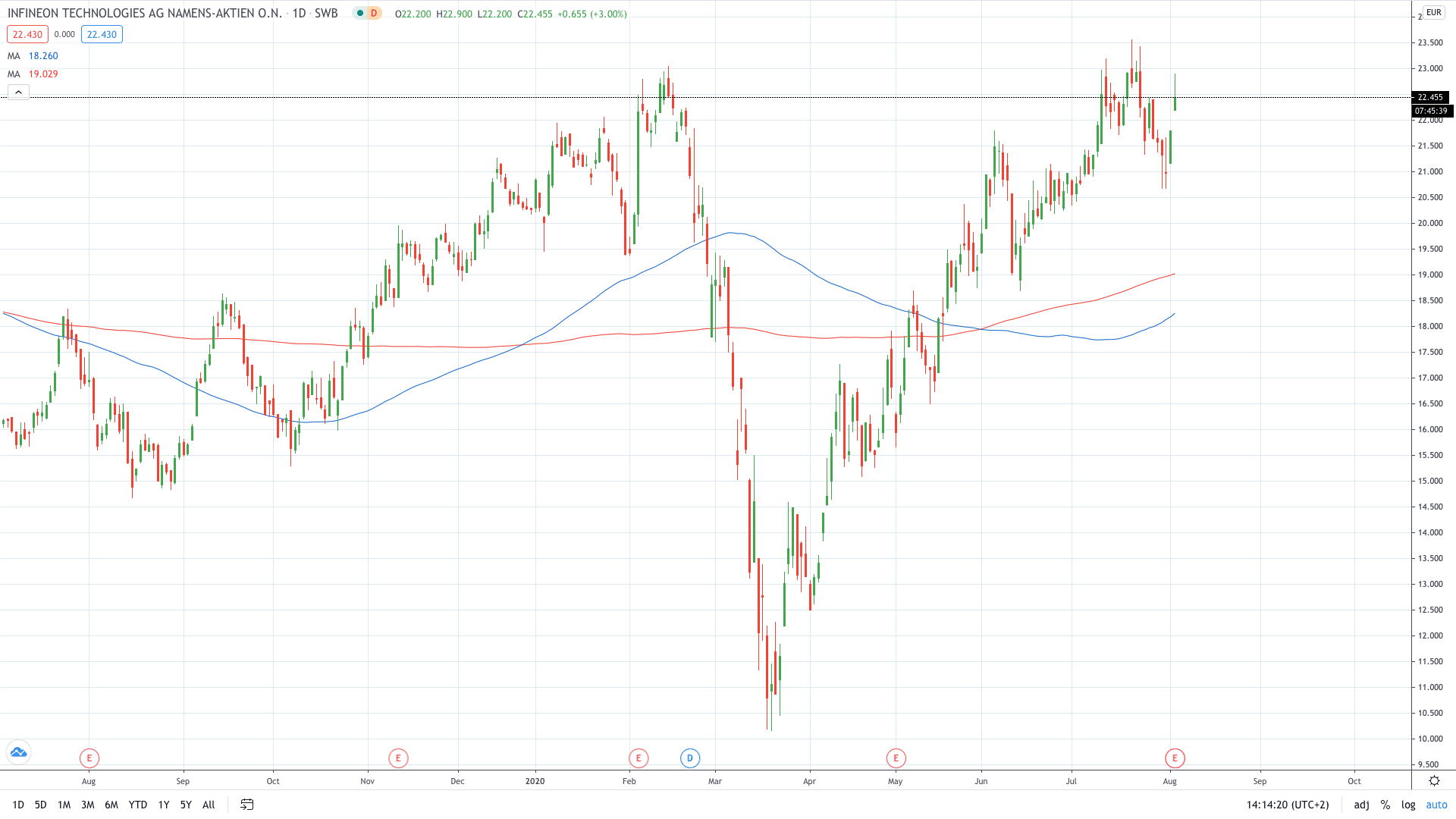

The Q3 earnings report prompted UBS and Goldman Sachs to reaffirm their buy ratings on Infineon stock. UBS analyst David Mulholland set a price target of €23.5, an increase of 7.8% compared to yesterday’s closing price of €21.8.

On the other hand, Goldman analyst Alexander Duval has a price target of €22.5 on Infineon stock.

Infineon share price soared 4% to edge closer to the 2-year high of €23.57 set last month.

- Trade stocks on this free demo account

- Learn stock trading strategies

- Learn from experts on risk management in trading