Hochschild Mining PLC (LON: HOC) share price tumbled 11% today after the FTSE 250 precious-metals mining company said its pretax profit plunged to $6.5 million for the first half of the year, significantly lower than a profit of $29.5 million for the same period last year.

“Gold has recorded an all-time high recently and silver has reached its highest price level in seven years and we are therefore hopeful of delivering a strong rebound in profitability in the second half of the year,” the company said.

Adjusted earnings before interest, taxes, depreciation and amortization were reported at $80.6 million, which is over 50% lower than $153.7 million for the first half of 2019. Similarly, revenue tumbled to $232.0 million from $354.5 million.

As a result, Hochschild Mining posted a loss per share of $0.01 compared with earnings per share of $0.04 in 2019. The firm scrapped a dividend payout, arguing that “it would be inappropriate to pay a distribution to shareholders at this time”.

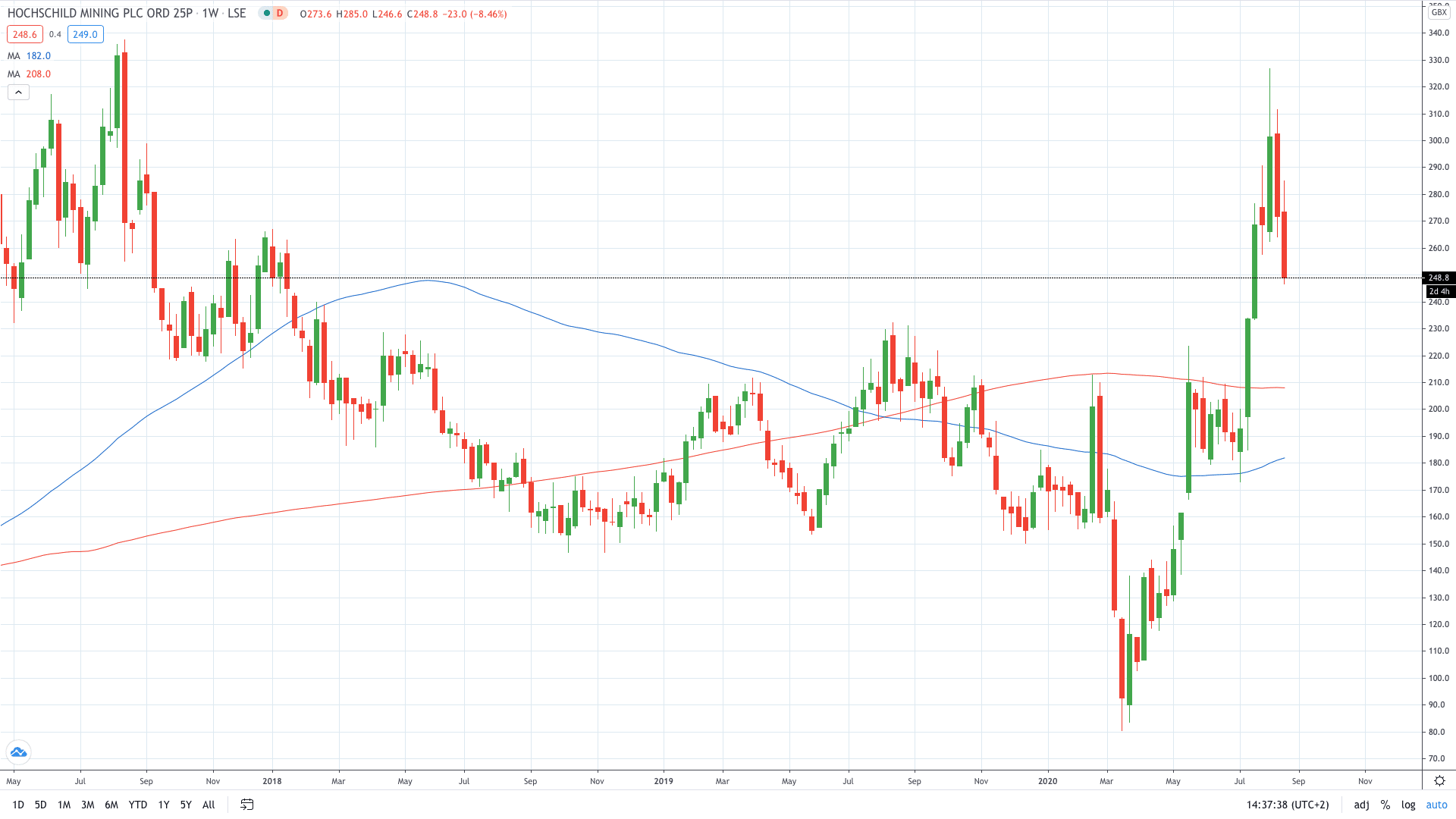

Hochschild Mining share price fell more than 10% today to trade below 250p just two weeks after posting a 3-year high at 326.8p.

- Explore stock trading strategies

- Learn from experts on risk management in trading