Shares of Frasers Group PLC (LON: FRAS) soared 7% on Tuesday on reports that CEO Mike Ashley is looking to buy 30 stores from rival retailer Debenhams, Mail Online reported.

Frasers Group, the owner of the sportswear giant Sports Direct and House of Fraser, is looking to seize the opportunity as financial difficulties are creating a major problem for the retail industry.

This news doesn’t come as a surprise given that Ashley attempted to buy Debenhams on at least two occasions in the past. Investors expect to hear from Ashley, who also owns Newcastle United football club, on Thursday when Frasers Group is due to report their full-year set of financial results.

Last month, Frasers Group wrote a letter to its landlord saying they aren’t looking to pay rents until the prior trading levels are reached.

“We write to confirm that we shall not be making any rental payment in respect of the property that we occupy until we are fully able to freely trade as a business at this location and the level of trade reaches a level which the parties would have envisaged when they drew up the lease,” it is stated in a letter.

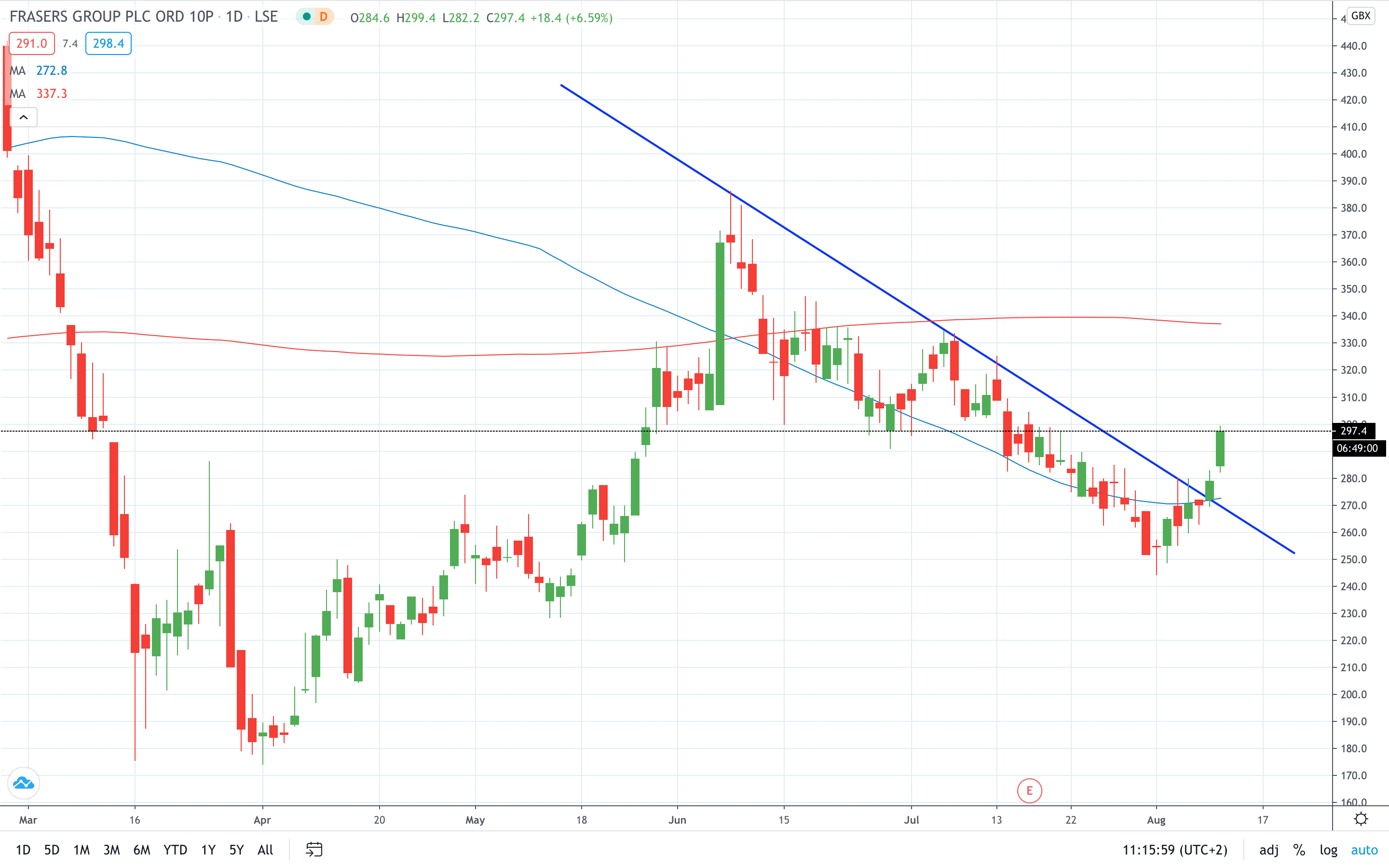

Frasers Group share price trades around 7% higher just below the 300p mark. The price action has broken above the descending trend line, opening the door for more gains in the near future.

- Explore stock trading strategies

- Learn from experts on risk management in trading