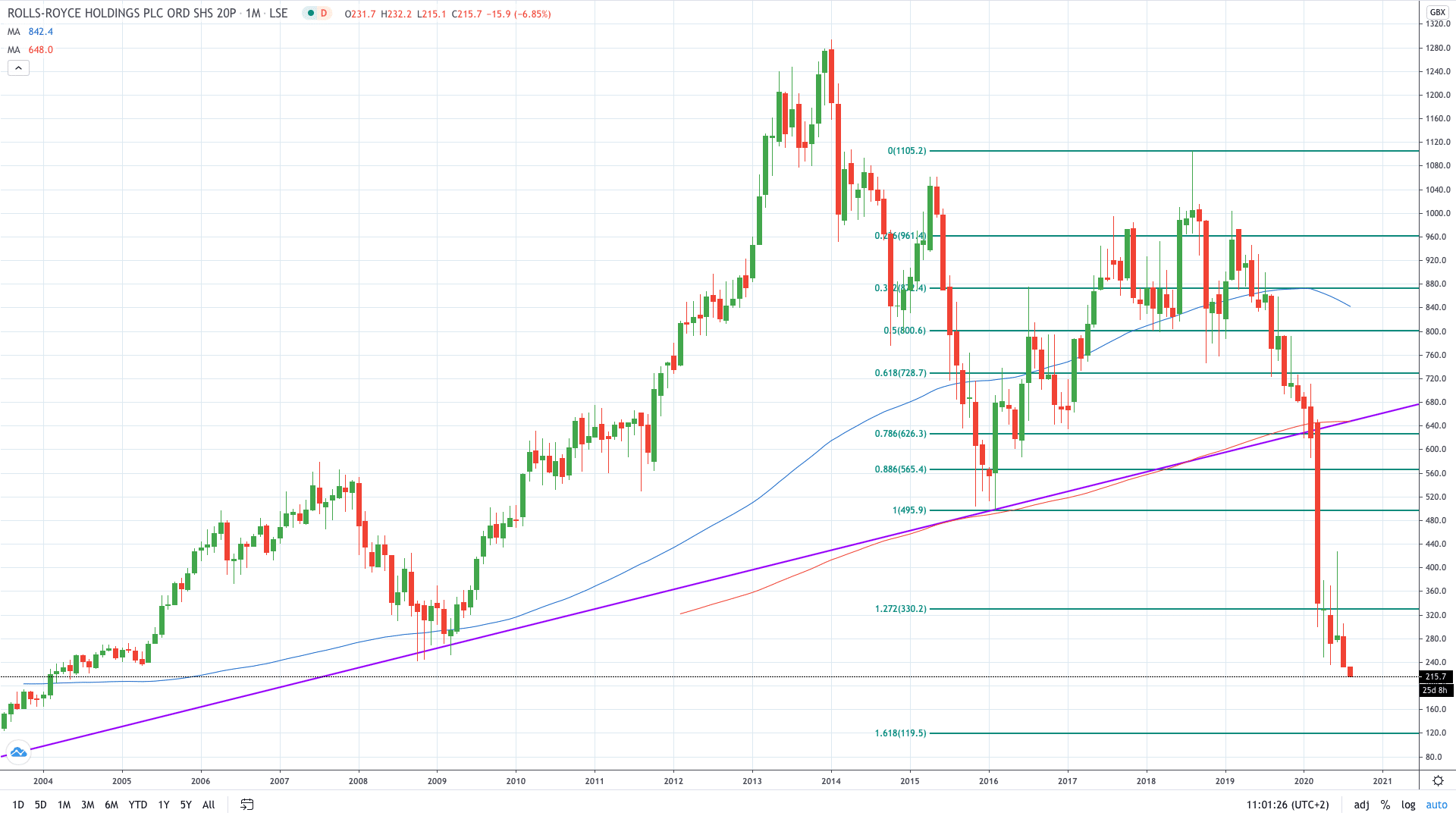

Shares of Rolls-Royce PLC (LON: RR.) plunged 7% today to trade at 215p, the lowest the stock traded since 2004. The engine maker is feeling the consequences of the worst crisis encountered in the history of the aviation industry.

According to media reports, Rolls-Royce is looking to raise £1.5 billion to improve its liquidity as the aviation industry faces a slower-than-expected economic recovery.

Among a few options, the engine maker is expected to raise funds through a rights issue for existing investors at a discount to the market price. Rolls-Royce is advised by BNP Paribas, Morgan Stanley, and Jefferies.

Last month, the company announced plans to clash 9,000 jobs. This, among other things, prompted Moody’s to downgrade the company’s bonds to “junk” status.

“None of our borrowing facilities contain covenants or credit rating triggers that demand early repayment, nor do any of our contracts with airlines. Our current financial position and liquidity remain strong,” the company said in a statement issued following the Moody’s downgrade.

Rolls-Royce share price has lost around 70% of its value since February. A break of the 2008 lows at 240p is likely to accelerate losses.

- Trade Rolls-Royce shares with the best stock brokers

- Learn how to trade stocks on this free demo account

- Learn Stock Trading Strategies