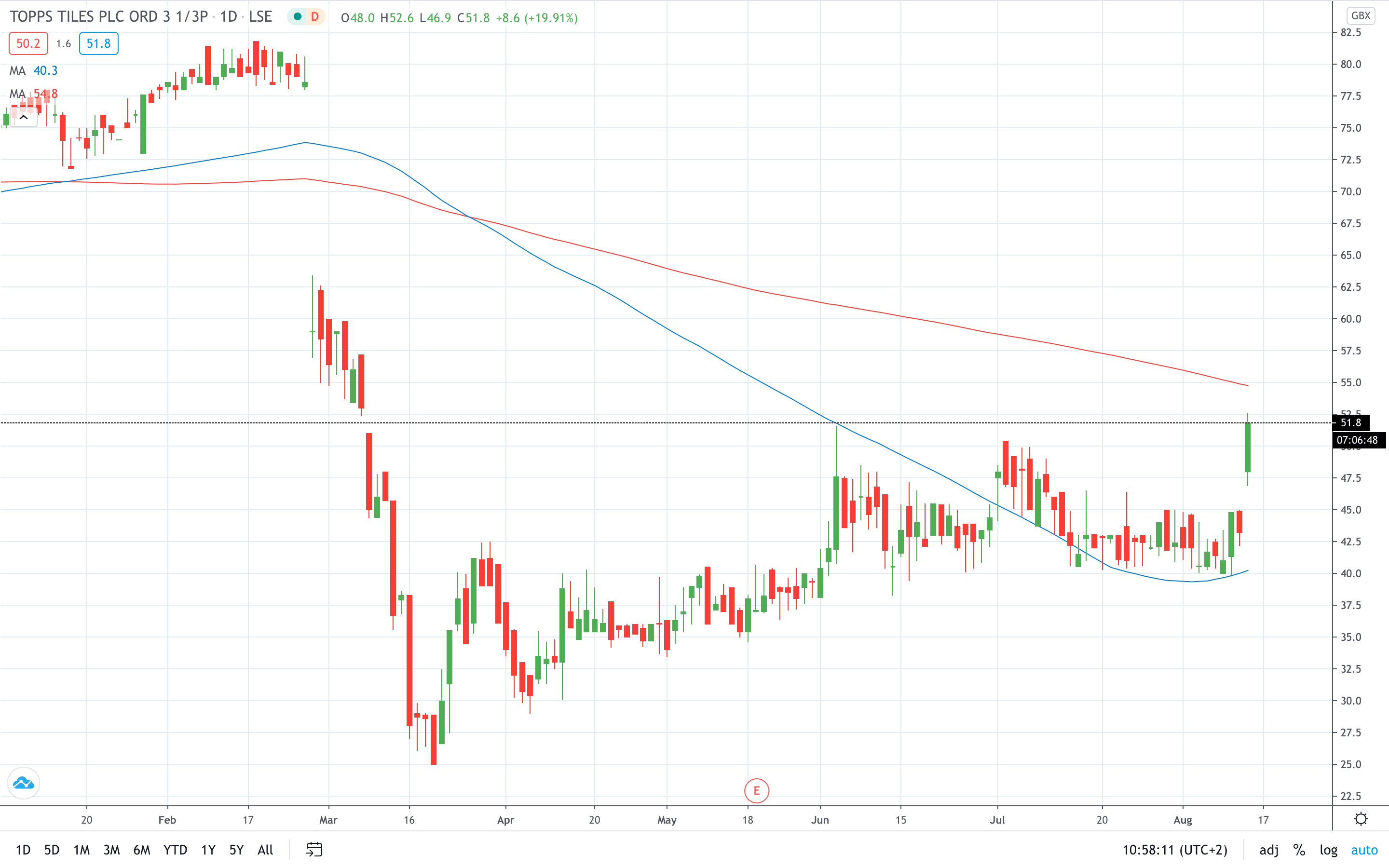

Shares of Topps Tiles PLC (LON: TPT) jumped more than 20% on expectations that the retailer will be able to post a “modest” profit this year despite the closure of stores amid the pandemic.

Topps Tiles has witnessed a strong rebound after the lockdown measures were relaxed, with like-for-like sales jumping by 15.5% in the first six weeks of its final quarter. The firm saw a surge in demand for do-it-yourself tools during the lockdown.

The home improvement retailer saw its average weekly sales crash 80% in April amid the lockdown. In the following month, sales tumbled 69% before recovering in June to “only” 20% in the red. Finally, the uptrend has continued in the six weeks to August 6 where an average weekly growth of 13.1% was observed.

“I am pleased with how well the business has navigated the crisis to date and feel that we are well positioned for whatever comes next,” Topps Tiles chief executive Rob Parker said.

“Our response to the pandemic has strengthened the business and fundamentally improved our liquidity position, providing further flexibility and putting us in a strong position both to benefit from the recovery in our markets and to meet any future challenges.”

Despite the closed stores during the lockdown, Topps Tiles expects to report an adjusted pre-tax profit for the full-year period to September 26.

Topps Tiles share price soared over 20% to trade at 52.6p, which is the new 5-month high for the stock.

- Learn stock trading strategies

- Learn from experts on risk management in trading