Key points:

- THG shares are down 23% on interim results

- The reason is simply that those results aren't very good

- Revenues just about stand still with inflation, costs are rising, margins shrinking

THG (LON: YHG) formerly known as The Hut Group, shares are down 23% on the announcement of the interim results. Given that THG share price movement clearly something's wrong with those half year results but what is it? Well, looking at those results, it's that those results aren't good. Actually, they're what could be called terrible for a so-called growth stock. For revenue has only just managed to stay current with inflation – this being something we've got to keep in mind as we look at sales figures now that inflation has reared its ugly head again.

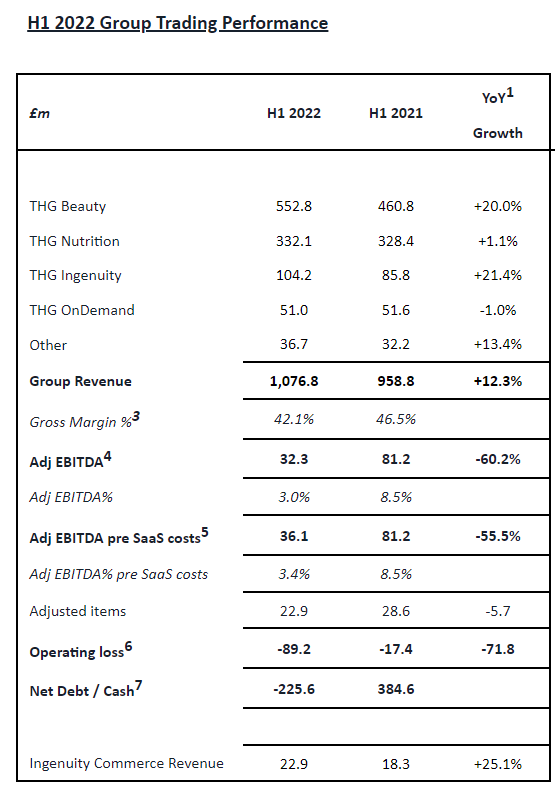

Here's the layout of those interim figures:

Well, growth of 20% in the Beauty section looks alright, Nutrition plus 1%, that's at least holding steady – but no, that's not right. These are nominal numbers. That is, before any allowance for inflation is taken into account. The last inflation figures were something over 9% for the UK. Call that, among friends, 10% – it could be less than the whole inflation rate for FMCG goods like this, could be more. We're looking though for a rough guide at this point. So, we need to subtract 10% from all of those numbers to give us real, inflation adjusted, figures. That is, take 10% off 2022 H1 figures to give us something comparable to H1 2021. Do note this isn't an accurate piece of analysis, it's rule of thumb stuff here.

Group revenues up 12.3%, take off that 10% for inflation and we've, well, standing still really. Further, given that overhead costs have gone up by something like the inflation rate, as have the costs of goods, we see that the loss has blown out and margins – both gross and net – have shrunk.

Also Read: How To Buy Tesco Shares

Another way of looking at the same numbers, from THG itself: “Group revenue of £1.1bn, +12.3% YoY and +64.0% two-year growth (CCY). Lower growth rate vs prior period reflects lockdown comparatives and market uncertainty across consumers and corporates linked to macro-economic events.” Well, yes. So, to unpack that in an unflattering way. THG did really well out of lockdown as people flocked to buy online. The market started valuing that growth as if it was a signal of a permanent change in the market – THG was a growth stock with soaring sales ahead of it. The end of lockdown has meant a retreat from online, meaning that the growth formerly built into the THG share price isn't, in fact, there.

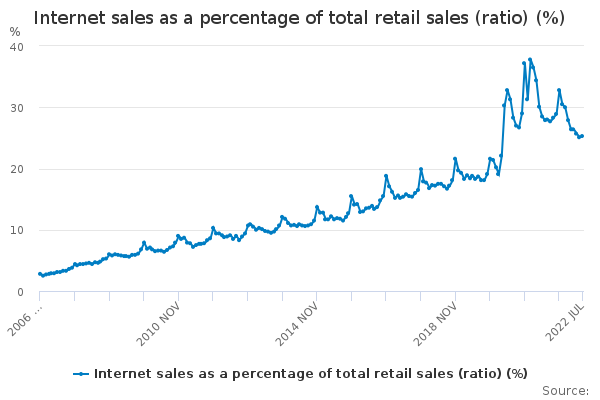

We can confirm this by looking at the ONS numbers for online sales.

There was a boom in online during lockdown which has faded back to trend. What some were thinking was a structural change at The Hut Group turns out to be, at least in part, just a part of that cyclical trend.

We also think this is fun: “This earning reduction is mainly driven by the stated strategy to limit the consumer pass through of commodity cost increases to prioritise retention and growth in the global customer base.” The other way to say that same thing is that we can't raise our selling prices as fast as our cost prices because if we do then we'll lose sales.

Revenues just about standing still with inflation, margins shrinking under those same inflationary pressures, no, these are not good interims for THG. Which is why the share price has gone down of course. They're just not good financial results.