Shares of IAG S.A. (LON: IAG) fell nearly 6% on Friday after the owner of British Airways confirmed it is seeking to raise $3.27 billion to weather the crisis.

The cash is needed to survive the worst crisis that the aviation industry faced so far. The plan is supported by IAG’s biggest shareholder – Qatar Airways.

“These are really extreme times. We’re seeing a much slower and more gradual build-up,” Chief Executive Willie Walsh told BBC.

IAG reported an operating loss before exceptional items of 1.365 billion euros for the second quarter.

The company is operating only at 20% capacity, although it had expected to work at 50% capacity in July.

“This is worse by any measure, by many times,” said Walsh when asked to compare the current state of play with 9/11 or the global financial crisis.

The company, which also owns Iberia and Aer Lingus, developed a worst-case scenario that expects the full recovery to pre-coronavirus levels not before 2023.

Following a record quarterly loss, British Airways pilots accepted a pay cut of 20% and compulsory job cuts of around 270.

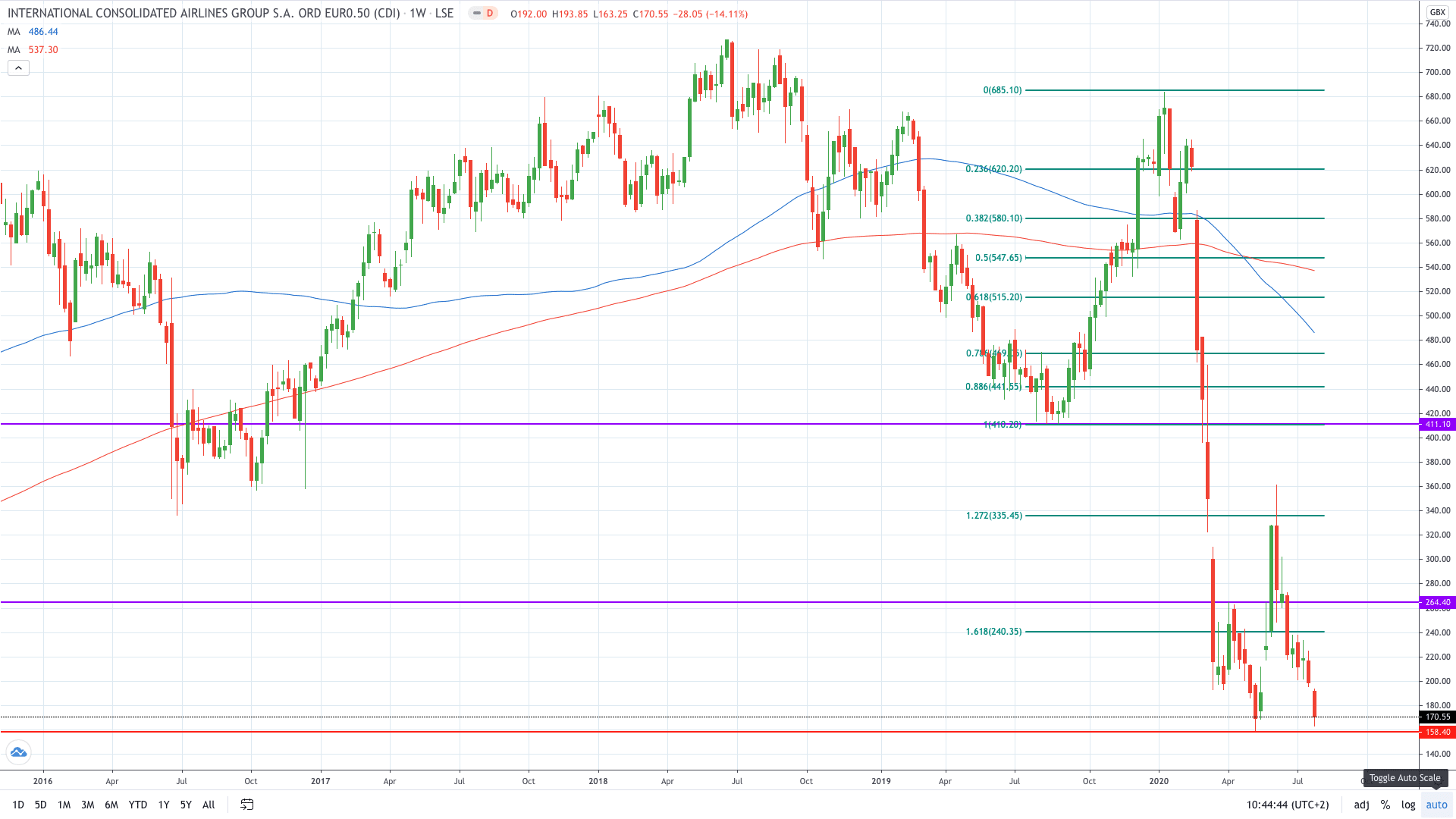

IAG share price closed at 170.55p – 5.79% lower on Friday amid a record quarterly loss. As a result, the IAG stock price closed over 14% lower on the week to trade near 8-year lows set in May.

- Read more about why IAG share price gained last week

- Start trading IAG stock

- Or check out some other stock brokers