Key points:

- Entain's paid a £17 million settlement with the Gambling Commission

- It's not, in fact, a fine

- But there's speculation over what this means for the gambling licence

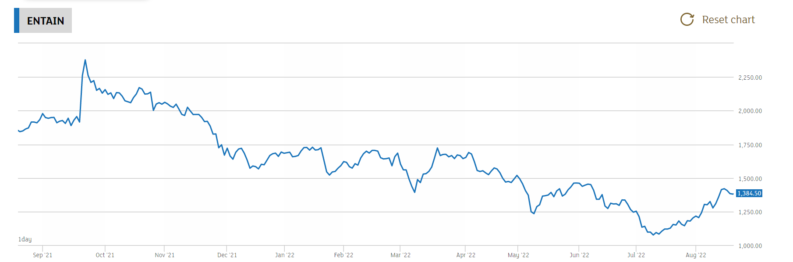

Entain (LON: ENT) shares are down only half a percent, 0.5%, this morning on the back of the story about their £17 million fine. Which isn't, as Entain itself is at pains to point out, actually a fine at all. It's a voluntary payment to charities dealing with the detritus of gambling – but it's also a payment made in order to sidestep legal actions. This is not a big deal, in and of itself, which is why the share price is so unmoved.

However, the implications of this range from the current near nothing all the way up to being truly transformative. So any position has to be decided upon the probability we apply to the varied possible outcomes. For gambling is becoming very much more regulated and so it's pleasuring the regulators that matters in the end. We've got to decide how much we think they're going to flex their muscles and how.

As an example, The Guardian headline says that Entain could lose their UK gambling licence over this. That's a possibility, to be sure, but again that lies on a spectrum of risk. Somewhere between really very unlikely indeed and unlikely perhaps, but it is still a risk that is there. Perhaps not over this specific incident but the regulator does have the power to withdraw such licences.

Also Read: Are You A Stock Market Speculator Or Just A Gambler?

As Entain itself points out this settlement is about historic errors “Entain accepts that certain legacy systems and processes supporting the operations of its British business during 2019 and 2020 were not in line with the evolving regulatory expectations of the Commission” so in one sense we can think that it's all put to bed and that's the end of it.

However, that's not where we need to stop. The danger word here is “evolving”. Because we've seen this game before, regulators do change how they see the world. High interest credit (so, Amigo, Morses and of course Wonga) for example, the companies found that not only were they judged by the new standards on old business they essentially got regulated out of the market. That might be more than we think will happen to gambling but it is still that remote possibility that we should keep in mind.

We can also run Entain back the other way, for the American business is vastly more important as a source of growth than the UK. So UK regulatory actions aren't the be all and end all of the business. Which is true – but losing a licence in one country is likely to lead to problems with licences in others.

But to come back to current reality rather than dreams of possible futures. The Guardian says “Gambling giant Entain could lose UK licence after record £17m fine” which contains a number of errors. It's not a fine, for example. There's also nothing from the Commission which implies they're even thinking about the licence. It's therefore a very remote possibility and one that would depend upon current and future practices being like those of the past. You know, unlikely,