Key points:

- Cineworld shares are in a rut, down 40% this year

- The company's financial situation looks bleak

- But overall cinema demand provides a small ray of hope

Cineworld (LON: CINE) shares are in a significant rut. Down 40.5% this year and 69% in the last 12 months, it's been a terrible period for shareholders.

The fall was, of course, the result of the pandemic. However, it was its ambitious expansion plans and the debt accrued to fund that expansion that meant the company was affected more than most by Covid-related lockdowns.

Cineworld splashed out $3.6 billion on Regal Entertainment in 2017, funding the acquisition through debt facilities, although former dissenting Regal shareholders will be paid further.

Meanwhile, it also attempted to acquire Cineplex but now has to pay $940 million in damages after pulling out of the deal, something it cannot afford, and there is a risk it could go the way of Vue.

So, the signs for Cineworld, financially, are not good…

However, as we alluded to in the title, there is a small ray of hope for the struggling cinema chain.

Cinema Demand

Post-pandemic, there was a jump in demand as people rushed outdoors and then in, to restaurants, gyms, and cinemas.

In its preliminary results for the period ending December 31, 2021, Cineworld reported admissions jumped by 75%. That was before the complete removal of restrictions in 2022 and ahead of blockbuster releases such as Top Gun: Maverick.

Meanwhile, Statista data shows cinemas in the US and Canada sold roughly 492.2 million tickets in 2021, up from less than 222 million tickets in 2020. However, the 2021 figure accounts for just 40% of the almost 1.23 billion tickets sold in 2019, before the pandemic.

But we are now post, post-pandemic, and cinema demand is continuing to improve.

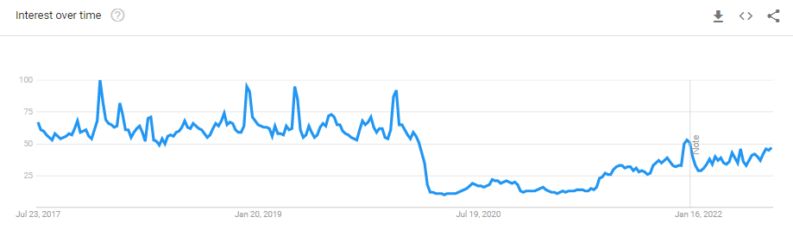

While not yet at pre-pandemic levels, Google Trends shows worldwide cinema searches are climbing since their pandemic plunge. At the same time, Cineworld’s UK website traffic is also close to pre-pandemic levels, hitting around 4.3 million per month on average, according to Semrush.

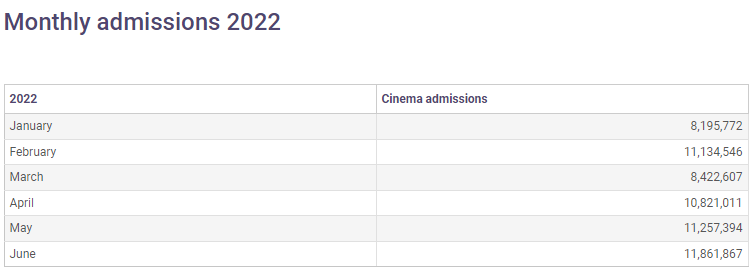

UK Cinema Association data shows admissions grew from 8.1 million in January to 11.8 million in June. In comparison, January 2019 admissions were 13.7 million, and June 2019 admissions were 13.9 million, so there is still some catching up to do.

Furthermore, a recent note from Morgan Stanley analysts states that they expect the North American box office to grow to 85% of 2019 levels in 2023, with the film business continuing to recover.

“Consumers are returning to theaters: Beginning in late '21, the N. American box office has been trending steadily upward as consumers have become more comfortable with going to theaters,” Morgan Stanley said in the note.

Bottom Line

Yes, demand data is moving positively, but Cineworld’s financial troubles cannot be ignored, and the challenges that lie ahead make it extremely tough to be bullish at this time. Nevertheless, despite my own previous pessimism about the cinema sector overall, demand is improving. Whether it will be able to hit and sustain its pre-pandemic numbers in the long run, is something we will have to watch for over the next few months.