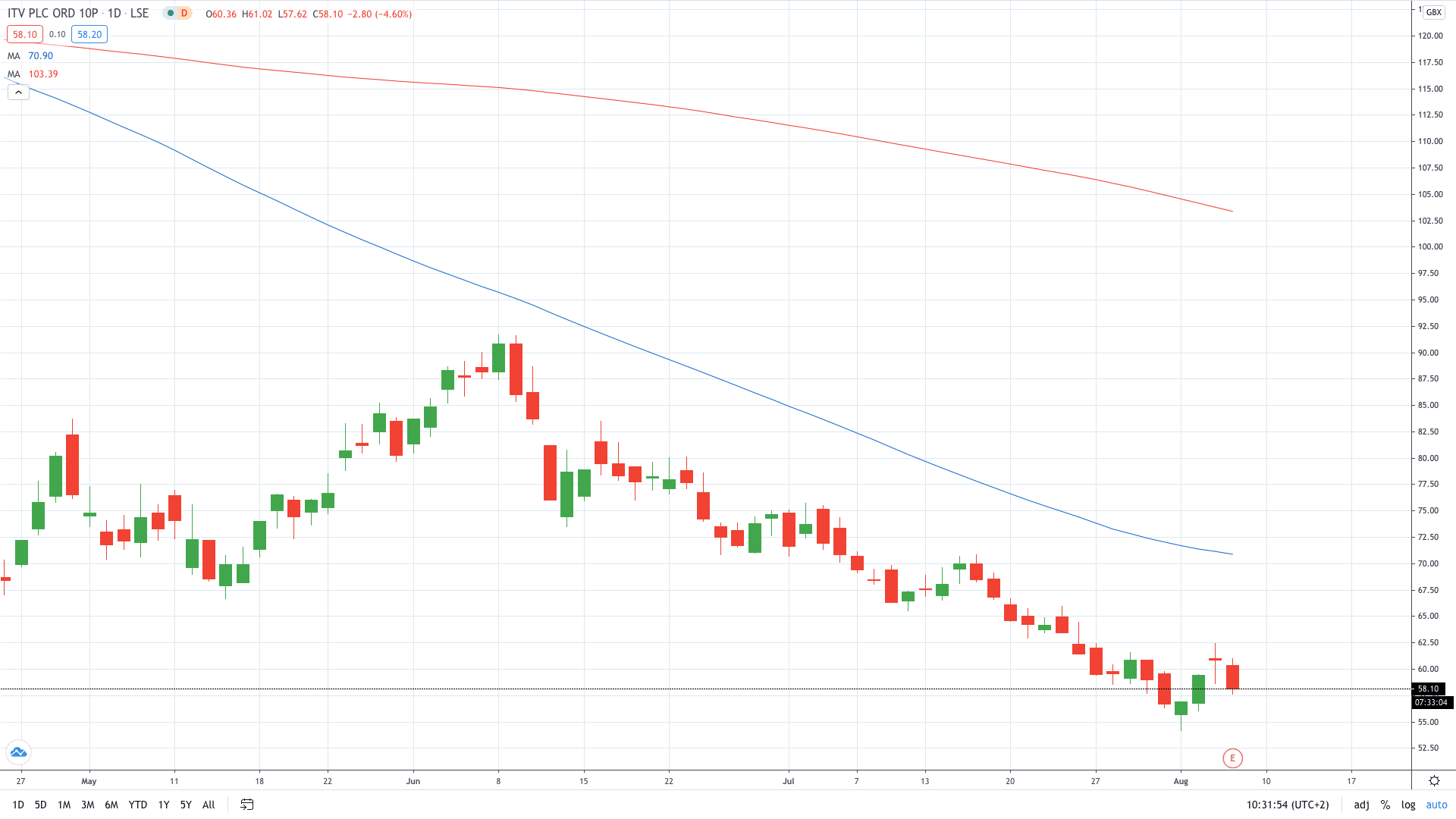

Shares of ITV PLC (LON: ITV) tumbled 5% after the media firm posted a 50% decline in adjusted earnings (EBITDA) to £165 million. The falling profit came as a result of a contraction in revenue by 17% to £1.21 billion

The FTSE 100 firm blamed a “significant decline in the demand for advertising” during the pandemic and lockdown for a plunge in profits. The ad revenue plunged 21%, partially offset by a jump in online viewing by 13%.

However, ITV says it noted an uptick in demand for advertising as its production restarted following the lockdown easing.

“This has been one of the most challenging times in the history of ITV…,” said chief executive Carolyn McCall in a statement.

“The future is still uncertain due to the pandemic but the action we have taken to manage and mitigate the impact of [coronavirus] puts us in a good position to continue to invest in our strategy of transforming ITV into a digitally led media and entertainment company”, McCall added.

ITV share price closed 2.5% higher yesterday after Deutsche Bank upgraded its stock to “buy” from “hold” and hiked the stock target price to 120p from 80p.

- Read more about why Deutsche Bank upgraded ITV stock yesterday

- Learn stock trading strategies

- Learn from experts on risk management in trading