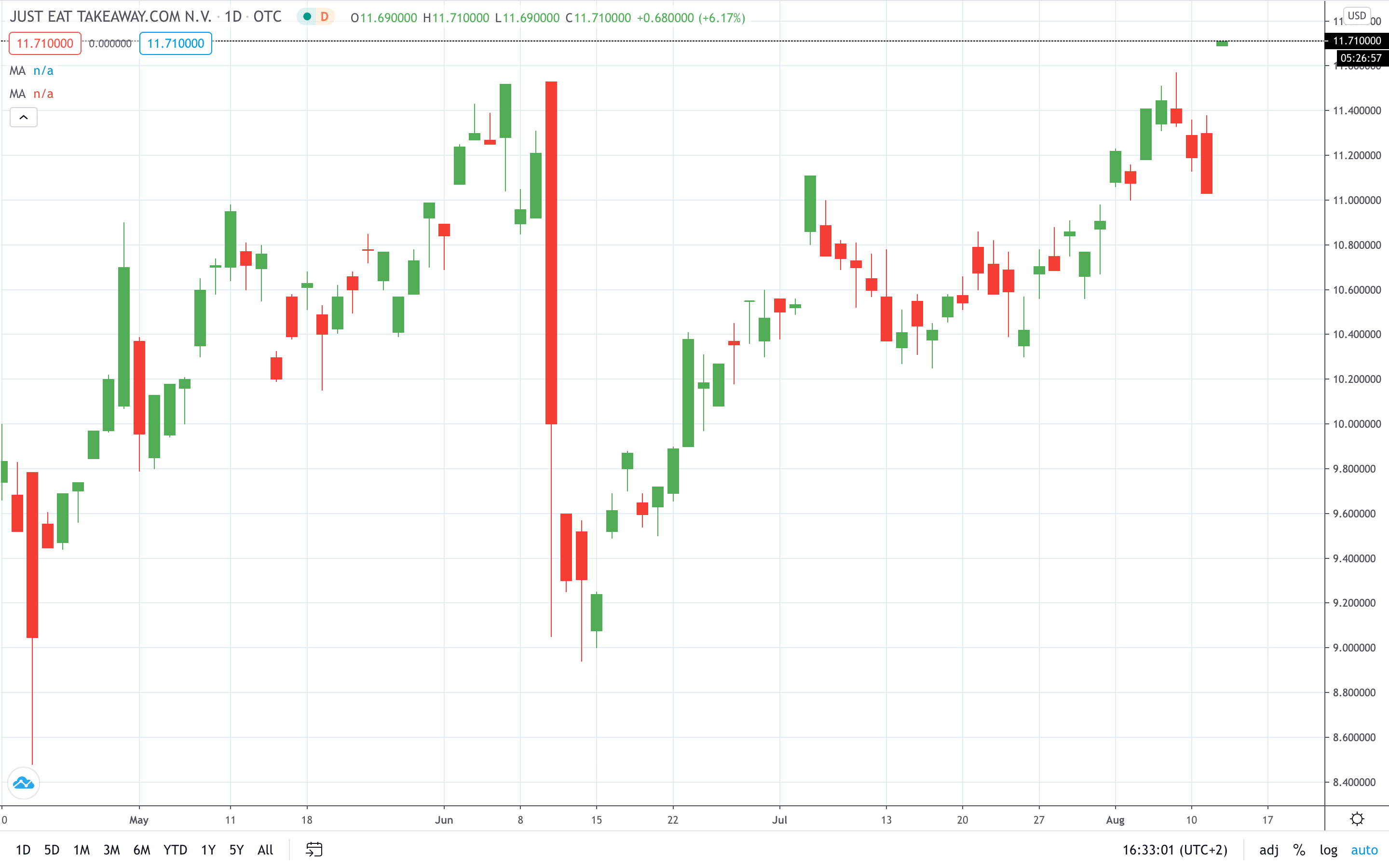

Shares of Just Eat Takeaway.com NV (AMS: TKWY) gained 6% today after the provider of online food order and delivery services posted strong first-half results.

Just Eat Takeaway, created recently through the merger of Just Eat and Takeaway.com, reported adjusted profits of 177 million euros, higher than 76 million euros in 2019. Food delivery orders rose to 257 million, an increase of 32% on a year-to-year basis.

Similarly, revenue jumped by 44% to 1.03 billion euros from 715 million a year earlier. Growing revenue and profits come as a result of an extremely strong performance in the largest European markets. For instance, sales in Germany, the largest market for the company, rose more than 100%.

“Just Eat Takeaway.com is in the fortunate position to benefit from continuing tailwinds. We are convinced that our order growth will remain strong for the remainder of the year,” Chief Executive Officer Jitse Groen said in a statement.

Two months ago, Just Eat Takeaway acquired Grubhub in a $7.3 billion all-stock deal.

Just Eat Takeaway share price jumped 6% to print a fresh record high at 102.46.

- Read more about why Just Eat Takeaway share price gained in July