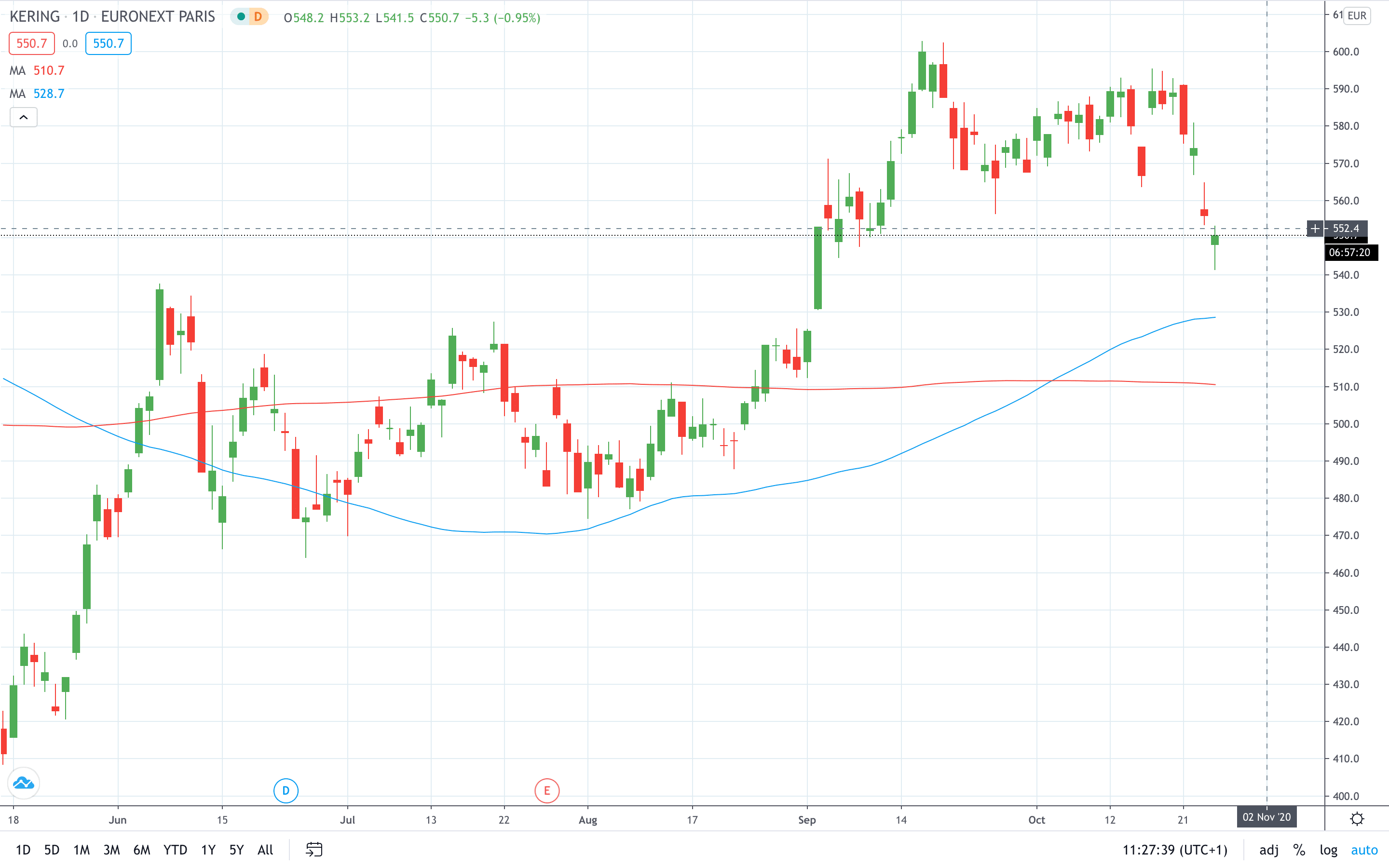

Shares of Kering (EPA: KER) have lost about 6% in two trading days after the luxury fashion group reported lower-than-expected sales for its main Gucci brand.

Kering reported that like-for-like sales fell 1.2% in the third quarter, much better than 8-13% fall expected earlier. The coronavirus-fueled lockdowns resulted in a 44% tumble in the second-quarter sales for Kering.

Similar to LVMH, Kering said that it witnessed a strong demand for its luxury products in Asia and United States. Still, investors were disappointed that sales of Gucci fell 8.9% in the quarter. Gucci generated about 60% of revenue for Kering.

“Gucci has perhaps suffered more than others from the lack of tourist flows,” Kering’s CFO, Jean-Marc Duplaix said.

“The key question for Kering is how fast and effectively Gucci will be able to renew itself,” commented Bernstein’s analyst Luca Solca.

Kering share price initially closed 3.15% in the red on Friday to extend weekly losses to 5.67%. This morning, shares of Kering made another step down by gapping 2% lower to print an 8-week low at 541.5.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here’s Why Just Eat Takeaway Share Price Just Soared to Fresh Record Highs

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan