- ‘Insurtech’ IPO Lemonade Inc (NASDAQ:LMND) launched Thursday and left its listing price far behind it in just the first session of trading.

- Nasdaq-listed LMND sold 11 million shares at $29, but just hours later the market had priced that same stock at $69.41.

- A long-held criticism is that investment bankers appear to be taking advantage of the start-up entrepreneurs and under-pricing the stock, so their institutional clients get a free lunch at time of launch.

- The awkward three-way relationship between, founders, bankers and investors still functions though because everyone gets a piece of the pie.

- In current market conditions, there are also opportunities for smaller, retail traders to scoop up some profits for themselves.

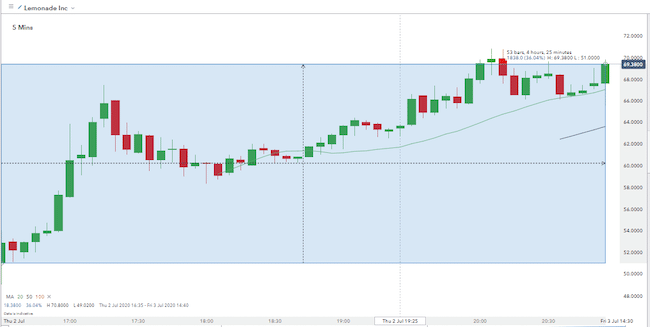

Soft-bank backed ‘insurtech’ firm Lemonade’s share price has had a blistering first day. A total of 11 million shares were listed at an initial price of $29. As they were released into the market at the opening-bell, they were trading at $52.98 They then went on to post a daily high of $70.8 and closed at $69.41.

The excitement around IPOs stems from the fresh ideas they represent, but also the opportunities to make substantial profits. As long as traders weren’t shorting against the tide, it was hard to not make money.

Lemonade Inc Share Price — 2nd July 2020

Trading is a zero-sum game, for every winner there’s a loser and identifying who that is helps understand why a strategy works. It was therefore rather embarrassing for the Lead Manager valuation teams at the IPO’s listing banks that the Lemonade share price more than doubled during the first day of trading. The bank’s first and foremost task is indeed to ‘get it away’ to a good start. A small initial premium is market standard, to ensure the price charts show upward trajectories from day one. But a doubling of value is frankly a bit awkward.

The great and the good of Wall Street were involved in pricing the firm and calling their big-money clients in the build-up to the market launch. The lead managers of the offering were Goldman Sachs & Co. LLC, Morgan Stanley & Co. LLC and Allen & Company LLC. Barclays Capital Inc. was a bookrunner. JMP Securities LLC, Oppenheimer & Co. Inc., William Blair & Company, L.L.C. and LionTree Advisors LLC took part as co-managers. Did they get the price wrong or just do a very good job of generating a buzz about the stock? It looks like a case of a bit of both.

It’s also hard to gauge market sentiment. The buying pressure has been put down to two fundamental factors. Both of which outline why those monitoring the Lemonade share price may still be a reason to get on board.

Not since the 1950s has the insurance industry suffered the challenge of such a dynamic insurgent competitor. With the Nasdaq at all-time highs, just mentioning the word ‘disruptor’ catches the attention of investors. Particularly when the ‘disrupting’ is in a sector that is quite frankly in need of it.

The second plus point for the Lemonade share price is the way it’s going about changing the insurance sector. The firm has a strong focus on Millennials. It takes a fee on each policy it sells, then donates to charity any reserves not used for claims.

The firm raised $2bn in off-market private placements last year. The valuation put on the firm by that deal was far lower than the current one. While the founders may be smarting slightly at yesterday’s intra-day surge. Any feeling they sold out too cheaply will at least now be compensated by the fact that buyers and sellers have given a clearer indication of the market price. Of course, the mood in the Lemonade board room will be helped by the fact that there are always more shares to release into the market — particularly at such heady prices.

Risk factors

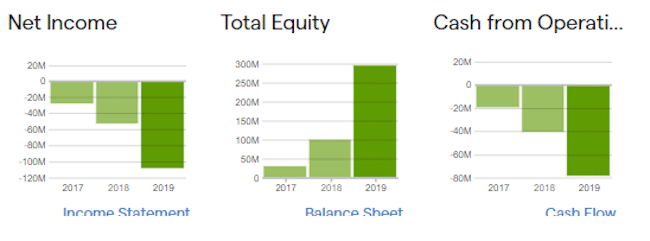

There is also a need to consider the fact that the firm doesn’t actually make a profit. Not just that, but sales are in the tens of millions range and improving healthily rather than exponentially.

Lemonade Inc Fundamentals

The $3bn valuation is of a firm, which reported $67 million in revenue last year with a loss of $108.5 million, compared to $22.5 million in revenue and a loss of $53 million in 2018. Wall Street is well up to speed in terms of snapping up shares in loss-making firms. It’s not even a post-Covid ‘new normal’, it’s been going on for years and is very much part of the ‘old normal’.

The darkest cloud over the Lemonade share price is the suggestion that it might not actually be that much ‘tech’. Industry site Insurance Nerds covered the thoughts of Nick Lamparelli, who wrote:

“It’s still just an insurance company with a fancy website. I can buy insurance from other insurance companies where I can choose from dealing with their website, walking into an agent’s office or calling them over the phone. They’ve eliminated 2 options from me, and given me a sole option that is little different from what I could have had before.”

Source: Insurance Nerds

The WeWork IPO of last year was derailed by a dawning realisation that the management team might be a little too off-beat and that no matter how hard you try, office rentals aren’t ever really going to be ‘tech’.

Bad valuations can lead to good trading opportunities

Efforts to excuse the massive mispricing can refer to the current market conditions and the tech bubble, but the staff performing the task are well remunerated and never turn down the plaudits when they get it right. Venture capitalist Bill Gurley of Benchmark tweeted his thoughts on the situation:

“Pretty amazing that there is a financial exercise on this planet involving hundreds of millions of dollars where its OK to not even get to 50% of the actual end result. The process is so rigged/broken at this point. They missed by more than the original guess.”

Source: Twitter

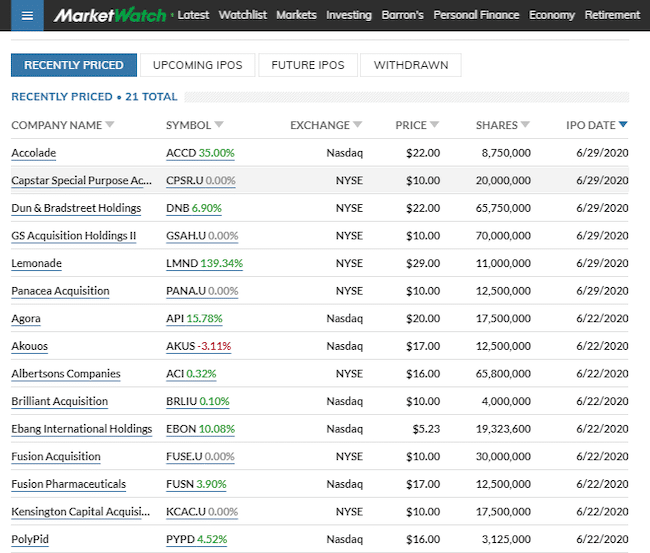

Last week, Chinese cloud software developer Agora, was also massively priced and the Nasdaq-listed Agora share price surged 150% in its first day of trading as well.

Taking the Lemonade Inc share price as an example, there are also opportunities for retail traders to profit from the IPO bonanza.

A long position at the opening price would have generated an eye-watering one-day return of 36.04%.

Lemonade Inc Share Price — 2nd July 2020

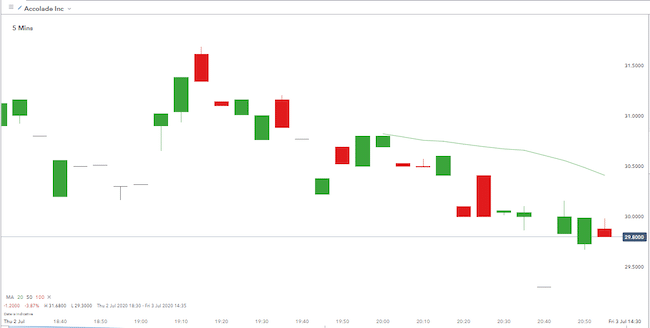

Not all of the IPOs are putting on such phenomenal first-day displays. Also listing yesterday was Accolade Inc., which should be a prime target for investors given its business model is personalised health and benefits solutions — something of a hot topic during the coronavirus outbreak.

Accolade Inc. priced its initial public offering of 10 million shares at $22 per share, raising $220m.

Accolade Inc Share Price — 2nd July 2020

Unlike Lemonade Inc., the Accolade share price offered fewer opportunities for investors to get into positions at the opening bell and enjoy the ride up. Reflecting these thoughts, Glenn Solomon, a partner at venture firm GGV Capital (which is an investor in Agora), explained the difficulties facing the market:

“At a macro level, you have an enormous amount of optimism about the future of technology. At a micro level, it’s a challenge. You have bankers trying to price offerings based on some reasonable valuation multiple while the market is paying up for new names and growth.”

Source: CNBC

The win-loss ratio appears skewed towards the bulls. Buying and holding is one approach, scalping first-day euphoria is another. With such large percentage point, the returns on offer means traders are also able to scale back on position size and just ‘toss on a position’. Making money doesn’t have to be difficult. The good news for those focussing on IPOs is that the already healthy pipeline will likely grow following the headline-grabbing launches of Agora and Lemonade. Fortunately, the MarketWatch calendar of upcoming launches captures the names of all the potential targets.

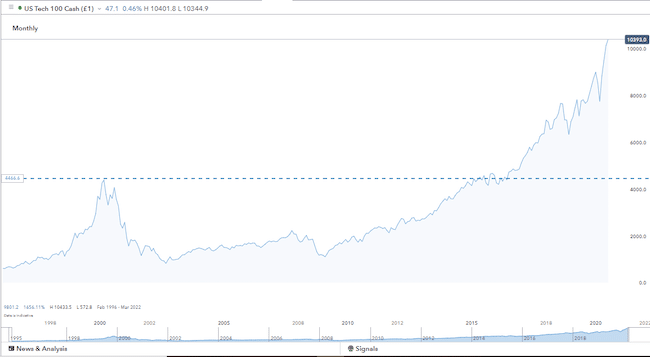

If this is triggering distant memories, the last time that the ‘just buy it’ strategy was so effective was 1999 — the period before the dot-com crash. The subsequent 81% fall in value of that index (and the share prices that form it) was a slump, which the Nasdaq took 14 years to recover from.

Nasdaq – price chart 1995–2020

The Lemonade share price is challenged by more than broad market risk. Time will tell if the Lemonade founders, not shareholders, may ultimately prove to be the real winners from the situation. As Lamparelli wrote.

“Are they truly in it for the customer, do they really want to revolutionize the business model or is the exit strategy already in place.”

Source: Insurance Nerds