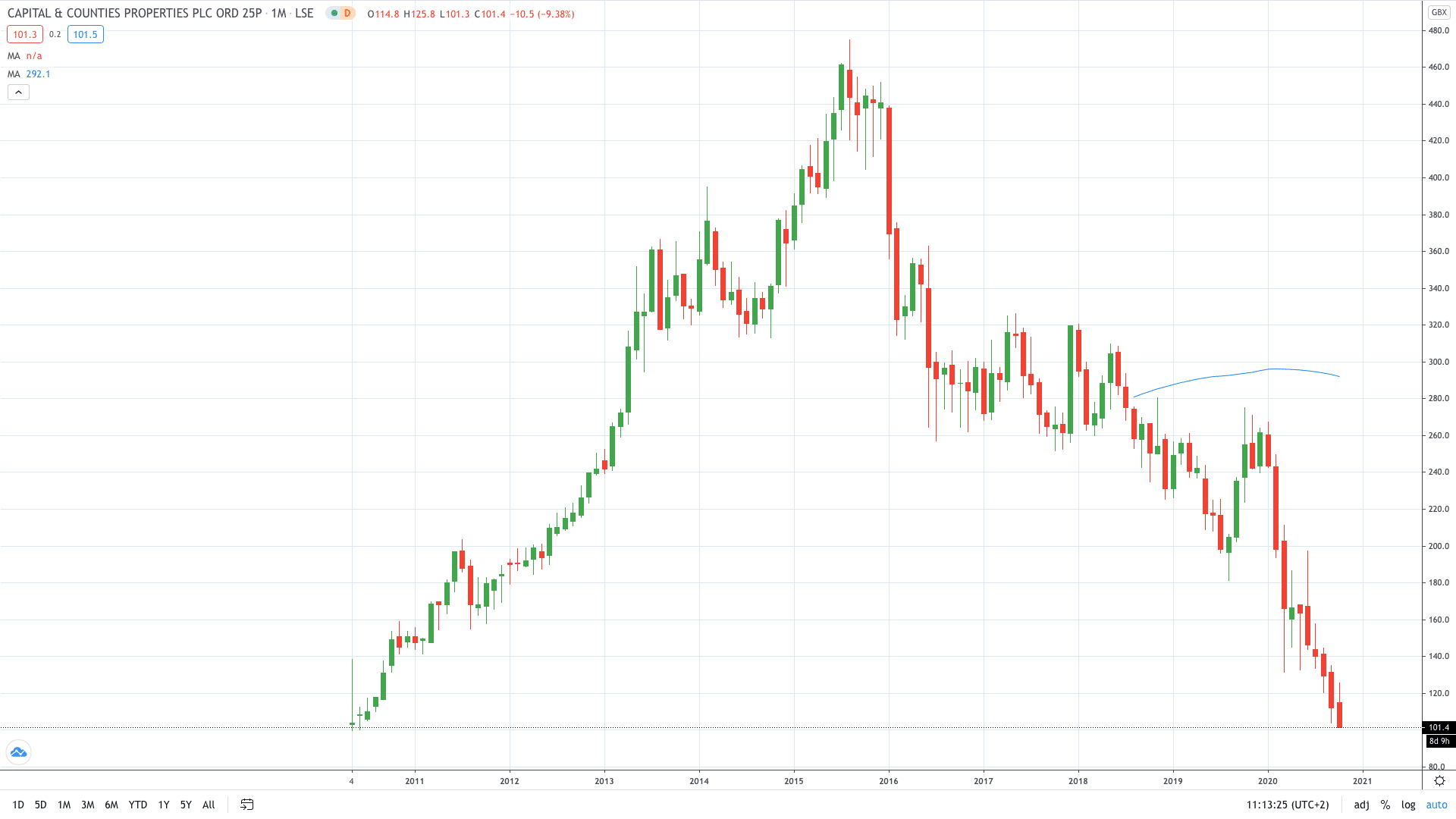

Shares of Capital & Counties PLC (LON: CAPC) fell over 10% on Thursday after two major banks downgraded the stock and its price target.

The property investment and development firm focused on London’s West End saw its stock downgraded to “Underperform” by Bank of America and price target slashed from 140p to 100p.

Moreover, the fellow U.S. investment bank Jefferies cut the price objective on CAPC to 130p from 165p while maintaining its “Neutral” rating on the stock.

Two downgrades come just a day before popular “Capco” announced it increased its stake in Shaftesbury by £65 million. The company now owns more than 25% of the London-focused real estate investor.

“The Board believes that the Investment is priced attractively in view of the long-term prospects and resilience of prime central London and is consistent with Capco’s strategy to invest in attractive opportunities on or near the Covent Garden estate,” the company said in a statement.

Capco recently sold the Wellington block, a freehold island site on the south-east corner of Covent Garden, for £76.5 million.

Capital & Counties share price fell over 10% to hit 101.3p, which is the lowest the stock traded since 2010 and close to 99.6p – an all-time low for CAPC.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here’s Why Just Eat Takeaway Share Price Just Soared to Fresh Record Highs

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan