Shares of Daimler AG (ETR: DAI) soared more than 5% today after the carmaker reported better-than-expected third-quarter results.

Daimler Group reported EBIT of €3.07 billion, smashing the market consensus of €1.95 billion. On an adjusted basis, EBIT came in at €3.48 billion vs €2.50 consensus.

“The third quarter shows a very strong performance and provides further proof that we are on the right path to reducing the break-even of our company.

“This gives us confidence to push ahead with our work both on the strategic and operational side of the business. We expect positive momentum to continue in the fourth quarter, however with the regular year-end seasonality,” said Harald Wilhelm, Member of the Board of Management of Daimler AG.

The most positive aspect of the 3Q report is a free cash flow, which was reported at €5.14 billion, again comfortably higher than analysts’ expectations of € 2,97 billion.

“Free cashflow beat is a solid surprise,” Philippe Houchois, an analyst at Jefferies, said in a note.

Following this morning’s report, J.P. Morgan’s analyst Jose Asumendi maintained a ‘Buy’ rating on Daimler on Thursday, with a price target of €63.00 per share.

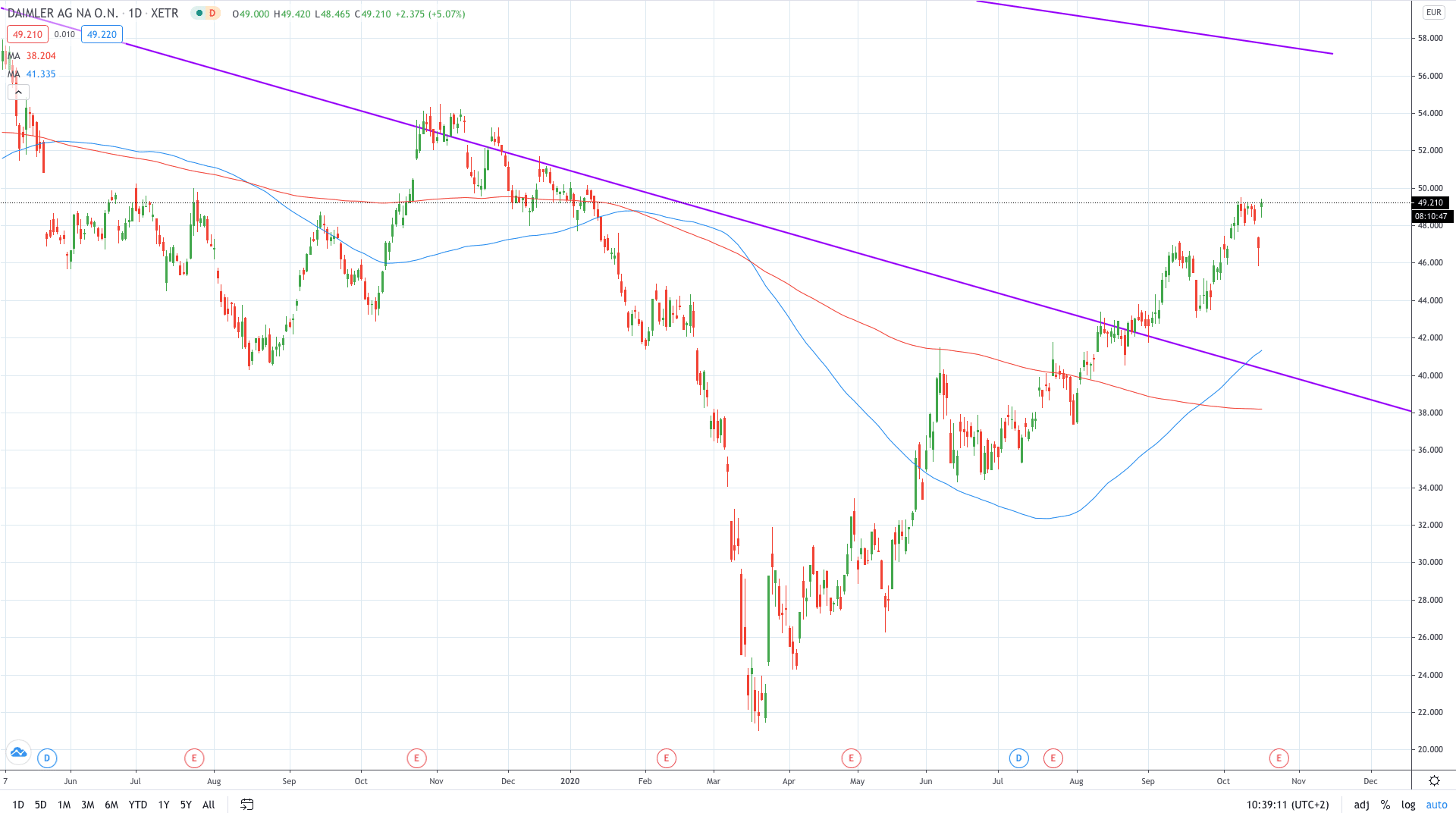

Daimler share price now trades at €49.21, up 5.07% on the day. A move above €50.31 would mark a new 2020 high.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here’s Why Just Eat Takeaway Share Price Just Soared to Fresh Record Highs

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan