Oil is moving higher today, +1.6%, as Turkey starts the attack against Syria. I call that geopolitical escalations and oil should trade higher as this narrative gains focus.

The last Saudi Aramco drone attack has been “washed out” by now, so oil trades “cleaner” here than 10 days ago where the washing out of positions was still in motion post the big spike and the subsequent fall in oil.

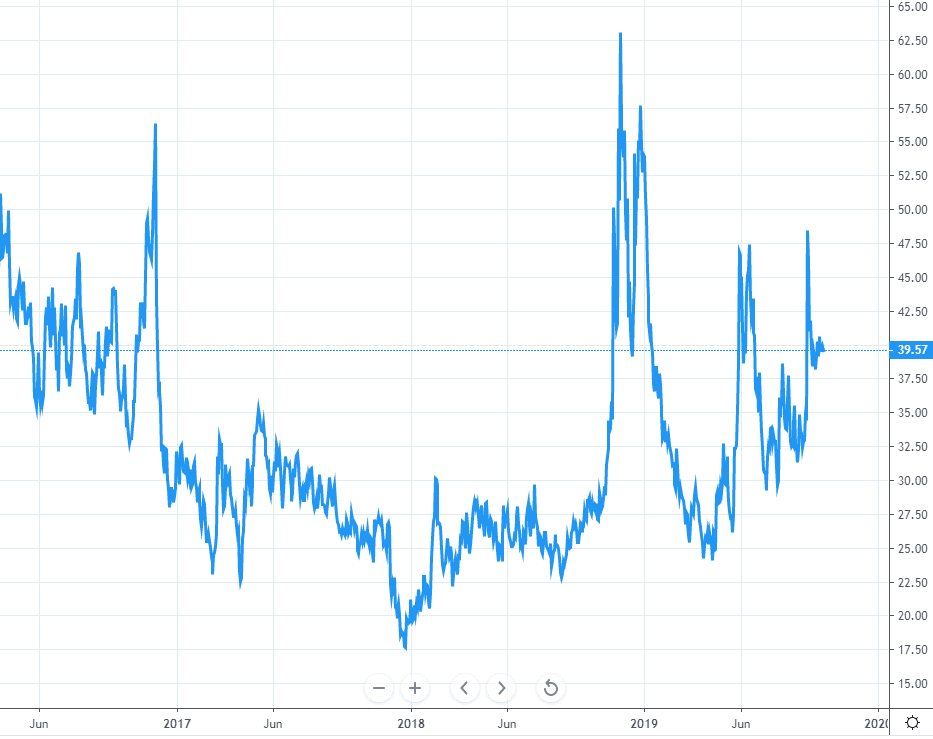

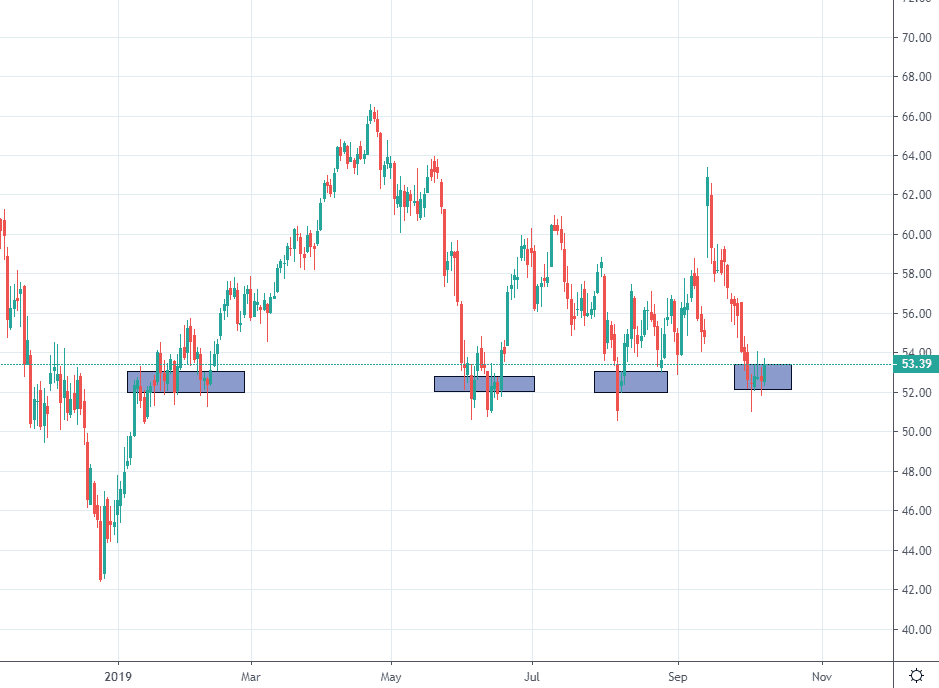

Oil is putting in the first positive candle today in a long time, bouncing right on the support levels. This area has acted as big support many times before and I stick with my long oil call here.

Energy ETF, XLE, follows oil of course, but has traded very muted. If you want some equity related oil exposure, look at the XLE, but for the pure play I stay with oil. XLE is also down to big support levels, but is heavier.

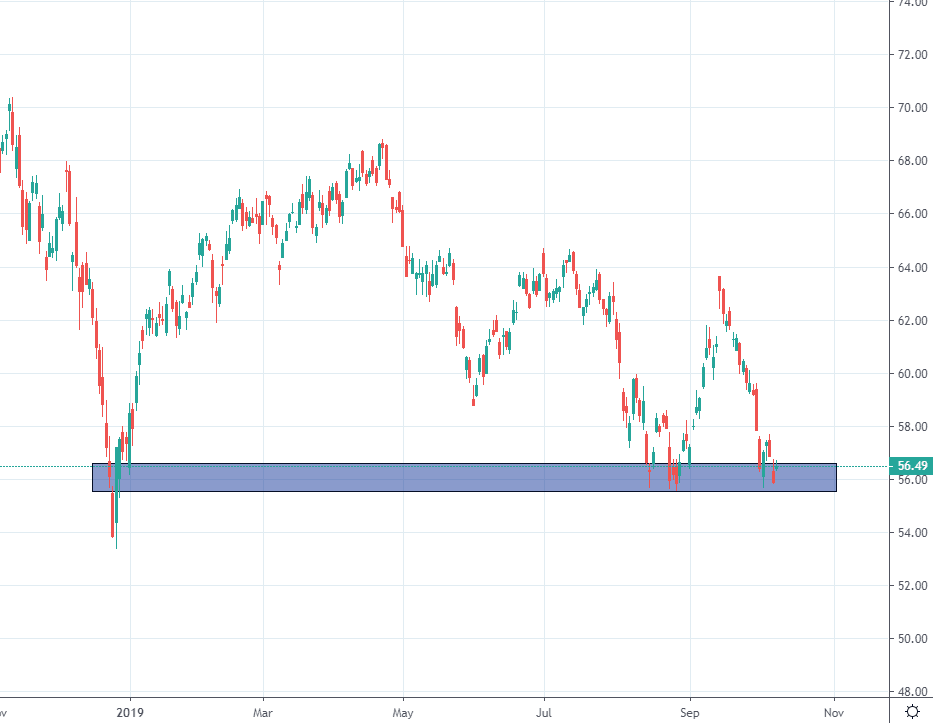

Oil volatility, OIV, is offering interesting options play here. OIV is rather elevated, and has stayed elevated post the Aramco attacks. The huge moves we saw on the back of those attacks managed stirring positions around. These types of volatility shocks tend to take time before they are “out of the system”.

What is interesting here is to play a positive view in oil via net selling of oil volatility. Depending on your view, interesting options plays would be selling put spreads or buying outright long oil and selling relatively expensive calls against the longs, entering into a covered call.

Options risks where you end up selling net premium must be monitored well, but pay offs are often good, especially if your view takes time to develop. I do not believe oil will spike massively asap, but support area should hold this time, and oil should continue the bounce higher.