- Phase one of the US-China trade deal is reported to be ‘totally done’.

- Friday’s news is met with a muted market reaction.

- The deal is in line with market expectations, but the small print of the agreement leaves room for future conflict between the two economic giants.

The fact that US trade representative Robert Lighthizer has over the weekend been insisting that the phase one US-China trade deal is “totally done” raises the question, why was he being asked that question in the first place? (source: CNBC)

The detail of the agreement announced on Friday contains some very loose terms — a first glance leaves room for analysts to think it is half-baked. A more granular analysis shows that terms and conditions are indeed in place but often set as variable rather than fixed. After the days and weeks of horse-trading, it is the US concessions that are detailed in black and white, whereas Chinese concession are ‘in principle’ and ‘to be confirmed’.

The agreement’s first intervention was that the US held off raising tariffs on Chinese goods on Sunday 15th, and Beijing did not implement the retaliatory tariffs it had lined up. This shows a willingness of both sides to demonstrate the progress being made and trust established because the agreement is not yet officially signed off. That part of the process is pencilled in for the first half of January.

It would appear highly likely that both teams may try and take advantage of that time-extension to finesses some of the clauses. The more that phase one looks like a standard trade agreement, the better its chances of holding up to the pressures, which will undoubtedly be placed upon it in the future.

The area that is under most scrutiny relates to the increased purchases of US agricultural products that China is expected to make. The total amount of purchases is seen by some to be unfeasibly high. There is also very little detail in terms of what will actually be bought and when. The part of the deal relating to the transfer of intellectual property was described by CNBC as remaining “murky”. The Chinese part of the agreement is more of a ‘living document’ — in that offers Beijing a framework to use to meet its part of the bargain. Lighthizer said:

“If the hardliners are making the decisions, we’re going to get one outcome. If the reformers are making the decisions, which is what we hope, then we’re going to get another outcome.”

Source: CNBC

The concessions that the US team made are more tangible. The Office of the US Trade Representative said in a statement that the US would reduce tariffs on $120bn in products to 7.5% from 15%. This reduction is set to take effect 30 days after the agreement is officially signed.

“We have a list that will go manufacturing, agriculture, services, energy and the like. There’ll be a total for each one of those… Overall, it’s a minimum of 200 billion dollars. Keep in mind, by the second year, we will just about double exports of goods to China, if this agreement is in place. Double exports.”

Source: CNBC

At the same time, the US will keep the 25% tariffs on $250bn of Chinese goods, along with 7.5% duties on another $120bn of Chinese imports. Both of these tariffs are set to be addressed at a later date.

Market reaction

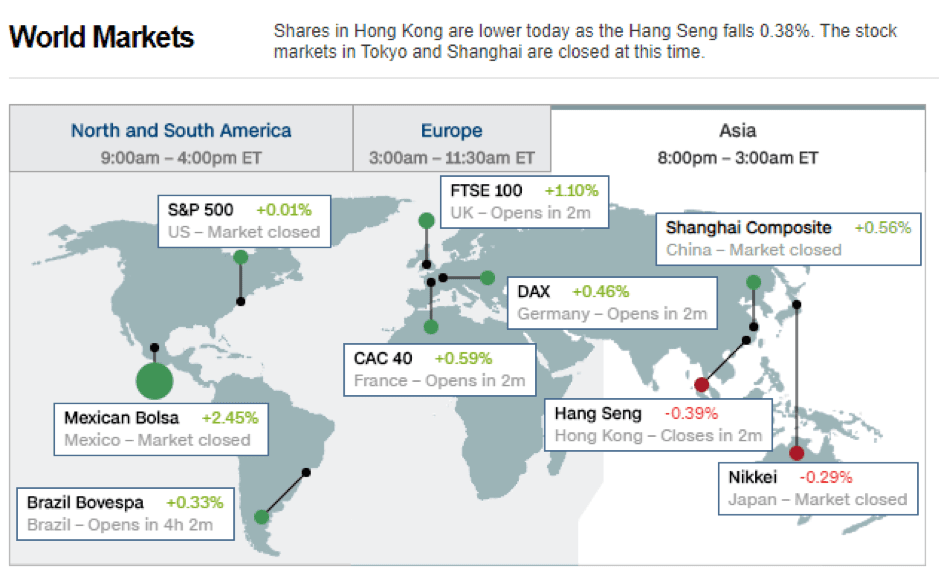

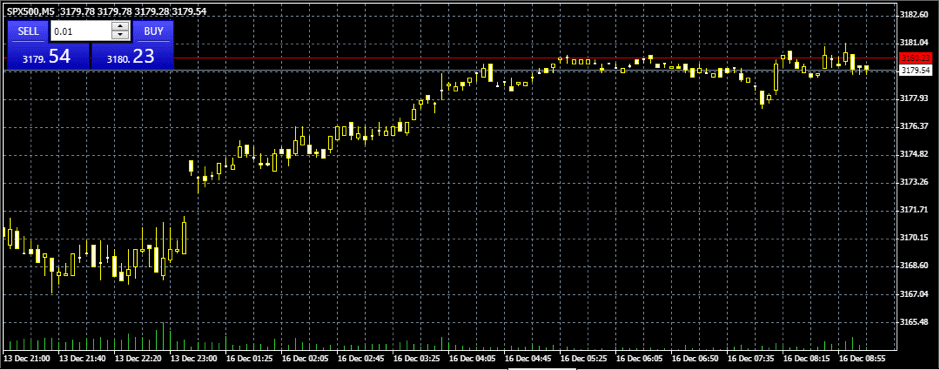

The markets have had a muted reaction to the news. The feeling is that the news may already have been priced in. The S&P 500 futures offered a polite rather than resounding approval to the news. The move from 3,170 to 3,180 is relatively small in absolute terms and as the five-minute chart shows took a long time to materialise.

Japanese and Hong Kong stocks were slightly down during Monday’s early trading, while the Chinese composite’s positive return was attributed to positive domestic data. This could be a sign that the trade war may now play a secondary role to fundamental analysis.

SPX500 five-minute candle: 13th–16th December 2019:

Larry Hu, head of Greater China economics at Macquarie, released a note on Saturday, which explained the situation. He said:

“A phase-1 trade deal could prevent things from getting worse by cancelling the new tariff, but could not make things much better.”

Source: CNBC

Hu also picked up on the point that future market moves may be down to ‘real’ data rather than political soundbites. Hu added:

“The trade tensions have a greater impact on sentiment than economic growth, which is more reliant on other factors.”

Source: CNBC

Off to market

Chinese agricultural buying patterns look set to be key indicators for the foreseeable future. The country has historically taken advantage of its huge buying power to move markets to its advantage. Arable production has a timeline of months, so China has been able to analyse on a global scale, what crops are being grown where and has been able to time purchases to its own benefit. The threat of the biggest buyer walking away from the table is often enough to focus the minds of farmers.

Source: WOSU Radio

Giving up this buying power and committing in advance to buying X, Y and Z is a big ask. The terms of the agreement appear to be set to allow China to make up an amount of total purchases of US agricultural products but not according to any set formula. Demonstrating China’s willingness to comply with the spirit, as well as the letter of the agreement, the US Soybean Export Council reported:

“China has also been increasing its purchases of American soybeans this year, despite an overall expected decline in Chinese demand for the product.”

Source: CNBC

Robert Lighthizer told reporters that China would buy at least $16bn more US agricultural goods in each of 2020 and 2021. That means the targeted additional purchases total approximately $50bn in both years. Such a target will be hard to meet in practical terms. It also requires China to move 180 degrees from being the shrewdest buyer in the market to the one that all sellers can off-load to. Ting Lu, chief China economist at Nomura, released a note over the weekend, which said:

“That scale of purchases seems implausible and Chinese officials were reluctant to mention any specific target during their press conference.”

Source: CNBC