Shares of Rathbone Brothers (LON: RAT) are gaining on Thursday after the company reported a resilient 2020 performance.

The company’s CEO Paul Stocktonsaid it was an “immensely challenging year”, but they “continued to deliver a high-quality service to clients, whilst prioritising the safety and wellbeing of our employees, advancing our strategy and keeping a close eye on operating costs.”

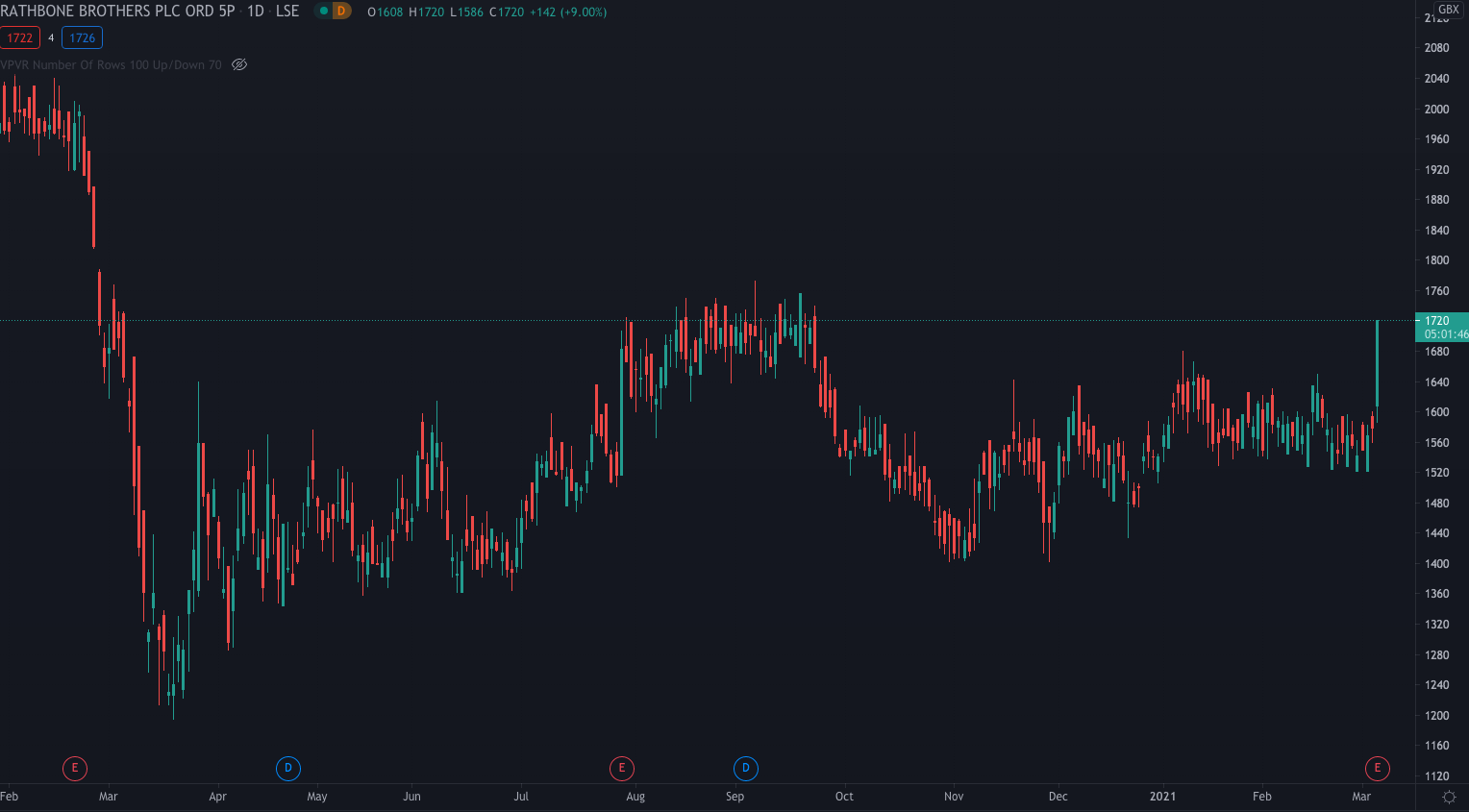

The wealth manager’s share price is up over 8% at 1710p at the time of writing.

Rathbone reported total funds under management and administration of £54.7 billion at the end of 2020, representing an 8.5% increase from 2019.

Total net inflows worth £2.1 billion compared to £600 million in 2019.

The company made a pre-tax profit of £43.8 million in 2020 compared to £39.7 million the previous year.

Finally, the board recommended a final dividend of 47p for 2020, making a total of 72p for the year and a 2.9% increase from 2019.

“Whilst we expect 2021 to remain volatile, our balance sheet is robust with a strong capital position,” said Stockton.

He continued, saying the “near-term focus is to execute our growth strategy, to build our market share, to balance ongoing investment in the business, and to continue to apply strict cost discipline. Rathbones will emerge stronger after the challenges of the pandemic begin to subside.”