Shares of Schneider Electric (EPA: SU) soared about 3.5% on Thursday after the French electrical giant upgraded the full-year forecast.

Schneider Electric said it now expects its revenue to fall between 5% and 7% for the full-year. This is better compared with a tumble of 7% – 10% it projected in July.

“The crisis has reinforced our customer’s agenda for sustainability and digitisation, both areas where Schneider has focused its strategy,” Chief Executive Officer Jean-Pascal Tricoire said in a statement.

The upgraded forecast came after the company posted third-quarter revenue of 6.46 billion euros ($7.65 billion), beating the market expectations of 6.03 billion euros. The reported figure is also 1.3% higher year-on-year.

The company witnessed a surge in demand in its residential business, as well as accelerating activities in industrial and commercial buildings.

As a result, Schneider also increased its full-year core profit margin target to above 15% (15.1% – 15.4%), from prior 14.5% – 15.0% previously. The electrical giant aims to hit a 17% profit margin by 2022.

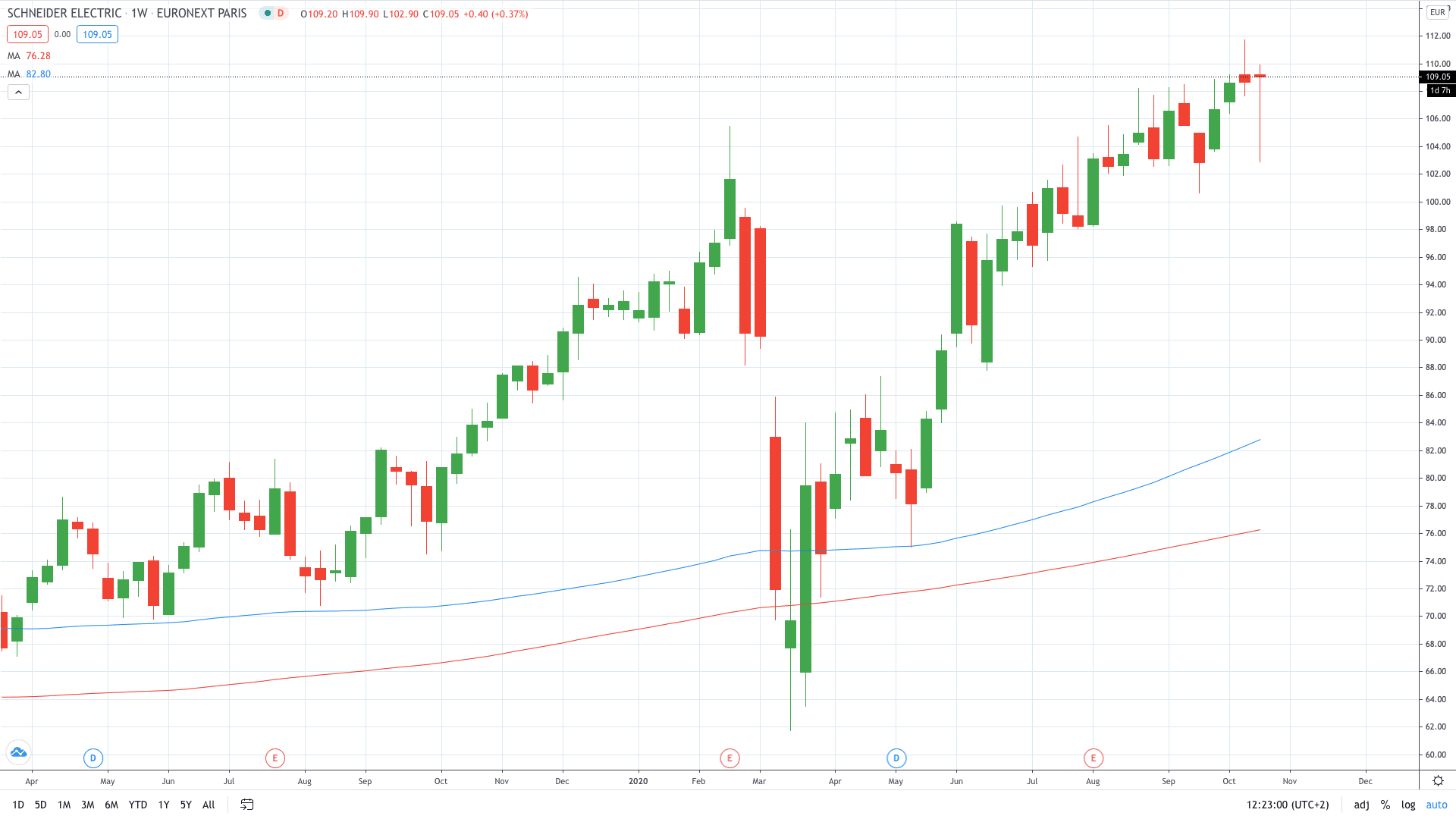

Schneider Electric share price rose around 3.5% to €109.80 and therefore turning positive on the week.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here’s Why Just Eat Takeaway Share Price Just Soared to Fresh Record Highs

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan