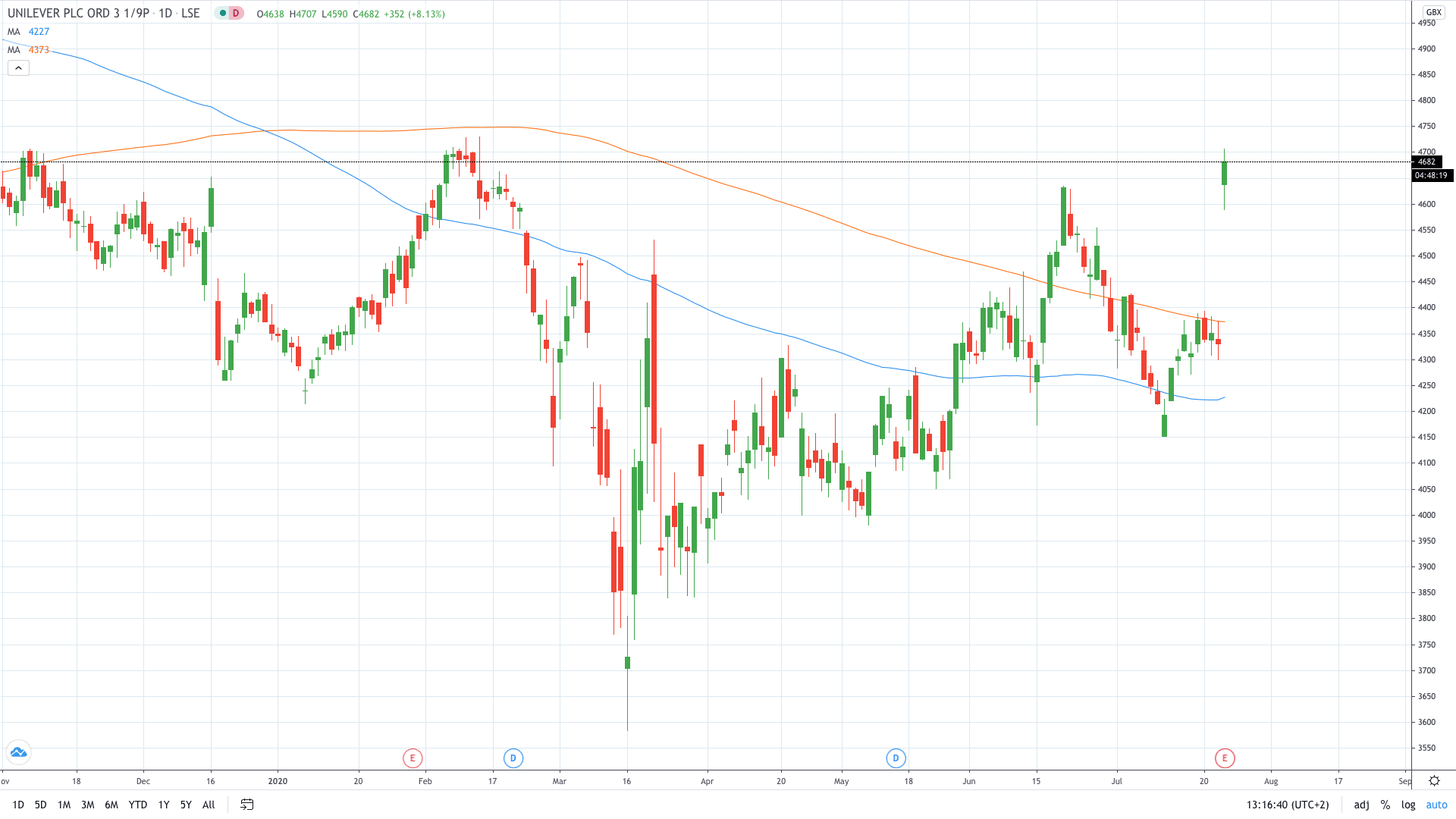

Shares of Unilever PLC (LON: ULVR) jumped more than 8% on Thursday after the Anglo-Dutch giant reported a surge in its net earnings by 10% in the first half of the year.

The food and cosmetics giant recorded 25.7 billion euros in sales, which is a decrease of 1.6% compared to the last year. Still, the net earnings rose by 10%. Unilever, the owner of brands such as Knorr, Magnum, Hellmann, and Dove, recorded strong sales in the United States, its biggest market.

Analysts expected a much sharper drop in sales for the April – June quarter due to the lockdown measures. However, Unilever said its sales dropped “only” 0.3% in this period while the market analysts expected a drop of 4.3%.

“Performance during the first half has shown the true strength of Unilever. We have demonstrated the resilience of the business – in our portfolio, in a continued step-up in operational excellence, and in our financial position – and we have unlocked new levels of agility in responding to unprecedented fluctuations in demand,” said Alan Jope, Unilever’s CEO.

The beauty and personal care business, Unilever’s largest, saw a plunge in the demand for cosmetic products. However, the pandemic facilitated strong sales of the skin-cleansing products, with sales rising 27% in this segment.

“Overall, Unilever's strong performance in the period and an increasingly focused strategy has led to a sigh of overdue relief from investors,” said Richard Hunter, head of markets at interactive investors.

Unilever share price jumped more than 8% to trade above 4700p for the first time since February this year.

- Start learning more about strategies for online stock trading

- Learn how to trade stocks