Shares of Vodafone PLC (LON: VOD) dipped 5% on Friday after the telecom giant reported a fall in revenue for the first quarter ending June 30.

Vodafone sales fell 1.3% as the pandemic caused less travelling and therefore, less revenue from roaming charges. Sales in the UK, Italy, and Spain were all reported as declining.

“Whilst we have seen the direct impact on our revenue from travel restrictions and business project delays, we have also seen increased usage in voice and data, alongside record NGN [next-generation network] broadband customer net additions in Europe,” said CEO Nick Read.

Vodafone confirmed it will ist its towers business – Vantage Towers – in Frankfurt. The initial public offering (IPO) is supposed to take place early next year. The telecom giant plans to retain a major stake in the company was listed.

“Vantage Towers will also unlock further value for shareholders, notably through the IPO targeted for early 2021,” explained Read.

The new company is expected to operate 68,000 towers across nine European cities.

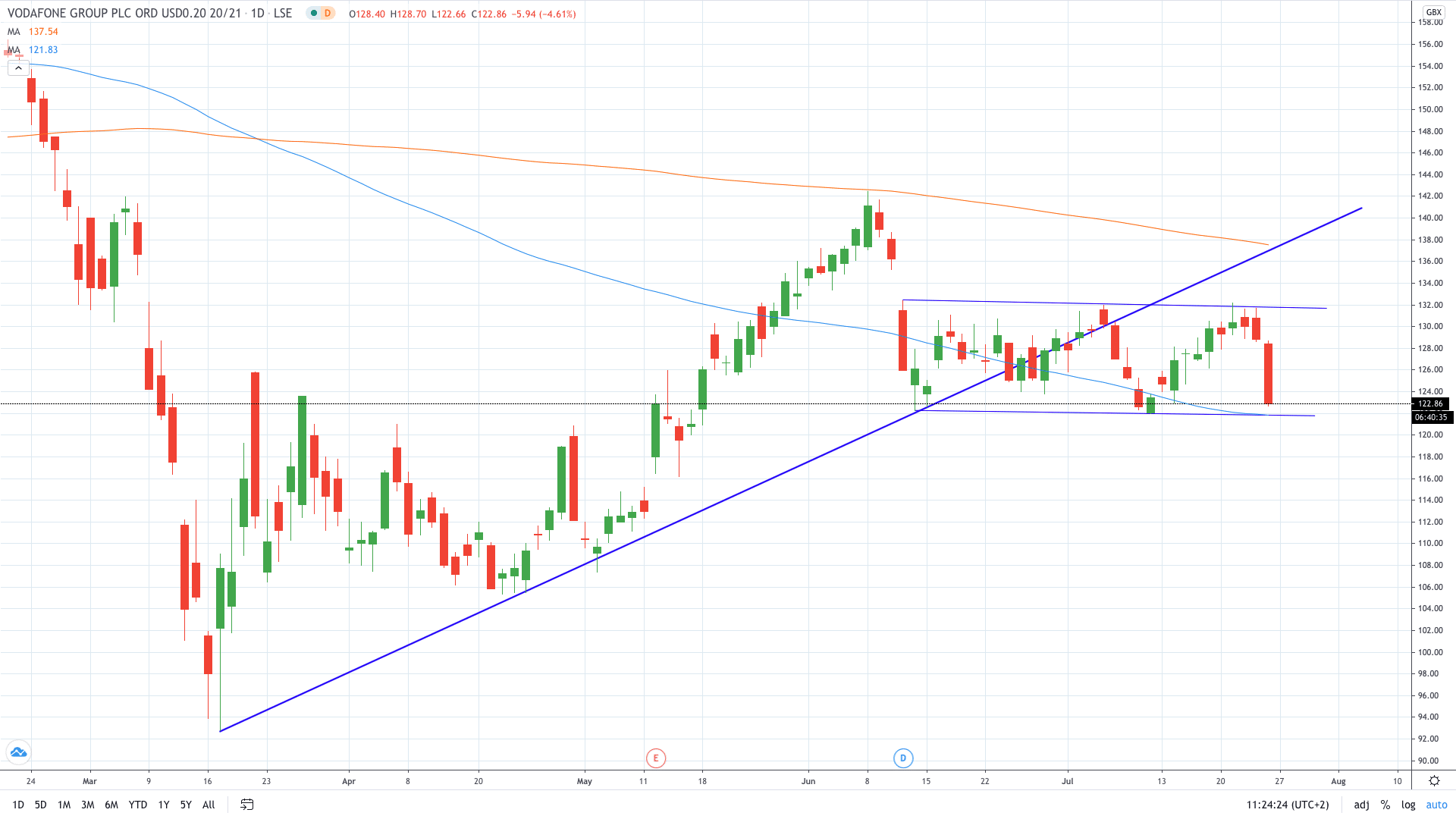

Vodafone share price plunged around 5% following the news. Shares are trading more than 15% lower this year as the sellers seek to set a fresh 2-month low below 122p.

- Read more about why Vodafone share price fell last week

- Start trading Vodafone stock with the best stock brokers

- Learn how to trade stocks