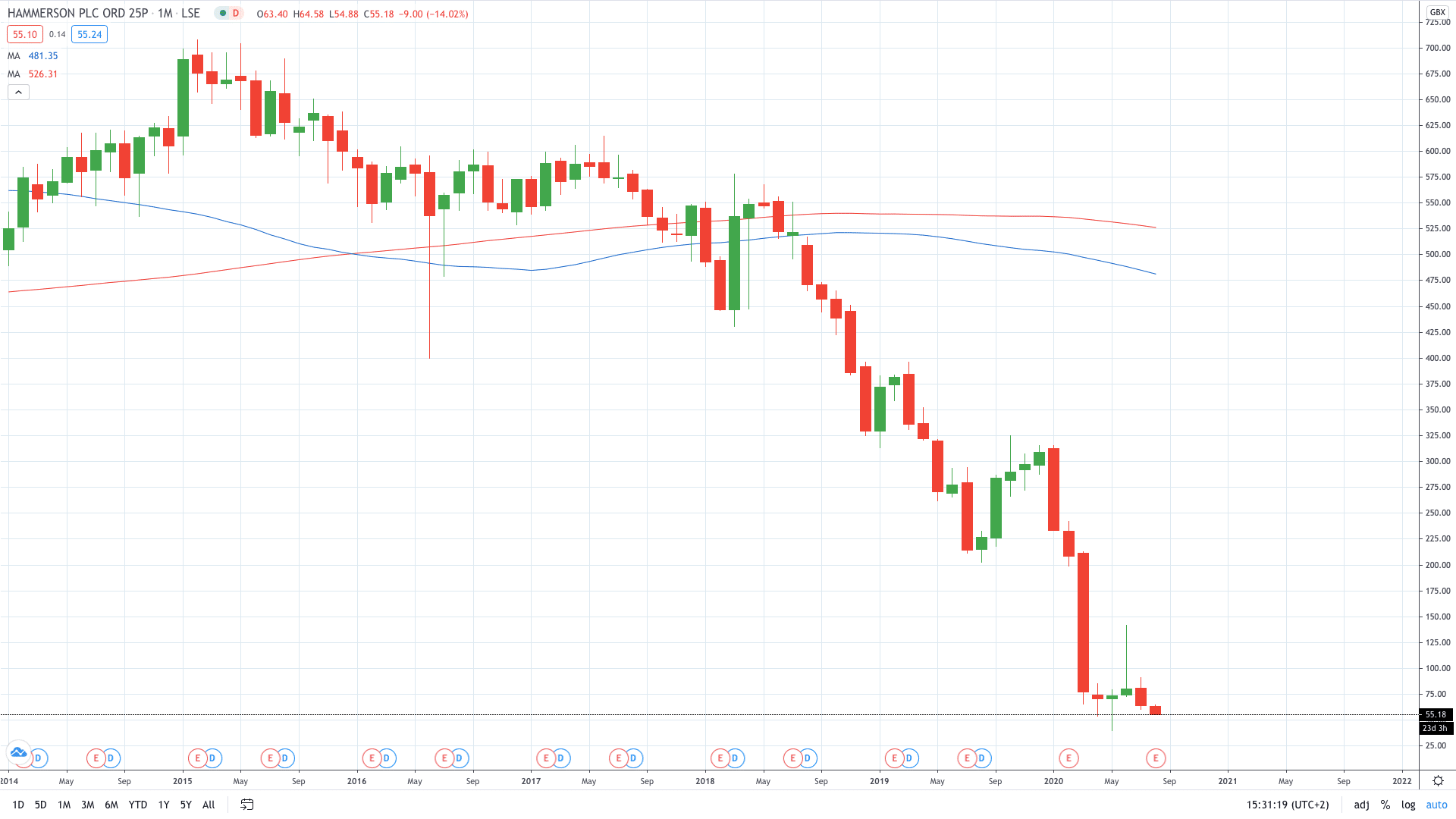

Shares of Hammerson PLC (LON: HMSO) lost a further 9% today as the stock now trades over 60% lower since the first week of June.

Investors have continued to aggressively sell Hammerson stock after the shopping-center operator opened talks to dispose of its interest in VIA Outlets and raise funds to boost its liquidity.

The Telegraph reported that hedge funds, such as Marshall Wace and Capeview Capital, earned millions of pounds on short-selling Hammerson stock.

The owner of the Bullring and Brent Cross shopping centres has struggled to cope with the consequences of lockdown measures. Hammerson has been approved 300 million pounds from the Covid Corporate Finance Facility support program provided by the Bank of England.

Moreover, the firm is seeking to raise over 500 million pounds from its shareholders to enhance its balance sheet.

Hammerson share price plunged around 9% today to trade below 55p, the lowest since mid-May. Over 60% of the market cap has been wiped off in the past two months on a struggle with high debts.

- Read more about why Hammerson share price fell 13% on Monday

- Learn stock trading strategies

- Learn from experts on risk management in trading